NTT DATA Group (TSE:9613): Assessing Valuation After Strong Share Price Momentum

Reviewed by Simply Wall St

Price-to-Earnings of 39.2x: Is it justified?

NTT DATA Group appears overvalued when looking solely at its price-to-earnings ratio. Compared to the Japanese IT industry average and peers, its valuation stands out as notably expensive.

The price-to-earnings (P/E) ratio shows how much investors are willing to pay for each yen of the company’s net earnings. For tech companies, a higher P/E can reflect growth expectations, but it can also signal market optimism being built into the current price.

Here, NTT DATA’s P/E of 39.2x is well above industry and peer averages. This may mean that investors expect above-average earnings growth or see unique strengths in the company. Alternatively, it could suggest the shares are priced for perfection with little room for disappointing results.

Result: Fair Value of ¥3,402.86 (OVERVALUED)

See our latest analysis for NTT DATA Group.However, slower revenue growth or a sudden shift in investor sentiment could quickly challenge the current valuation and momentum story for NTT DATA Group.

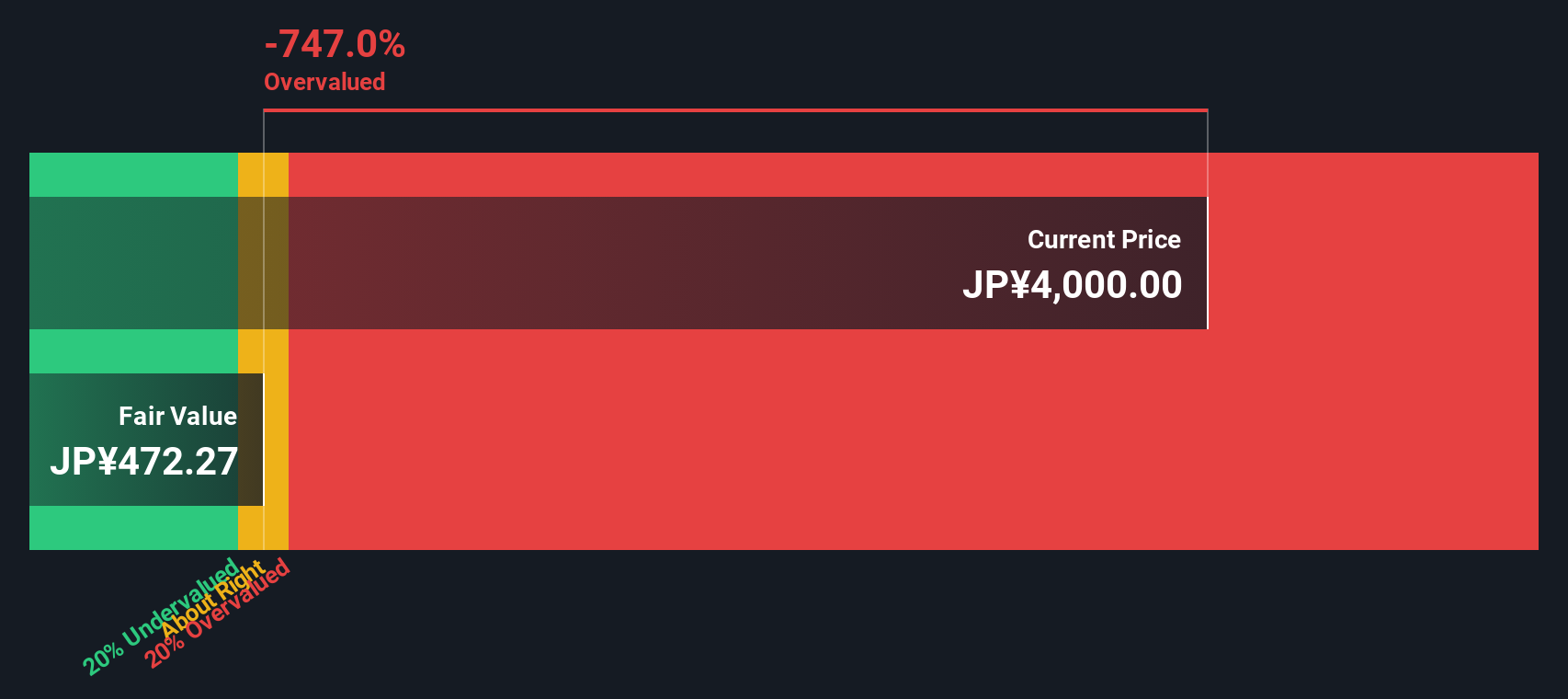

Find out about the key risks to this NTT DATA Group narrative.Another View: What Does the DCF Say?

Taking a different approach, our DCF model suggests a strikingly different read on fair value. It indicates NTT DATA Group might be even more overvalued than initial multiples suggest. Which method should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own NTT DATA Group Narrative

If you have a different perspective or would like to see how your own analysis compares, it is easy to create your own in just a few minutes. Do it your way

A great starting point for your NTT DATA Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Opportunities?

Strong returns rarely come to those who just watch from the sidelines. Use the Simply Wall Street Screener to connect with standout stocks built on real potential.

- Uncover hidden gems among companies with robust financials by checking out penny stocks with strong financials. These stocks are powering growth beyond their size.

- Tap into the future of medicine with advancements led by healthcare AI stocks, which is revolutionizing healthcare through artificial intelligence.

- Get ahead with unique value plays by exploring undervalued stocks based on cash flows that combine solid fundamentals with attractive pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NTT DATA Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:9613

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives