- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3670

Just Three Days Till Kyoritsu Computer & Communication Co.,Ltd. (TYO:3670) Will Be Trading Ex-Dividend

It looks like Kyoritsu Computer & Communication Co.,Ltd. (TYO:3670) is about to go ex-dividend in the next 3 days. This means that investors who purchase shares on or after the 25th of February will not receive the dividend, which will be paid on the 1st of January.

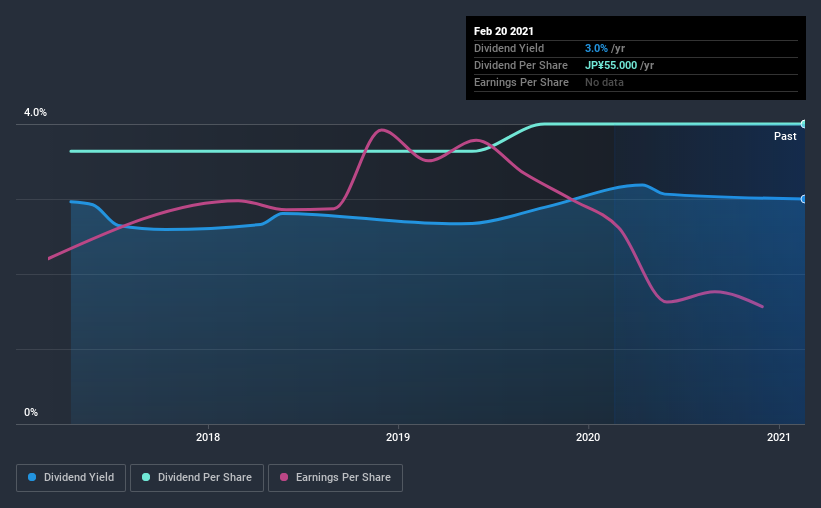

Kyoritsu Computer & CommunicationLtd's next dividend payment will be JP¥55.00 per share, on the back of last year when the company paid a total of JP¥55.00 to shareholders. Last year's total dividend payments show that Kyoritsu Computer & CommunicationLtd has a trailing yield of 3.0% on the current share price of ¥1833. If you buy this business for its dividend, you should have an idea of whether Kyoritsu Computer & CommunicationLtd's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Kyoritsu Computer & CommunicationLtd

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Kyoritsu Computer & CommunicationLtd paid out more than half (58%) of its earnings last year, which is a regular payout ratio for most companies. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Fortunately, it paid out only 40% of its free cash flow in the past year.

It's positive to see that Kyoritsu Computer & CommunicationLtd's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Kyoritsu Computer & CommunicationLtd's earnings per share have dropped 6.6% a year over the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Kyoritsu Computer & CommunicationLtd has delivered an average of 2.4% per year annual increase in its dividend, based on the past four years of dividend payments. That's interesting, but the combination of a growing dividend despite declining earnings can typically only be achieved by paying out more of the company's profits. This can be valuable for shareholders, but it can't go on forever.

The Bottom Line

Is Kyoritsu Computer & CommunicationLtd worth buying for its dividend? The payout ratios are within a reasonable range, implying the dividend may be sustainable. Declining earnings are a serious concern, however, and could pose a threat to the dividend in future. All things considered, we are not particularly enthused about Kyoritsu Computer & CommunicationLtd from a dividend perspective.

However if you're still interested in Kyoritsu Computer & CommunicationLtd as a potential investment, you should definitely consider some of the risks involved with Kyoritsu Computer & CommunicationLtd. For example, we've found 4 warning signs for Kyoritsu Computer & CommunicationLtd (1 can't be ignored!) that deserve your attention before investing in the shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Kyoritsu Computer & CommunicationLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kyoritsu Computer & CommunicationLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSE:3670

Kyoritsu Computer & CommunicationLtd

Kyoritsu Computer & Communication Co.,Ltd.

Very low risk not a dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)