- Japan

- /

- Electronic Equipment and Components

- /

- TSE:268A

Rigaku Holdings (TSE:268A): Reassessing Valuation After ONYX 3200 Launch and Growing Semiconductor Growth Expectations

Reviewed by Simply Wall St

Rigaku Holdings (TSE:268A) just rolled out its ONYX 3200 semiconductor metrology system, with the first unit already shipped to a major foundry. Investors are watching how this launch feeds into future growth.

See our latest analysis for Rigaku Holdings.

The launch of ONYX 3200 seems to be feeding into a strong swing in market sentiment. Rigaku’s 30 day share price return of about 30 percent and year to date share price return above 30 percent suggest momentum is building off the back of improving growth expectations rather than just a one day pop.

If this kind of semiconductor demand story has your attention, it could be a good moment to explore other high growth tech names through high growth tech and AI stocks and see what else fits your watchlist.

With Rigaku’s shares already up nearly a third this year and still trading at a modest discount to analyst targets, the key question is whether this momentum is still mispriced or if the market now fully reflects future growth.

Price-to-Earnings of 29.9x: Is it justified?

Rigaku’s latest close at ¥1,174 implies a price-to-earnings ratio of 29.9 times, a level that prices in a premium versus peers despite the recent rally.

The price-to-earnings multiple links today’s share price to the company’s current earnings. It is a widely used yardstick for tech and semiconductor exposed names where investors are effectively paying up for each unit of profit.

In Rigaku’s case, the market is assigning a materially richer multiple than comparable companies. This suggests investors are willing to pay more for expected earnings growth and future profitability relative to what the company is currently delivering.

That premium stands out against both the peer group and the broader JP Electronic industry, with Rigaku’s 29.9 times earnings almost double the sector’s 14.7 times and also well above our estimated fair price-to-earnings ratio of 22.1 times that the market could eventually gravitate toward as expectations normalise.

Explore the SWS fair ratio for Rigaku Holdings

Result: Price-to-Earnings of 29.9x (OVERVALUED).

However, risks remain, including a slowdown in semiconductor capex or project delays, which could quickly cool sentiment around Rigaku’s premium valuation.

Find out about the key risks to this Rigaku Holdings narrative.

Another View: DCF Says the Price Looks Reasonable

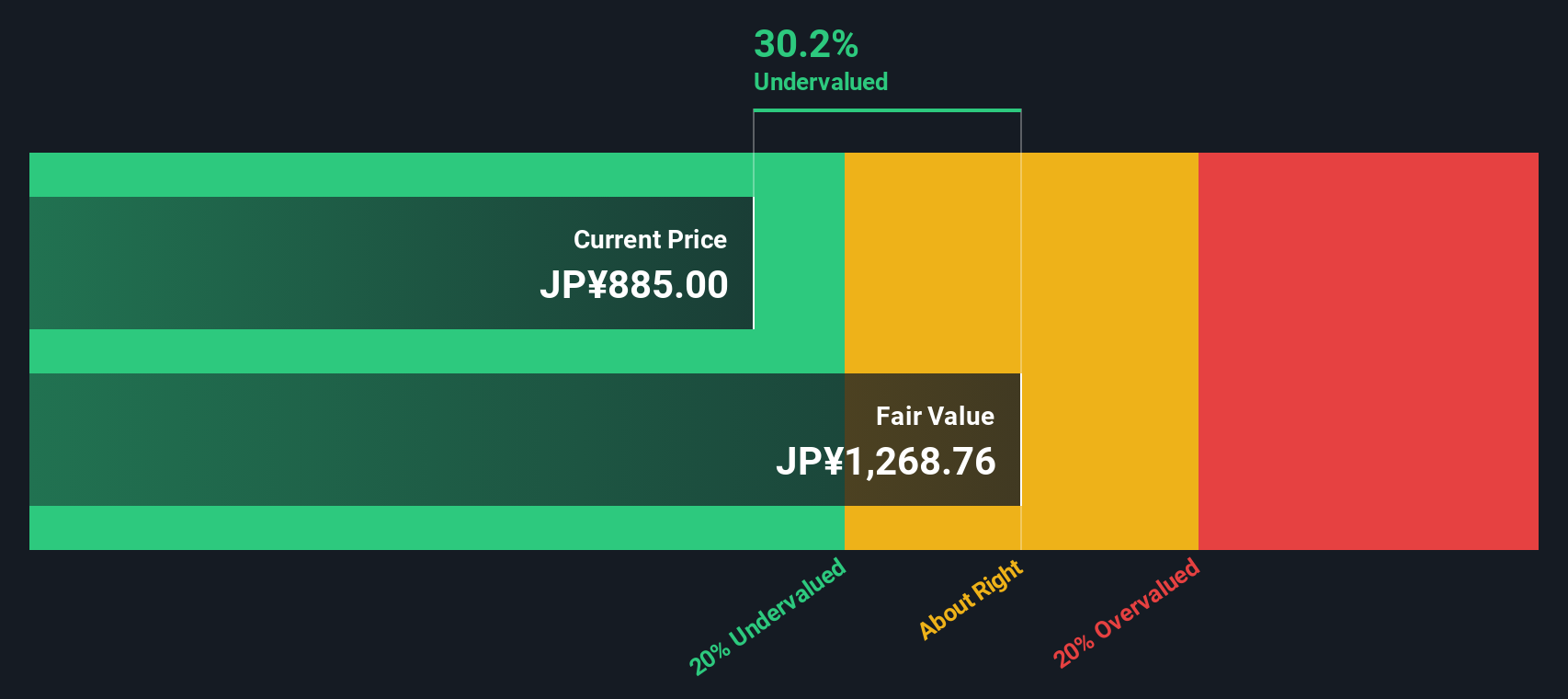

While the earnings multiple makes Rigaku look expensive, our DCF model paints a softer picture. It suggests fair value around ¥1,279 versus today’s ¥1,174. That 8 percent discount hints at modest upside rather than glaring overvaluation, so which signal should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rigaku Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rigaku Holdings Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Rigaku Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to act on your next opportunity?

Do not stop at one stock, use the Simply Wall Street Screener to uncover fresh ideas that match your strategy before the market catches on.

- Supercharge your growth hunt by targeting early stage names using these 3634 penny stocks with strong financials that already show financial strength rather than just hype.

- Capitalize on the AI wave with these 24 AI penny stocks that combine powerful technology trends with scalable business models, not just buzzword heavy pitches.

- Lock in income streams by zeroing in on these 12 dividend stocks with yields > 3% that can support your returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:268A

Rigaku Holdings

Engages in the manufacture and sale of scientific equipment in Japan, the United States, Europe, and Asia.

Excellent balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion