- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3891

3 Global Dividend Stocks Yielding Up To 6.6%

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions, U.S. equities have risen on positive trade headlines, while European and Asian indices also reflect a cautiously optimistic outlook. Amid this backdrop of fluctuating economic indicators and market sentiment, dividend stocks can offer investors a measure of stability and income through regular payouts.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.19% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.99% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.11% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.43% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.34% | ★★★★★★ |

Click here to see the full list of 1532 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

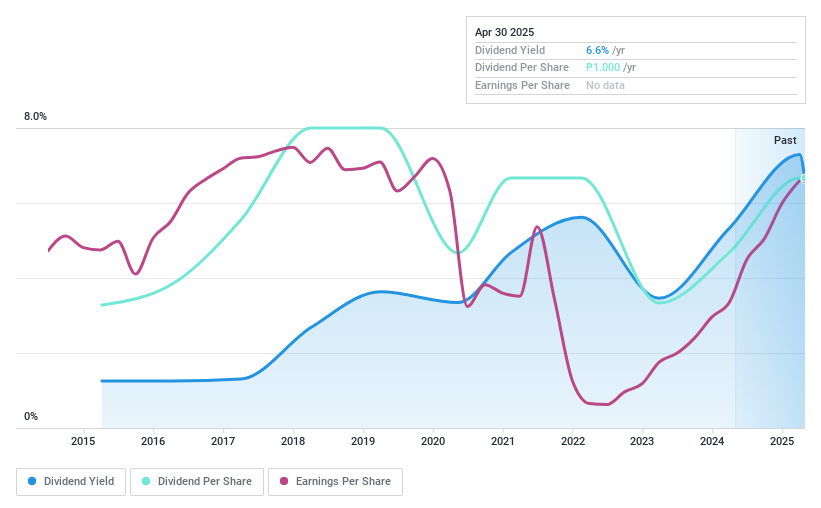

Concepcion Industrial (PSE:CIC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Concepcion Industrial Corporation, with a market cap of ₱5.94 billion, operates in the Philippines where it manufactures, sells, distributes, installs, and services HVAC products and services through its subsidiaries.

Operations: Concepcion Industrial Corporation generates revenue through the manufacturing, selling, distribution, installation, and servicing of HVAC products and services in the Philippines.

Dividend Yield: 6.6%

Concepcion Industrial Corporation's dividend yield of 6.62% ranks in the top 25% of Philippine dividend payers, supported by a low payout ratio of 46.7%. However, its dividends have been volatile over the past decade and are considered unreliable. Recent earnings growth, with net income rising to PHP 178.9 million in Q1 2025 from PHP 104.03 million a year ago, suggests potential for future stability but doesn't guarantee consistent dividends.

- Click here to discover the nuances of Concepcion Industrial with our detailed analytical dividend report.

- Our valuation report unveils the possibility Concepcion Industrial's shares may be trading at a premium.

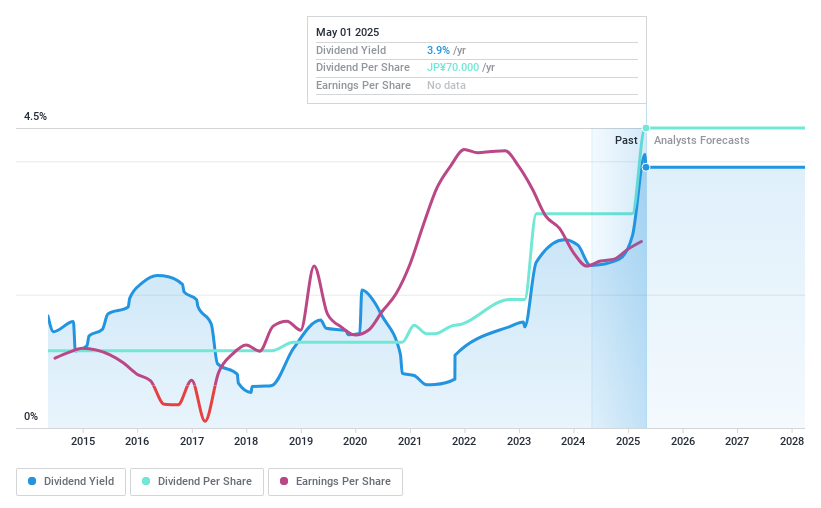

Nippon Kodoshi (TSE:3891)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Kodoshi Corporation manufactures and sells separators both in Japan and internationally, with a market cap of ¥18.74 billion.

Operations: Nippon Kodoshi Corporation generates revenue from the manufacturing and sale of separators both domestically in Japan and on an international scale.

Dividend Yield: 3.9%

Nippon Kodoshi's dividend yield of 3.91% is among the top 25% in Japan, yet its dividends have been unreliable and volatile over the past decade. Despite a low payout ratio of 35.8%, dividends are not covered by free cash flows, raising sustainability concerns. Recent earnings growth of 20.4% offers some optimism but doesn't ensure dividend stability. A recent share buyback for ¥198.51 million aims to enhance shareholder returns and improve capital efficiency, potentially benefiting investors in the long term.

- Click to explore a detailed breakdown of our findings in Nippon Kodoshi's dividend report.

- Upon reviewing our latest valuation report, Nippon Kodoshi's share price might be too pessimistic.

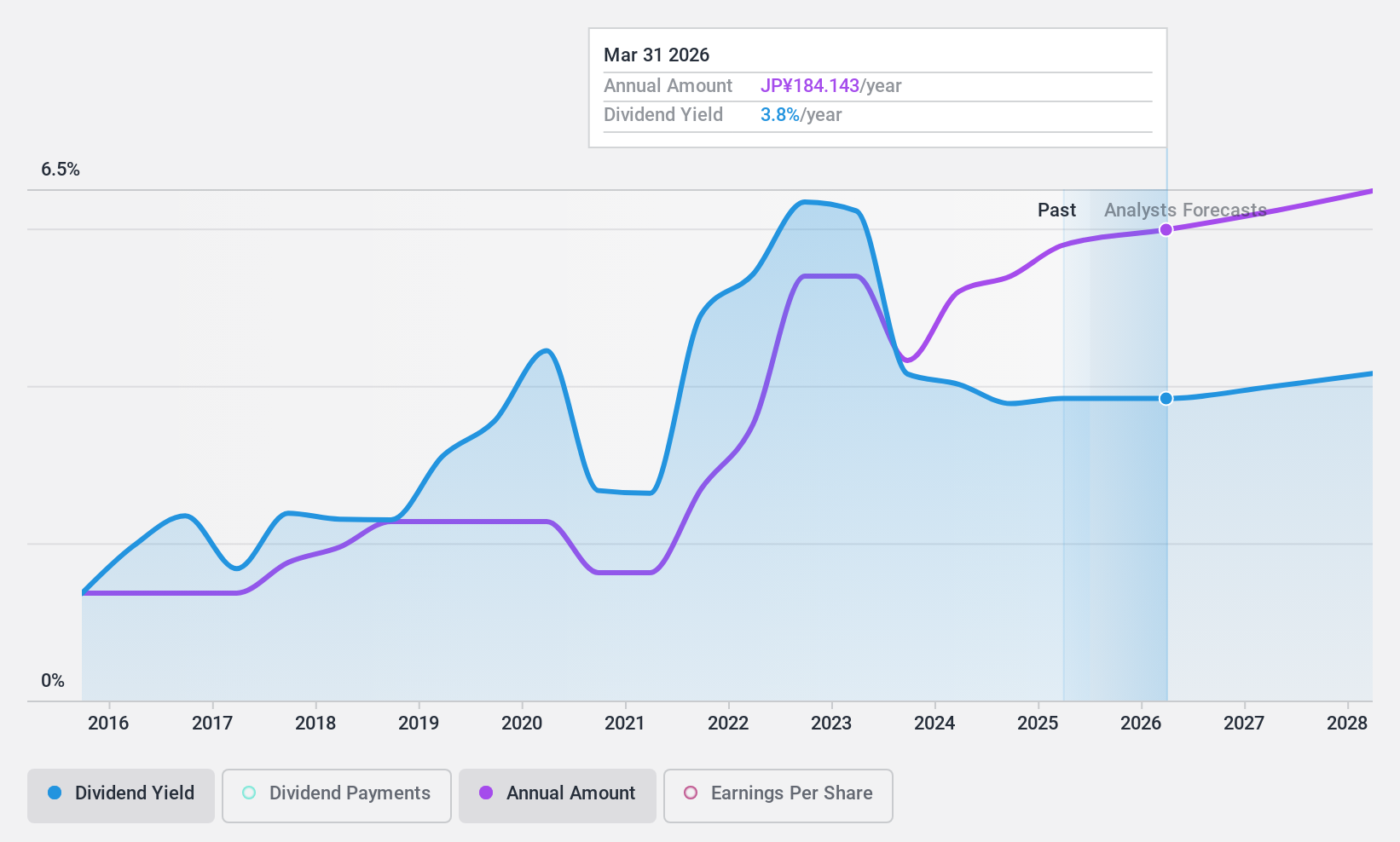

Niterra (TSE:5334)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Niterra Co., Ltd. operates in the manufacturing and sale of spark plugs and related products for internal-combustion engines, as well as technical ceramics, both in Japan and internationally, with a market cap of ¥881.46 billion.

Operations: Niterra Co., Ltd.'s revenue is primarily derived from its manufacturing and sales operations in spark plugs for internal-combustion engines and technical ceramics across Japan and international markets.

Dividend Yield: 3.7%

Niterra's dividend yield of 3.74% is slightly below the top tier in Japan, with dividends well-covered by both earnings and cash flows, given payout ratios of 38.6% and 36%, respectively. Despite an increase in dividends over the past decade, their volatility raises concerns about stability. Recent financial maneuvers include a ¥10 billion bond issuance and syndicated loan to finance operations, which could impact future dividend reliability amidst ongoing earnings growth forecasts of 5.59% annually.

- Get an in-depth perspective on Niterra's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Niterra's current price could be quite moderate.

Make It Happen

- Delve into our full catalog of 1532 Top Global Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nippon Kodoshi might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3891

Nippon Kodoshi

Manufactures and sells separators in Japan and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion