- Japan

- /

- Communications

- /

- TSE:6822

Does It Make Sense To Buy Oi Electric Co., Ltd. (TYO:6822) For Its Yield?

Dividend paying stocks like Oi Electric Co., Ltd. (TYO:6822) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

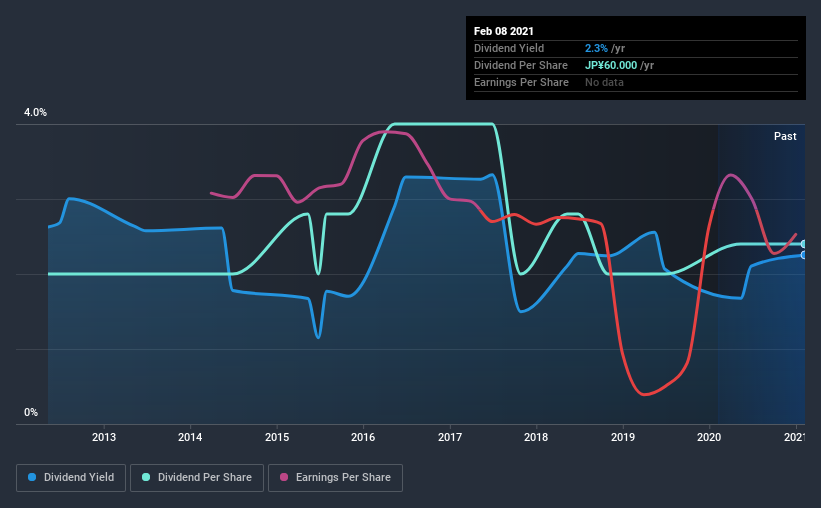

Investors might not know much about Oi Electric's dividend prospects, even though it has been paying dividends for the last nine years and offers a 2.3% yield. A low yield is generally a turn-off, but if the prospects for earnings growth were strong, investors might be pleasantly surprised by the long-term results. There are a few simple ways to reduce the risks of buying Oi Electric for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. While Oi Electric pays a dividend, it reported a loss over the last year. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

We update our data on Oi Electric every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Looking at the last decade of data, we can see that Oi Electric paid its first dividend at least nine years ago. It's good to see that Oi Electric has been paying a dividend for a number of years. However, the dividend has been cut at least once in the past, and we're concerned that what has been cut once, could be cut again. During the past nine-year period, the first annual payment was JP¥50.0 in 2012, compared to JP¥60.0 last year. This works out to be a compound annual growth rate (CAGR) of approximately 2.0% a year over that time. Oi Electric's dividend payments have fluctuated, so it hasn't grown 2.0% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

It's good to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth, anyway. We're not that enthused by this.

Dividend Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Oi Electric's EPS have declined at around 49% a year. A sharp decline in earnings per share is not great from from a dividend perspective, as even conservative payout ratios can come under pressure if earnings fall far enough.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're a bit uncomfortable with it paying a dividend while reporting a loss over the past year. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. To conclude, we've spotted a couple of potential concerns with Oi Electric that may make it less than ideal candidate for dividend investors.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 4 warning signs for Oi Electric (of which 2 are potentially serious!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Oi Electric or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:6822

Oi Electric

Provides information and communication equipment and related services for social infrastructure in Japan.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success