- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6663

Health Check: How Prudently Does Taiyo Industrial (TYO:6663) Use Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Taiyo Industrial Co., LTD. (TYO:6663) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Taiyo Industrial

What Is Taiyo Industrial's Debt?

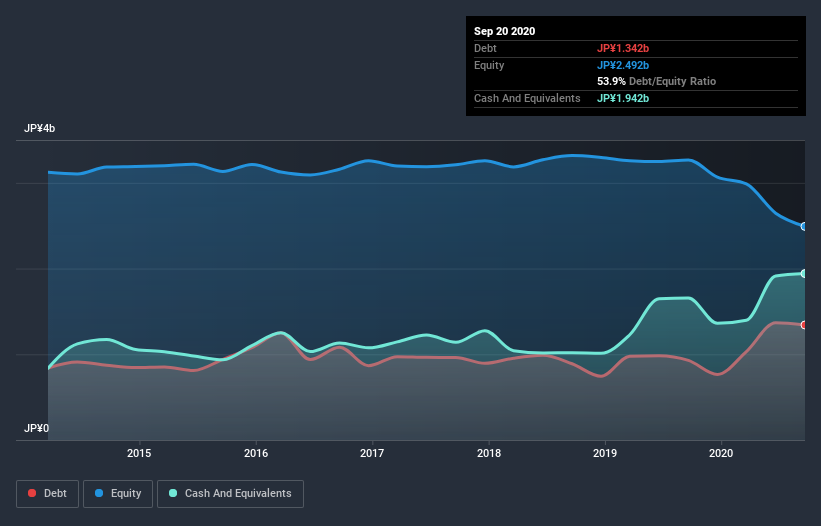

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Taiyo Industrial had JP¥1.34b of debt, an increase on JP¥929.0m, over one year. However, its balance sheet shows it holds JP¥1.94b in cash, so it actually has JP¥600.0m net cash.

A Look At Taiyo Industrial's Liabilities

We can see from the most recent balance sheet that Taiyo Industrial had liabilities of JP¥1.41b falling due within a year, and liabilities of JP¥1.21b due beyond that. Offsetting these obligations, it had cash of JP¥1.94b as well as receivables valued at JP¥526.0m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by JP¥156.0m.

Since publicly traded Taiyo Industrial shares are worth a total of JP¥2.31b, it seems unlikely that this level of liabilities would be a major threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. Despite its noteworthy liabilities, Taiyo Industrial boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Taiyo Industrial will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Taiyo Industrial made a loss at the EBIT level, and saw its revenue drop to JP¥3.3b, which is a fall of 19%. That's not what we would hope to see.

So How Risky Is Taiyo Industrial?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months Taiyo Industrial lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through JP¥19m of cash and made a loss of JP¥762m. With only JP¥600.0m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with Taiyo Industrial (including 1 which is a bit concerning) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Taiyo Industrial, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Taiyo TechnolexLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:6663

Taiyo TechnolexLtd

Engages in the design, manufacture, and sale of electronic boards, board test systems, and prober products primarily in Japan.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives