- Japan

- /

- Tech Hardware

- /

- TSE:4902

Konica Minolta (TSE:4902): Losses Compound at 26.3%, Testing Turnaround Narrative Ahead of Earnings

Reviewed by Simply Wall St

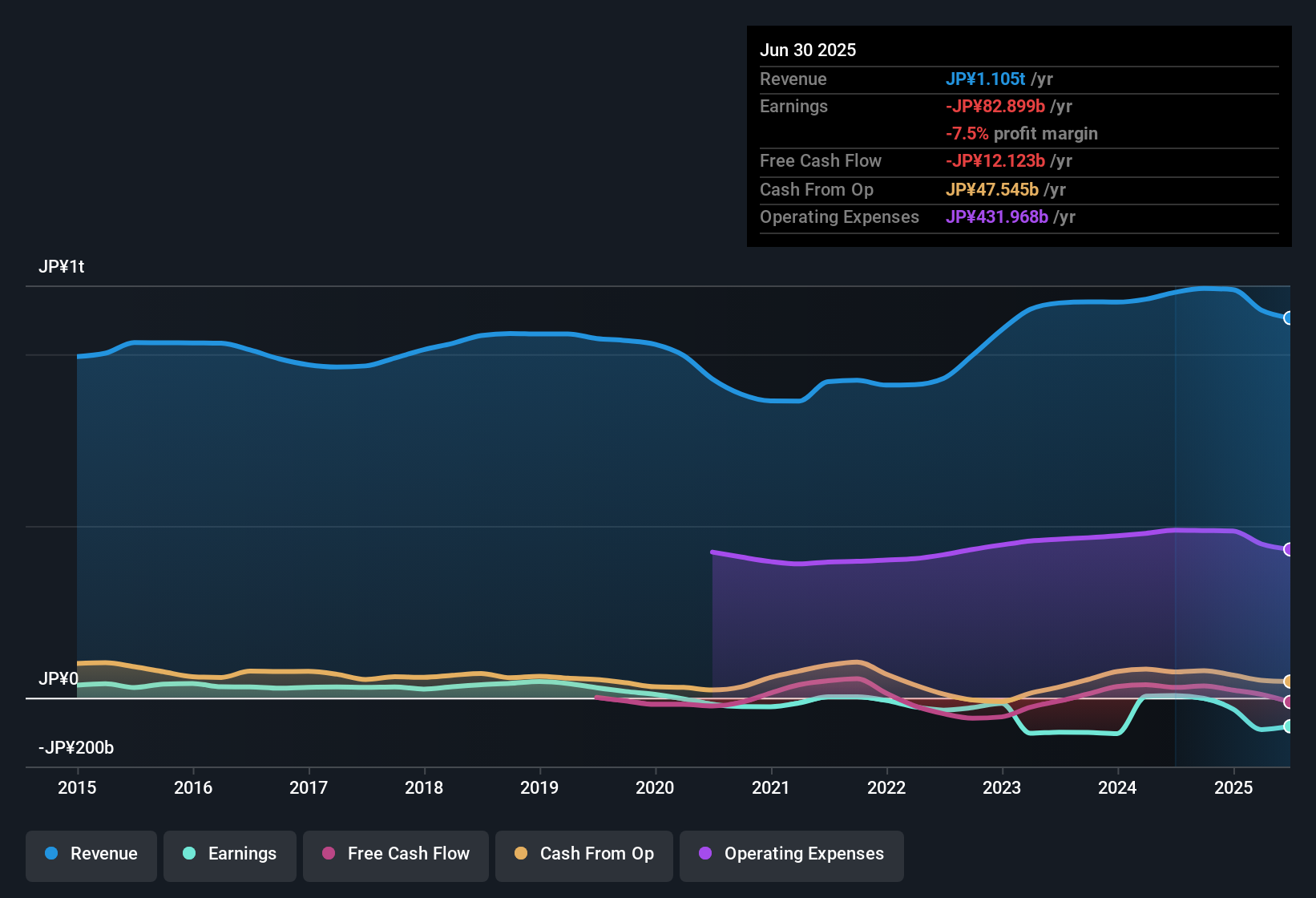

Konica Minolta (TSE:4902) remains unprofitable, with losses deepening at an average rate of 26.3% per year over the last five years. While management expects revenue to decline by around 1% per year through the next three years and net margins have not shown improvement, current forecasts anticipate earnings growth of 7.14% annually and a potential return to profitability within three years. The shares are currently trading at ¥609.7, which is below the estimated fair value of ¥805.17. The Price-to-Sales Ratio stands at 0.3x, outpacing peers and industry averages. Investors are weighing recent financial headwinds against the prospect of a turnaround driven by future profit growth and relative value.

See our full analysis for Konica Minolta.The next section will put these headline results in context, comparing the hard numbers against the most widely held market narratives to see where they converge and where the story gets re-written.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Compound at 26.3% Pace

- Konica Minolta’s net losses have increased by an average of 26.3% per year over the last five years, underscoring persistent challenges in achieving profitability despite management’s forecast of annual earnings growth ahead.

- What’s surprising from the prevailing analysis is that, while ongoing losses paint a tough picture for the company, forecasts now point to a turnaround within three years. This tests the belief that past financial difficulties will soon be reversed.

- Heavily compounding net losses directly challenge confidence in a swift profit rebound, but with a 7.14% annual earnings growth rate expected, the story is not purely negative.

- The tension lies in whether the expected shift to profits can actually materialize given that recent net profit margins have not shown improvement, making the forecasted turnaround more ambitious than assured.

Revenue Slippage and Stubborn Margins

- Revenue is set to decline by about 1% per year over the next three years, and net profit margins have shown no visible improvement in the most recent year. This creates a double drag on near-term financial momentum.

- Prevailing analysis highlights that, even as management and some optimists look toward future profit growth, these stubborn topline and margin trends make a rapid reversal of fortune less straightforward.

- Declining revenues directly erode the base from which future profits must recover, amplifying the difficulty of offsetting operational costs in a stagnant margin environment.

- The ongoing lack of margin progress stands in contrast to the planned return to profitability, suggesting revenue challenges could delay those hopes unless cost reduction or new business segments intervene.

Low Price-to-Sales Flashes Relative Value

- Konica Minolta’s Price-to-Sales Ratio, at just 0.3x, stands below peer and industry averages and sits alongside the stock’s current discount to a DCF fair value of ¥805.17. This strengthens perceptions of undervaluation.

- According to the prevailing market view, this deep valuation discount is fueling optimism that the shares are attractively priced for those willing to bet on a turnaround, but only if the company can realize the forecasted profit growth and overcome recent operating declines.

- Bulls may argue that this valuation gap provides an asymmetric risk-reward setup, especially with the current share price (¥609.7) notably below DCF-derived fair value. Bears will likely demand clearer evidence that positive results aren’t still years away.

- The favorable valuation serves as a cushion only if fundamental performance can catch up before further downside materializes from ongoing revenue and margin pressures.

- To find out if this valuation gap offers genuine potential or another false bottom, check the full narrative for analysis that ties these numbers back to the long-term outlook. 📊 Read the full Konica Minolta Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Konica Minolta's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Konica Minolta faces ongoing revenue declines and stubbornly weak margins, which cast doubt on the speed and reliability of any profit turnaround.

If you want steadier results, focus on companies that consistently deliver smoother performance through the ups and downs by using our stable growth stocks screener (2074 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Konica Minolta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4902

Konica Minolta

Engages in digital workplace, professional print, healthcare, and industry business in Japan, China, other Asian countries, the United States, Europe, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion