- Japan

- /

- Electronic Equipment and Components

- /

- TSE:268A

Rigaku Holdings (TSE:268A): Evaluating Valuation After Revenue Decline and Updated Growth Forecast

Reviewed by Simply Wall St

Rigaku Holdings (TSE:268A) reported its financial results for the nine months through September, noting a 5% drop in revenue and a 47% decline in profit before tax compared to last year. Despite these figures, management is now projecting modest revenue growth by the end of the fiscal year. This signals an expectation for a steady operational rebound.

See our latest analysis for Rigaku Holdings.

Rigaku Holdings has seen its share price rally by 21% over the past 90 days, signaling renewed investor optimism since management projected a turnaround despite recent profit declines. Even with this short-term momentum, the total shareholder return over the past year remains down nearly 18%, which underscores that the longer-term picture has yet to fully recover.

If you’re interested in finding more companies gaining momentum, now could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With analyst price targets sitting well above current levels and signs of an operational rebound, the question is whether Rigaku Holdings is undervalued at today’s price or if the market has already accounted for its recovery prospects.

Price-to-Earnings of 20.2x: Is it justified?

Rigaku Holdings is currently trading at a price-to-earnings ratio (P/E) of 20.2x, notably above both industry peers and the company's own historical levels. With a last close price of ¥967, this multiple signals that the market is placing a premium on the company's future earnings potential.

The price-to-earnings ratio measures how much investors are willing to pay for each yen of earnings the company generates. For a company in the technology and electronics space, the P/E ratio is often seen as a gauge of market confidence in future growth and profitability.

However, Rigaku Holdings' P/E of 20.2x is substantially higher than the peer average of 14.8x for similar Japanese electronics firms. Even within its own industry, the average is just 14.9x. This places Rigaku's valuation in the premium bracket. Compared to the estimated fair P/E ratio of 21.6x, however, it does not appear wildly out of line. This suggests there is still scope for the market price to move higher if expectations are met.

Explore the SWS fair ratio for Rigaku Holdings

Result: Price-to-Earnings of 20.2x (OVERVALUED)

However, weaker earnings growth or delays in operational recovery could put pressure on the share price and challenge the current optimistic projections for Rigaku Holdings.

Find out about the key risks to this Rigaku Holdings narrative.

Another View: What Does Our DCF Model Say?

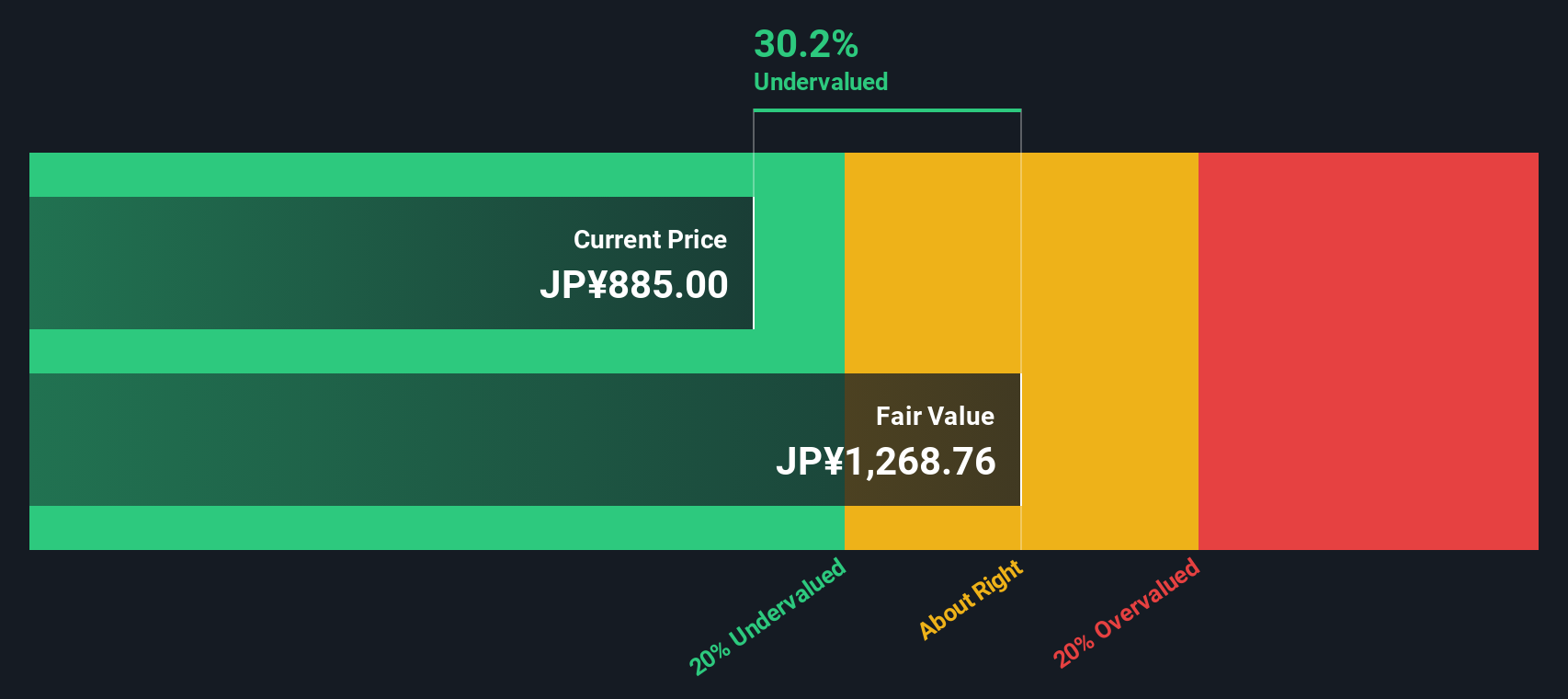

Looking from a different angle, our SWS DCF model estimates Rigaku Holdings’ fair value at ¥1,278.3, which is roughly 24% above today’s share price. This suggests the stock may actually be undervalued right now. However, whether this optimistic scenario can be realized depends on various risks and uncertainties.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rigaku Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 863 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rigaku Holdings Narrative

If you have a different perspective or want to draw your own conclusions, you can put together your own take on Rigaku Holdings in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Rigaku Holdings.

Ready for More Fresh Investment Ideas?

Smart investors never limit their horizons. Unlock stocks with hidden value, robust growth or surprising income potential using the Simply Wall St Screener's tailored picks.

- Boost your passive income with attractive yields by starting your search among these 16 dividend stocks with yields > 3%, setting new standards for consistent payouts.

- Capitalize on fast-moving innovations by uncovering market movers among these 24 AI penny stocks, transforming everything from automation to data intelligence.

- Position yourself ahead of the curve by hunting for future leaders in technology revolution among these 28 quantum computing stocks, reshaping computation as we know it.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:268A

Rigaku Holdings

Engages in the manufacture and sale of scientific equipment in Japan, the United States, Europe, and Asia.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives