3 Japanese Stocks Estimated To Be Up To 49.1% Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets have shown positive momentum recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up by 0.45%, supported by yen weakness which has enhanced the profit outlook for exporters. In this context of rising indices, identifying stocks that are potentially undervalued can offer investors opportunities to capitalize on discrepancies between market price and intrinsic value, making them attractive prospects in today's economic climate.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3450.00 | ¥6698.11 | 48.5% |

| Akatsuki (TSE:3932) | ¥2058.00 | ¥3750.53 | 45.1% |

| Densan System Holdings (TSE:4072) | ¥2659.00 | ¥5308.56 | 49.9% |

| Kotobuki Spirits (TSE:2222) | ¥1879.00 | ¥3434.73 | 45.3% |

| Pilot (TSE:7846) | ¥4662.00 | ¥8893.94 | 47.6% |

| Eternal Hospitality GroupLtd (TSE:3193) | ¥4150.00 | ¥7814.61 | 46.9% |

| Hibino (TSE:2469) | ¥3510.00 | ¥6917.23 | 49.3% |

| Appier Group (TSE:4180) | ¥1764.00 | ¥3465.27 | 49.1% |

| KeePer Technical Laboratory (TSE:6036) | ¥4195.00 | ¥7826.48 | 46.4% |

| Money Forward (TSE:3994) | ¥6240.00 | ¥11793.92 | 47.1% |

Let's explore several standout options from the results in the screener.

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that produces and sells sweets, with a market cap of ¥292.46 billion.

Operations: The company's revenue is primarily derived from its segments, including Shukrei at ¥27.03 billion, Casey Shii at ¥18.88 billion, Kotobuki Confectionery/Tajima Kotobuki at ¥13.19 billion, Sales Subsidiaries contributing ¥7.06 billion, and Kujukushima at ¥6.56 billion.

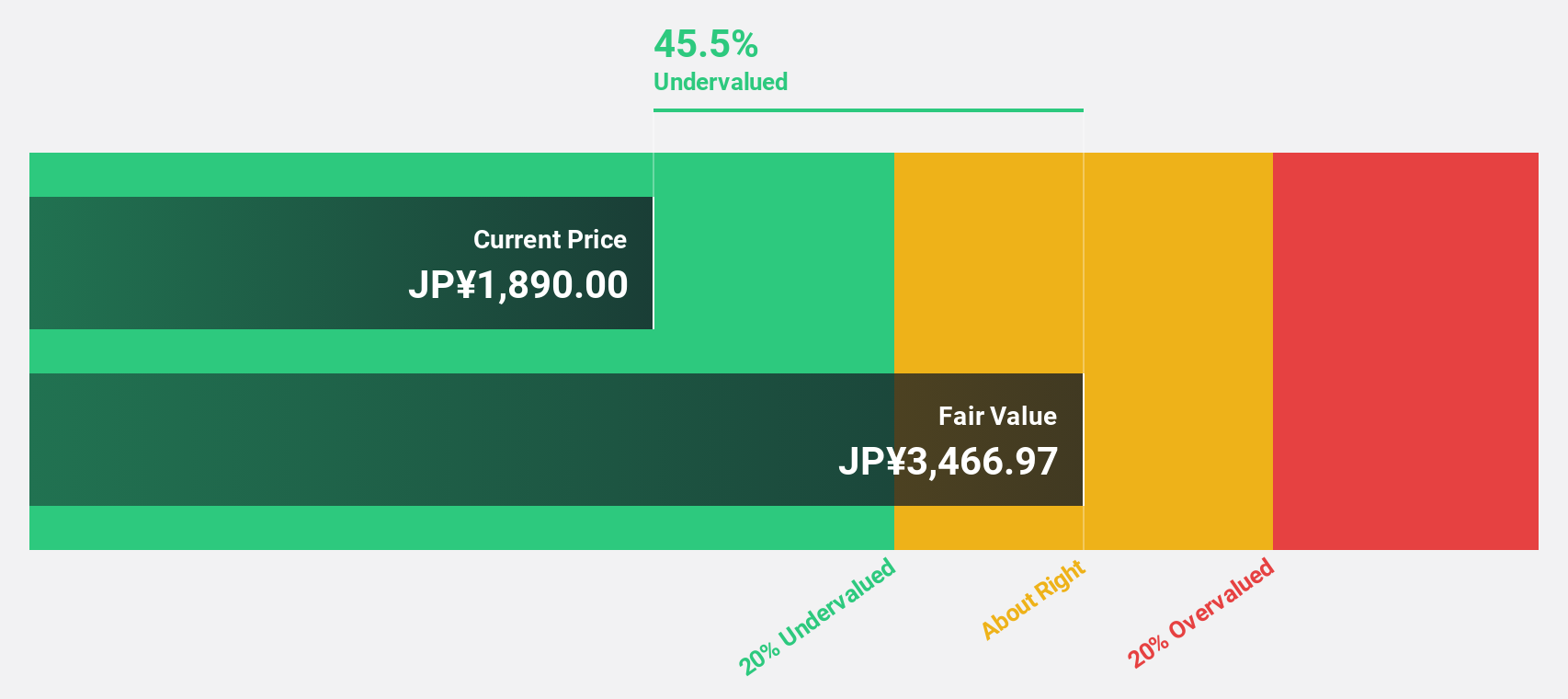

Estimated Discount To Fair Value: 45.3%

Kotobuki Spirits is trading at ¥1,879, significantly below its estimated fair value of ¥3,434.73, making it an attractive option based on cash flow valuation. The company's earnings grew by 33.7% last year and are forecast to grow at 12.77% annually, outpacing the Japanese market's average growth rate of 8.8%. Analysts agree on a potential price rise of 30.6%, highlighting its undervaluation relative to future growth prospects.

- Our earnings growth report unveils the potential for significant increases in Kotobuki Spirits' future results.

- Navigate through the intricacies of Kotobuki Spirits with our comprehensive financial health report here.

Lifedrink Company (TSE:2585)

Overview: Lifedrink Company, Inc. manufactures and sells beverages in Japan with a market cap of ¥92.87 billion.

Operations: The company's revenue primarily comes from its Beverage and Leaf Business, generating ¥39.57 billion.

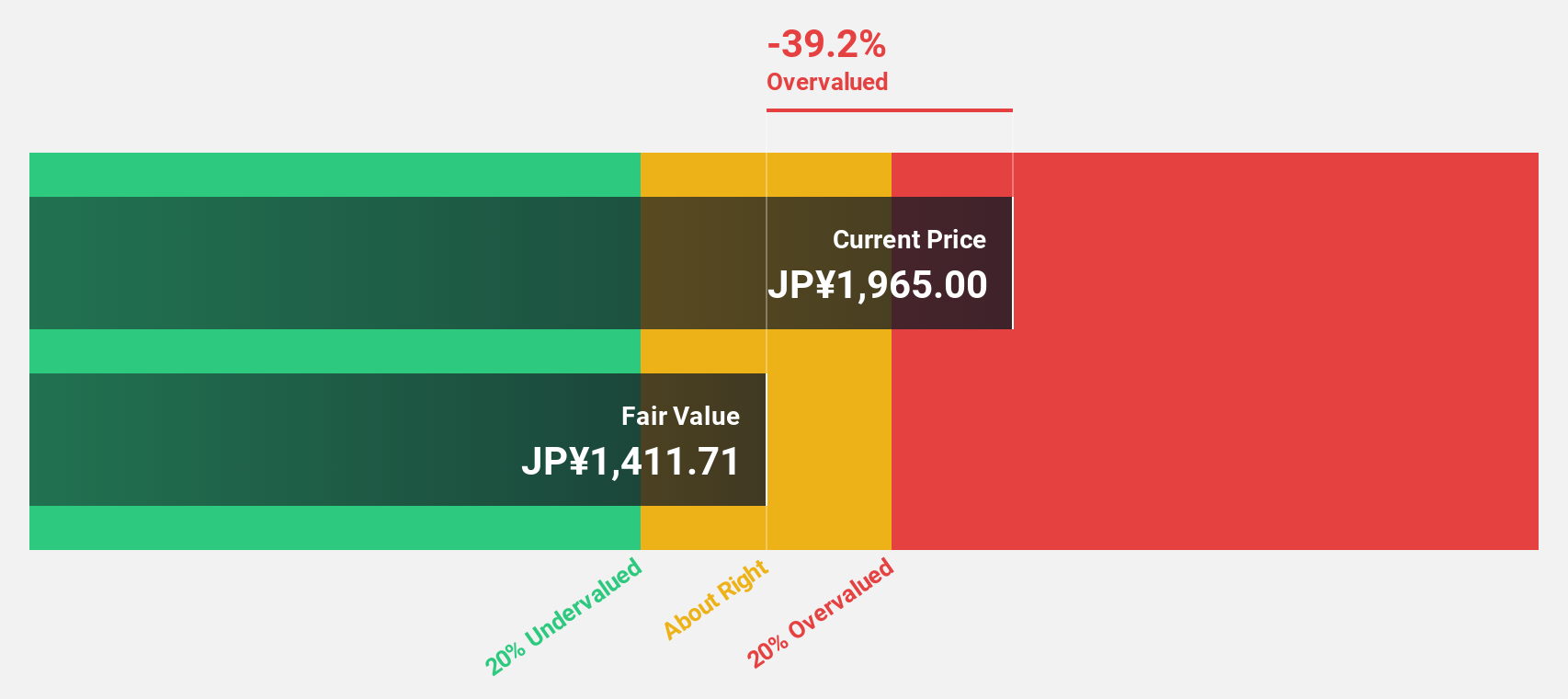

Estimated Discount To Fair Value: 11.3%

Lifedrink Company is trading at ¥1,777, slightly below its estimated fair value of ¥2,003.95. Despite high debt levels and recent share price volatility, the company's earnings grew by 30.5% last year and are expected to increase by 10.25% annually, surpassing the Japanese market's average growth rate of 8.8%. A recent 4:1 stock split may enhance liquidity but doesn't significantly impact its cash flow-based valuation appeal.

- According our earnings growth report, there's an indication that Lifedrink Company might be ready to expand.

- Unlock comprehensive insights into our analysis of Lifedrink Company stock in this financial health report.

Appier Group (TSE:4180)

Overview: Appier Group, Inc. is a software-as-a-service company that offers AI platforms to help enterprises make data-driven decisions both in Japan and internationally, with a market cap of ¥180.10 billion.

Operations: The company generates revenue from its AI SaaS Business, amounting to ¥30.22 billion.

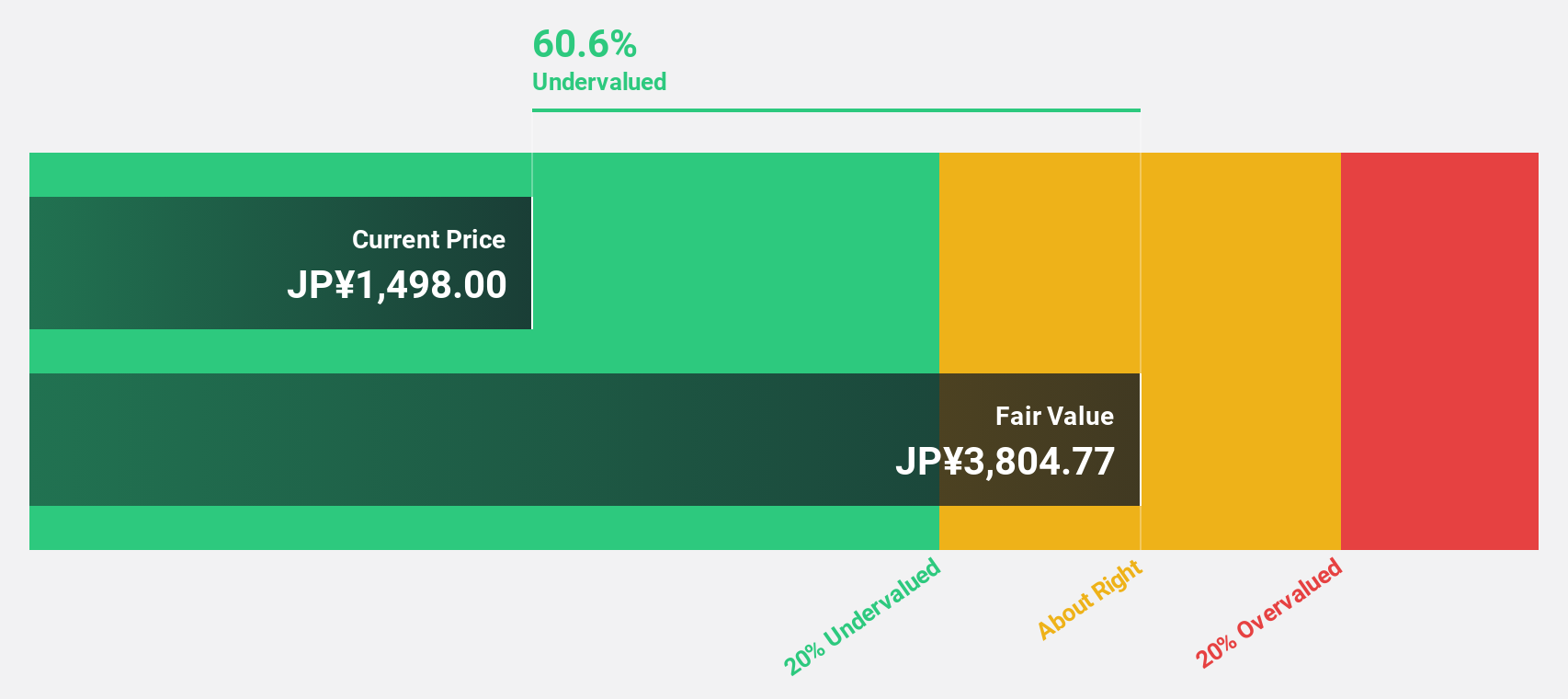

Estimated Discount To Fair Value: 49.1%

Appier Group is trading at ¥1,764, significantly below its estimated fair value of ¥3,465.27. Despite a volatile share price recently, the company's earnings grew by over 300% last year and are forecast to grow by 38.16% annually, outpacing the Japanese market's average growth rate. Recent buybacks aim to enhance capital efficiency and shareholder returns. Appier's partnership with Huy Thanh Jewelry highlights its AI capabilities in driving substantial ROI improvements for clients.

- In light of our recent growth report, it seems possible that Appier Group's financial performance will exceed current levels.

- Click here to discover the nuances of Appier Group with our detailed financial health report.

Taking Advantage

- Unlock our comprehensive list of 81 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2585

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives