Assessing SCSK (TSE:9719) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

SCSK (TSE:9719) recently saw a shift in its share price that has caught the eye of investors, even though no specific news or event triggered the move. Sometimes, stock movements like this can prompt us to step back and ask whether underlying fundamentals are quietly influencing sentiment or if it is simply a case of the market searching for direction. For anyone watching SCSK, it is worth considering what might be driving this momentum beneath the surface.

Looking at the bigger picture, SCSK’s stock has not just drifted sideways; it has actually gained 65% over the past year and is up 10% in the past three months. That follows several years of substantial gains, with annual growth bolstered by steady increases in both revenue and net income. While the market has not reacted to a specific catalyst lately, this streak of strong performance suggests that optimism may be building, or at least not fading, among investors.

So after a year marked by significant growth, is SCSK still a compelling value play for buyers, or has the recent momentum already factored in the next phase of its expansion?

Price-to-Earnings of 30.4x: Is it justified?

SCSK is currently trading at a Price-to-Earnings (P/E) ratio of 30.4x, which is significantly higher than the averages for both its industry and peers. This suggests that the market is pricing in strong future growth, but also raises questions about whether the optimism is warranted or if shares might be overheating relative to fundamentals.

The P/E ratio measures the price investors are willing to pay for each unit of earnings. It is a key metric for assessing a company's valuation. In the IT sector, this multiple can be particularly telling as it often reflects perceived potential for growth, innovation, or above-average profitability compared to more mature industries.

Despite recent earnings growth, SCSK's current valuation appears pricey compared to its industry peers and estimated fair value benchmarks. The market is demanding a premium, likely in anticipation of continued expansion. However, this rich multiple may not be fully supported if growth rates moderate or sector competition intensifies.

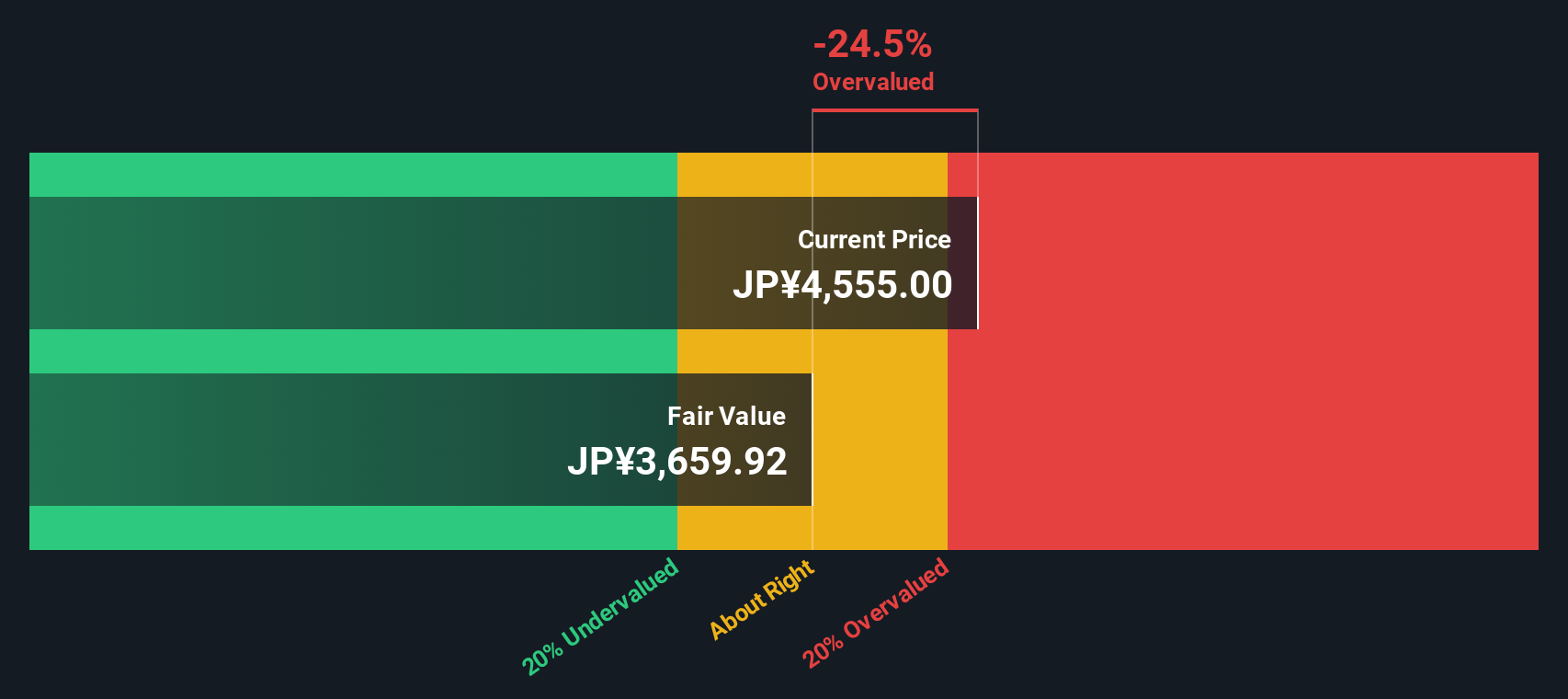

Result: Fair Value of ¥3,628.68 (OVERVALUED)

See our latest analysis for SCSK.However, slowing annual revenue and profit growth, or an uptick in sector competition, could challenge SCSK’s premium valuation in the future.

Find out about the key risks to this SCSK narrative.Another View: What Does the SWS DCF Model Suggest?

While the current market price appears expensive compared to industry averages, our DCF model tells a similar story, indicating that shares might be trading above their estimated fair value. Could both approaches be flagging the same concern, or is the market seeing something they are not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SCSK Narrative

If you have different insights, or would like to piece together your own view, you can quickly create your own assessment of SCSK in just a few minutes. Do it your way

A great starting point for your SCSK research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity slip away. Use the Simply Wall Street Screener to unlock stocks that fit your investment style and uncover tomorrow’s big winners today.

- Accelerate your hunt for growing, overlooked companies with strong financials by tapping into penny stocks with strong financials for untapped potential and early growth stories.

- Maximize your search for consistent income by finding market leaders with attractive yields using dividend stocks with yields > 3%, a tool tailored for dividend-focused investors.

- Stay ahead of the innovation curve and uncover companies reshaping health with advanced technology with healthcare AI stocks, targeting breakthrough opportunities in medical AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9719

SCSK

Provides information technology (IT) services in Japan and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives