- China

- /

- Electronic Equipment and Components

- /

- SZSE:301099

Exploring Three High Growth Tech Stocks in Asia

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, Asian markets have been navigating a complex economic landscape, with the broader market sentiment being influenced by global trade policies. In such an environment, identifying high growth tech stocks in Asia requires a focus on companies that demonstrate resilience and adaptability to shifting market dynamics and geopolitical challenges.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.52% | 25.50% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| PharmaResearch | 20.73% | 27.75% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Yct Electronics GroupLtd (SZSE:301099)

Simply Wall St Growth Rating: ★★★★★☆

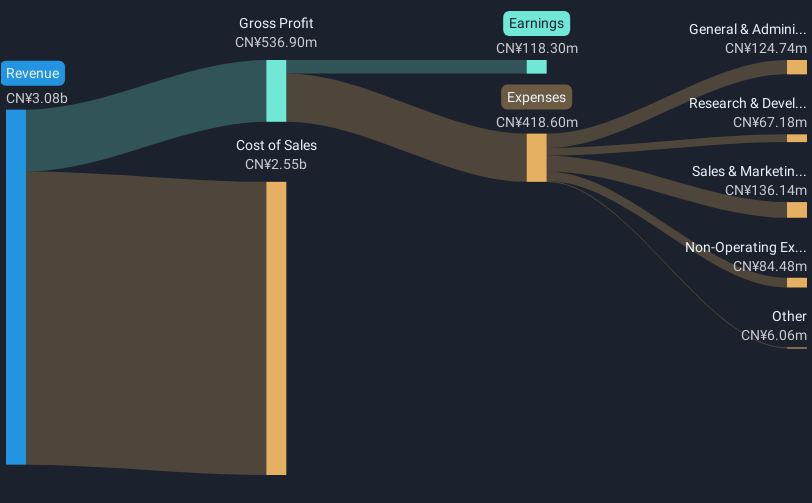

Overview: Shanghai YCT Electronics Group Co., Ltd specializes in providing electronic products in China and has a market capitalization of CN¥5.77 billion.

Operations: The company focuses on the production and sale of electronic products within China. The business generates revenue primarily through its diverse range of electronic offerings.

Shanghai Yct Electronics GroupLtd, a notable presence in Asia's tech landscape, has demonstrated robust growth with an annual revenue increase of 36.4% and earnings surge by 41.5%. This performance outstrips the broader Chinese market's growth rates of 12.7% for revenue and 24% for earnings, underscoring the company's competitive edge in electronics. Despite a volatile share price, recent strategic moves include a significant share repurchase program completed in March 2025 for CNY 74.04 million, enhancing shareholder value and reflecting confidence in its financial health. The company’s commitment to innovation is evident from its R&D investments which are crucial for sustaining its rapid growth trajectory and maintaining technological leadership.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★☆☆

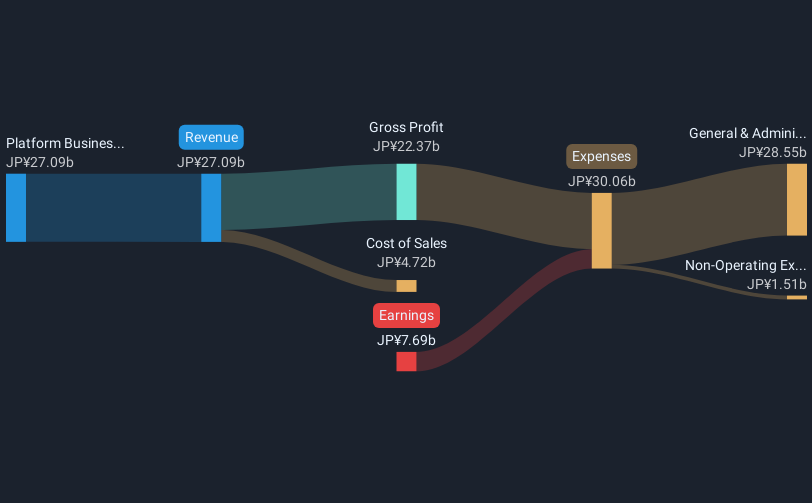

Overview: freee K.K. is a company that provides cloud-based accounting and HR software solutions in Japan, with a market capitalization of ¥212.11 billion.

Operations: The company focuses on cloud-based accounting and HR software solutions within Japan, generating revenue primarily from its Platform Business, which reported ¥28.91 billion.

Freee K.K. is navigating the competitive tech landscape in Asia with notable strategic initiatives and financial forecasts that suggest a promising future. Despite currently being unprofitable, the company is expected to reverse this trend, with earnings projected to grow by 56.16% annually. This growth trajectory is significantly above the broader Japanese market's forecast of 4.3% revenue growth per year. Additionally, Freee K.K.'s approach to expanding its market presence was highlighted in a recent board meeting where they discussed issuing new restricted shares, indicating proactive governance aimed at fueling further expansion and innovation.

- Navigate through the intricacies of freee K.K with our comprehensive health report here.

Explore historical data to track freee K.K's performance over time in our Past section.

GMO internet group (TSE:9449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GMO Internet Group, Inc. is a global provider of diverse internet services with a market capitalization of approximately ¥314.15 billion.

Operations: GMO Internet Group generates significant revenue from its Internet Infrastructure segment, contributing ¥184.91 billion, followed by the Internet Finance Business at ¥43.73 billion and the Internet Advertising and Media Business at ¥34.07 billion. The Crypto Asset Business adds another ¥9.13 billion to its diverse portfolio of services globally.

GMO Internet Group, a key player in Asia's tech sector, is making strategic moves to bolster its market position. With revenue growth projected at 7.6% annually and earnings expected to rise by 16.7%, the company outpaces Japan's average market projections significantly. A recent focus on share repurchases, with 1,894,900 shares bought back for ¥5.759 billion as part of their capital efficiency strategy, underscores their commitment to enhancing shareholder value. This approach is complemented by a robust R&D investment strategy that not only fuels innovation but also aligns with evolving industry demands—ensuring GMO remains at the forefront of technological advancements in the region.

- Delve into the full analysis health report here for a deeper understanding of GMO internet group.

Assess GMO internet group's past performance with our detailed historical performance reports.

Make It Happen

- Discover the full array of 492 Asian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301099

Shanghai Yct Electronics GroupLtd

Provides electronic products in China and internationally.

Moderate risk with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion