- Japan

- /

- Electronic Equipment and Components

- /

- TSE:268A

Rigaku Holdings’ Sharp Profit Drop and Upbeat Guidance Might Change The Case For Investing In TSE:268A

Reviewed by Sasha Jovanovic

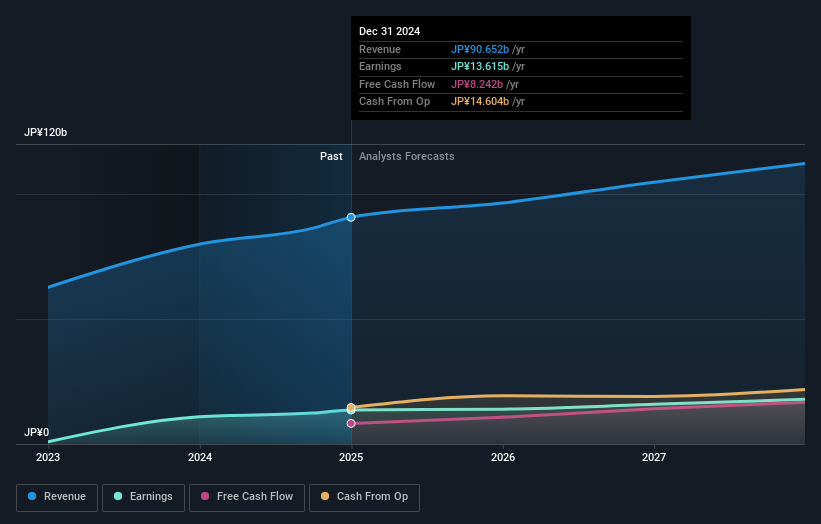

- Rigaku Holdings reported its consolidated financial results for the nine months ended September 30, 2025, showing a 4.9% decline in revenue and a 47.2% drop in profit before tax compared to the previous year.

- Despite ongoing operational headwinds, management remains confident, forecasting a slight 3.8% revenue increase for the full fiscal year ending December 31, 2025.

- We'll explore how the company's forward guidance for revenue recovery shapes perceptions of Rigaku Holdings’ investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Rigaku Holdings' Investment Narrative?

Rigaku Holdings’ latest results put a finer point on the kind of patience required from shareholders right now. With a nearly 5% revenue drop and profit before tax sliding by more than 47% for the first nine months, the central question is whether the business’ recent optimism about a modest upturn by year-end signals an inflection point or just a pause in a tougher cycle. The company has made clear strides in product innovation and global expansion, highlighted by its Taiwan R&D hub and a high-performance TXRF system launch aimed at semiconductor clients, but soft demand for key EUV components remains a real drag that could linger longer than management expects. This news event will likely sharpen the market’s focus on near-term growth deliveries, yet with the analyst price target suggesting only a moderate upside and mixed share price movements, it is uncertain if these results materially shift the risk-reward balance. Investors should be mindful of how sustained weakness in critical product lines could weigh on future recoveries.

But, given ongoing headwinds in multilayer EUV demand, profitability risks remain front of mind for investors. Despite retreating, Rigaku Holdings' shares might still be trading 23% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Rigaku Holdings - why the stock might be worth just ¥1056!

Build Your Own Rigaku Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigaku Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rigaku Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigaku Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:268A

Rigaku Holdings

Engages in the manufacture and sale of scientific equipment in Japan, the United States, Europe, and Asia.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives