Stock Analysis

High Growth Tech Stocks To Watch In Japan October 2024

Reviewed by Simply Wall St

Japan's stock markets have shown positive momentum, with the Nikkei 225 Index gaining 2.45% and the TOPIX Index rising by 0.45%, supported by a weaker yen that enhances export profitability. In this environment, identifying high-growth tech stocks involves looking for companies with strong innovation capabilities and adaptability to market changes, which can capitalize on favorable economic conditions and currency trends.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| GMO AD Partners | 69.79% | 97.87% | ★★★★★☆ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market cap of ¥340.35 billion.

Operations: The Platform Services Business generates revenue of ¥36.16 billion, focusing on providing financial solutions across various sectors in Japan.

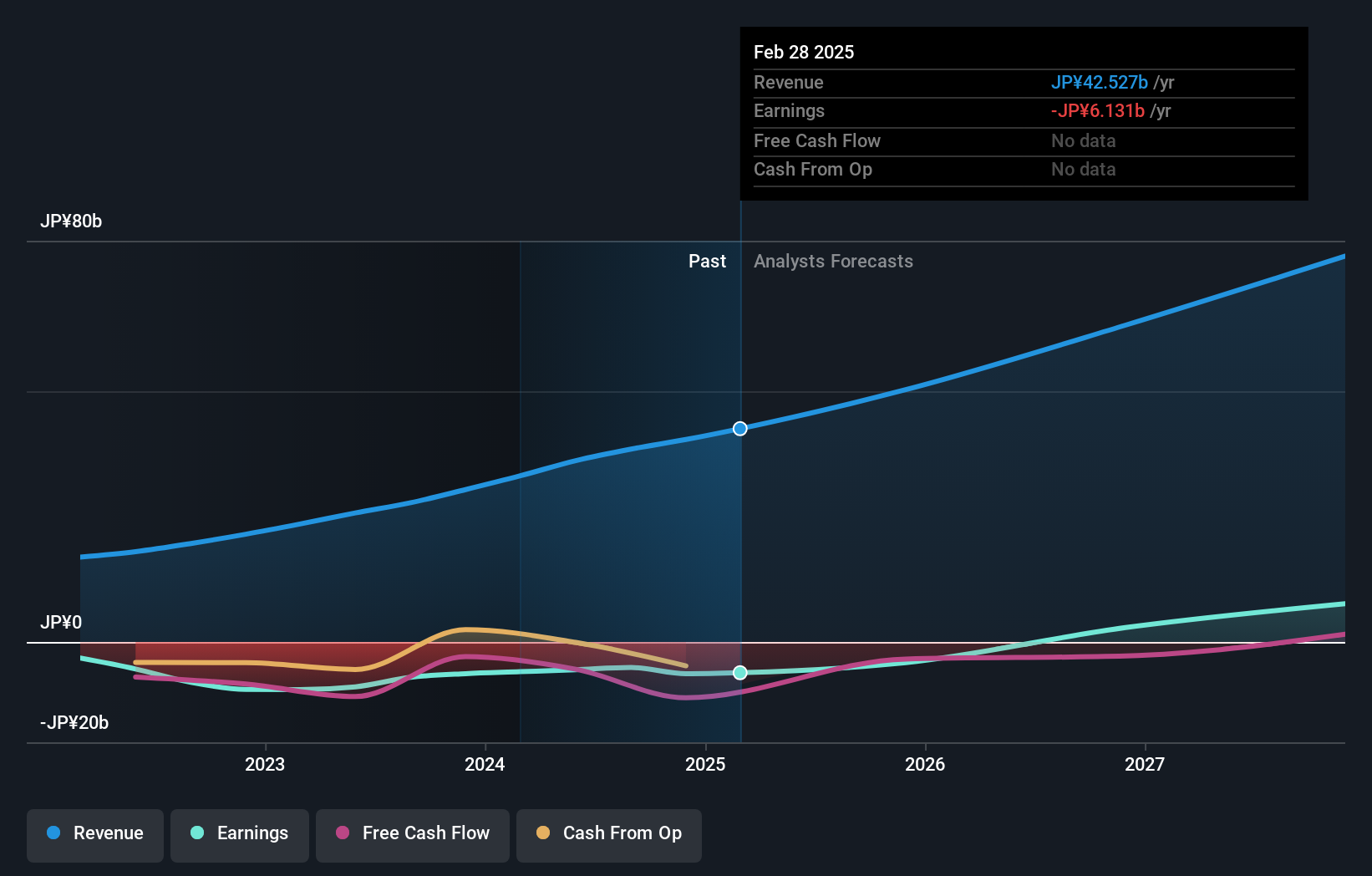

Money Forward's strategic maneuvers, such as its recent board decision to spin off its fintech business to Money Forward Kessai, underscore a focused realignment towards core technologies and services. This pivot is complemented by a robust projected annual revenue growth rate of 20.7%, significantly outpacing the Japanese market average of 4.3%. Moreover, the company's commitment to innovation is evident in its R&D spending trends which are crucial for sustaining long-term competitiveness in the fast-evolving tech landscape. Despite current unprofitability, earnings are expected to surge by 68.1% annually, highlighting potential for substantial financial improvement as strategic initiatives gain traction.

- Get an in-depth perspective on Money Forward's performance by reading our health report here.

Review our historical performance report to gain insights into Money Forward's's past performance.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market capitalization of ¥197.19 billion.

Operations: The company focuses on delivering cloud-based accounting and HR software services, primarily targeting small to medium-sized enterprises in Japan. Its revenue model is largely subscription-based, generating income through monthly or annual fees for its software solutions. The cost structure includes significant investment in research and development to enhance product offerings and maintain competitiveness in the market.

At freee K.K., the recent executive reshuffle, with Yasuhiro Kimura stepping in as the new CPO, aligns with its strategic vision to enhance its ERP system capabilities. This leadership transition underscores the company's commitment to technological innovation amidst its R&D expenditure which notably stands at 18.2% of revenue. Furthermore, freee is poised for significant growth with earnings expected to surge by 74.1% annually. These developments are pivotal as they navigate through unprofitability towards anticipated profitability over the next three years, reflecting a robust adaptation in a competitive landscape where tech firms increasingly pivot towards SaaS models for sustained revenue streams.

OMRON (TSE:6645)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OMRON Corporation operates globally in industrial automation, device and module solutions, social systems, and healthcare sectors with a market capitalization of ¥1.31 trillion.

Operations: OMRON Corporation generates revenue primarily from its Industrial Automation Business (IAB) and Social Systems, Solutions and Service Business (SSB), with ¥373.70 billion and ¥156.85 billion respectively. The Healthcare Business (HCB) contributes ¥150.40 billion, while the Devices & Module Solutions Business (DMB) adds ¥143.69 billion to the overall revenue structure.

OMRON's trajectory in the tech sector, marked by a robust R&D commitment, reflects its strategic focus. With R&D expenses constituting 5.6% of its revenue, the firm not only underscores its dedication to innovation but also aligns with industry demands for advanced automation solutions. Despite a modest revenue growth forecast at 5.6% annually, OMRON is poised for notable profitability improvements, expecting earnings to surge by 46.3% each year. Recent events like their Q1 2025 Earnings Call emphasize these financial dynamics alongside operational updates that could shape future strategy and market positioning within Japan's competitive tech landscape.

- Navigate through the intricacies of OMRON with our comprehensive health report here.

Gain insights into OMRON's historical performance by reviewing our past performance report.

Key Takeaways

- Delve into our full catalog of 120 Japanese High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if freee K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4478

freee K.K

Engages in the provision of cloud-based accounting and HR software solutions in Japan.