- Japan

- /

- Diversified Financial

- /

- TSE:7148

Top Japanese Dividend Stocks For October 2024

Reviewed by Simply Wall St

Japan's stock markets have shown positive momentum recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, bolstered by a weaker yen that enhances the profit outlook for exporters. As investors navigate this favorable environment, dividend stocks remain an attractive option for those seeking steady income, especially in times of economic uncertainty where consistent returns are valued.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.13% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.97% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.28% | ★★★★★★ |

| Innotech (TSE:9880) | 4.83% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.54% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.24% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.27% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

Click here to see the full list of 447 stocks from our Top Japanese Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Takeuchi Mfg (TSE:6432)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Takeuchi Mfg. Co., Ltd. is a company that manufactures and sells construction machinery both in Japan and internationally, with a market cap of ¥224.27 billion.

Operations: Takeuchi Mfg. Co., Ltd.'s revenue segments are comprised of ¥119.83 billion from the USA, ¥4.41 billion from China, ¥202.26 billion from Japan, ¥10.70 billion from France, and ¥12.06 billion from the United Kingdom.

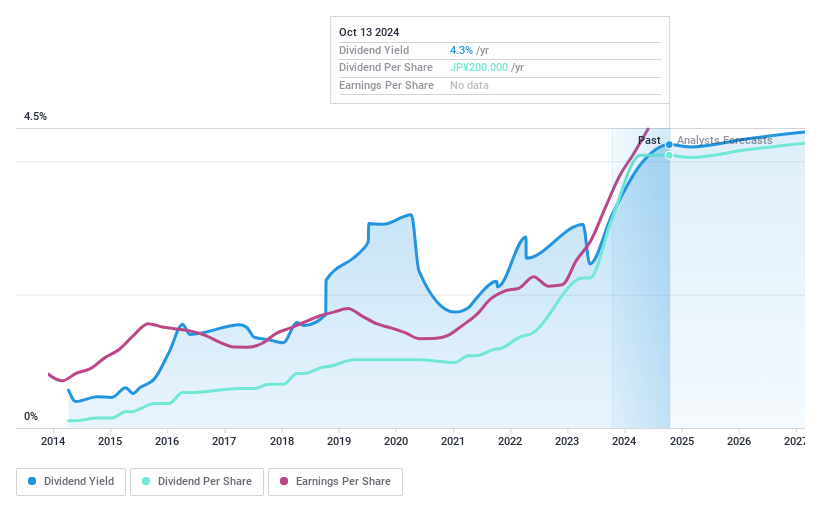

Dividend Yield: 4.3%

Takeuchi Mfg. offers a strong dividend profile with a 4.25% yield, placing it in the top 25% of Japanese dividend payers. Its dividends are well-covered by earnings and cash flows, with low payout ratios of 25.6% and 56.8%, respectively, ensuring sustainability. Additionally, dividends have grown steadily over the past decade without volatility. Recently, Takeuchi announced a share repurchase program worth ¥7 billion to further return profits to shareholders by January 2025, enhancing shareholder value.

- Navigate through the intricacies of Takeuchi Mfg with our comprehensive dividend report here.

- According our valuation report, there's an indication that Takeuchi Mfg's share price might be on the cheaper side.

Financial Partners GroupLtd (TSE:7148)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Financial Partners Group Co., Ltd., along with its subsidiaries, offers a range of financial products and services in Japan and has a market capitalization of approximately ¥206.11 billion.

Operations: Financial Partners Group Co., Ltd. generates revenue through its diverse portfolio of financial products and services offered within Japan.

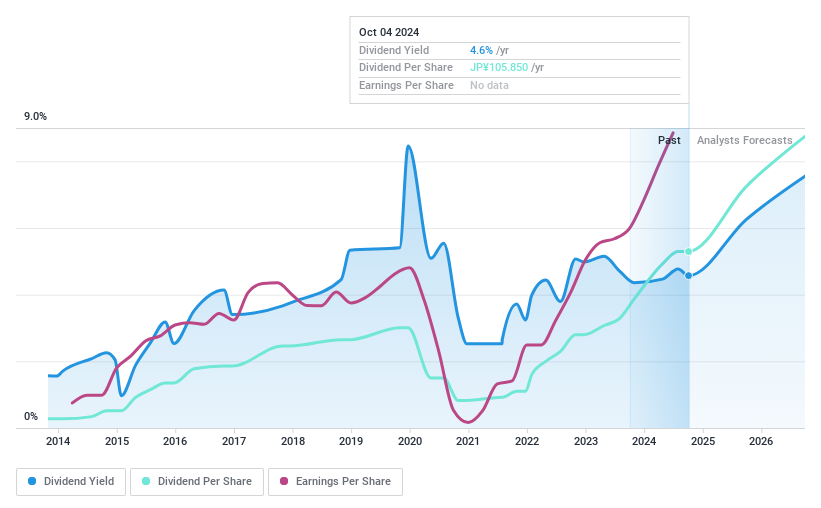

Dividend Yield: 4.3%

Financial Partners Group Ltd. offers a competitive dividend yield of 4.34%, ranking in the top 25% among Japanese dividend payers, though its dividends have been volatile over the past decade. Despite this volatility, current dividends are covered by earnings and cash flows with payout ratios of 51.6% and 34.6%, respectively. Recent strategic expansions and share buybacks reflect a commitment to growth and shareholder value, although high debt levels may pose risks to financial stability.

- Dive into the specifics of Financial Partners GroupLtd here with our thorough dividend report.

- Our valuation report here indicates Financial Partners GroupLtd may be undervalued.

With us (TSE:9696)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: With us Corporation, along with its subsidiaries, operates as an education service company in Japan and has a market cap of ¥15.20 billion.

Operations: With us Corporation generates revenue through its education services in Japan, with specific figures not disclosed in the provided text.

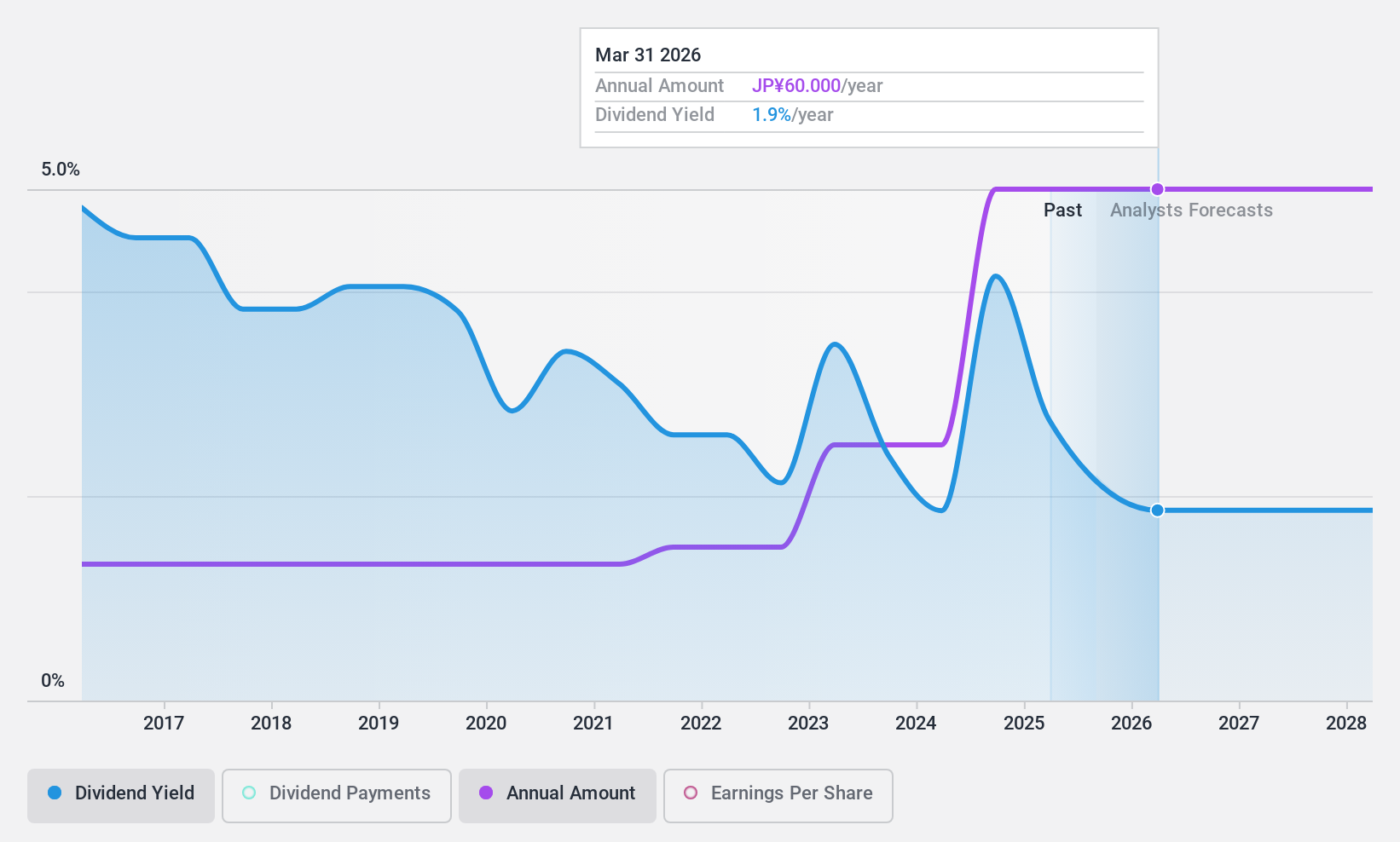

Dividend Yield: 3.6%

With Us has maintained stable and reliable dividend payments over the past decade, although its current 3.57% yield is below Japan's top 25% of dividend payers. While earnings cover the dividends with a payout ratio of 63.8%, they are not supported by free cash flows, raising sustainability concerns. Despite recent earnings growth of 56.9%, the lack of free cash flow coverage may challenge future dividend stability unless addressed through improved financial management or operational efficiencies.

- Click here to discover the nuances of With us with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, With us' share price might be too optimistic.

Next Steps

- Discover the full array of 447 Top Japanese Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7148

Financial Partners GroupLtd

Provides various financial products and services in Japan.

Excellent balance sheet established dividend payer.