- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6640

Market Participants Recognise I-PEX Inc.'s (TSE:6640) Revenues Pushing Shares 25% Higher

I-PEX Inc. (TSE:6640) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 65% in the last year.

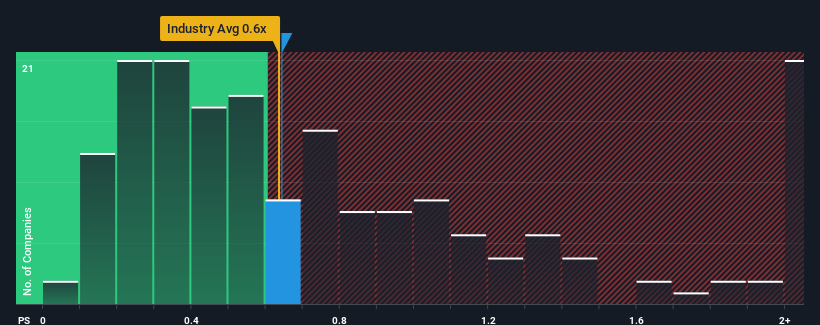

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about I-PEX's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Electronic industry in Japan is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for I-PEX

How Has I-PEX Performed Recently?

With revenue growth that's superior to most other companies of late, I-PEX has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on I-PEX will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like I-PEX's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.7% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 6.5% as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.0%, which is not materially different.

In light of this, it's understandable that I-PEX's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Final Word

I-PEX appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at I-PEX's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 3 warning signs for I-PEX that you need to take into consideration.

If you're unsure about the strength of I-PEX's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6640

I-PEX

Develops, manufactures, and sells connectors and electronics components, automotive electronics components, and semiconductor manufacturing equipment in Japan.

Flawless balance sheet very low.

Market Insights

Community Narratives