- Japan

- /

- Electronic Equipment and Components

- /

- TSE:2469

Hibino Corporation's (TSE:2469) P/E Is Still On The Mark Following 28% Share Price Bounce

Despite an already strong run, Hibino Corporation (TSE:2469) shares have been powering on, with a gain of 28% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 93% in the last year.

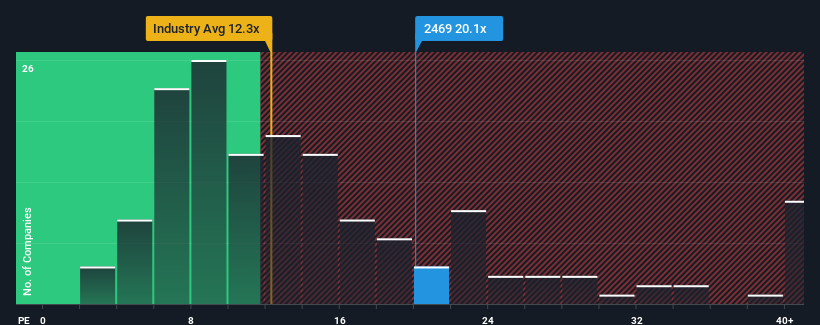

After such a large jump in price, Hibino may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 20.1x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Hibino as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Hibino

How Is Hibino's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Hibino's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 167%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 33% per annum as estimated by the one analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 9.3% per year, which is noticeably less attractive.

In light of this, it's understandable that Hibino's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Hibino's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hibino maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Hibino you should know about.

You might be able to find a better investment than Hibino. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hibino might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2469

Hibino

Designs, sells, installs, and maintains audio equipment in Japan and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives