China Sunsine Chemical Holdings And 2 Other Premier Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets respond to the recent U.S. election results and a Federal Reserve rate cut, investors are witnessing record highs in major indices like the S&P 500, driven by optimism over potential economic growth and regulatory changes. Amidst this backdrop of market enthusiasm, dividend stocks continue to attract attention for their ability to provide steady income streams; China Sunsine Chemical Holdings and two other notable companies stand out as premier options worth considering in this environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.51% | ★★★★★★ |

| Globeride (TSE:7990) | 4.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.69% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

China Sunsine Chemical Holdings (SGX:QES)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Sunsine Chemical Holdings Ltd. is an investment holding company that manufactures and sells specialty chemicals globally, with a market capitalization of SGD419.49 million.

Operations: China Sunsine Chemical Holdings Ltd. generates its revenue primarily from Rubber Chemicals (CN¥4.39 billion), along with contributions from Heating Power (CN¥202.99 million) and Waste Treatment (CN¥25.06 million).

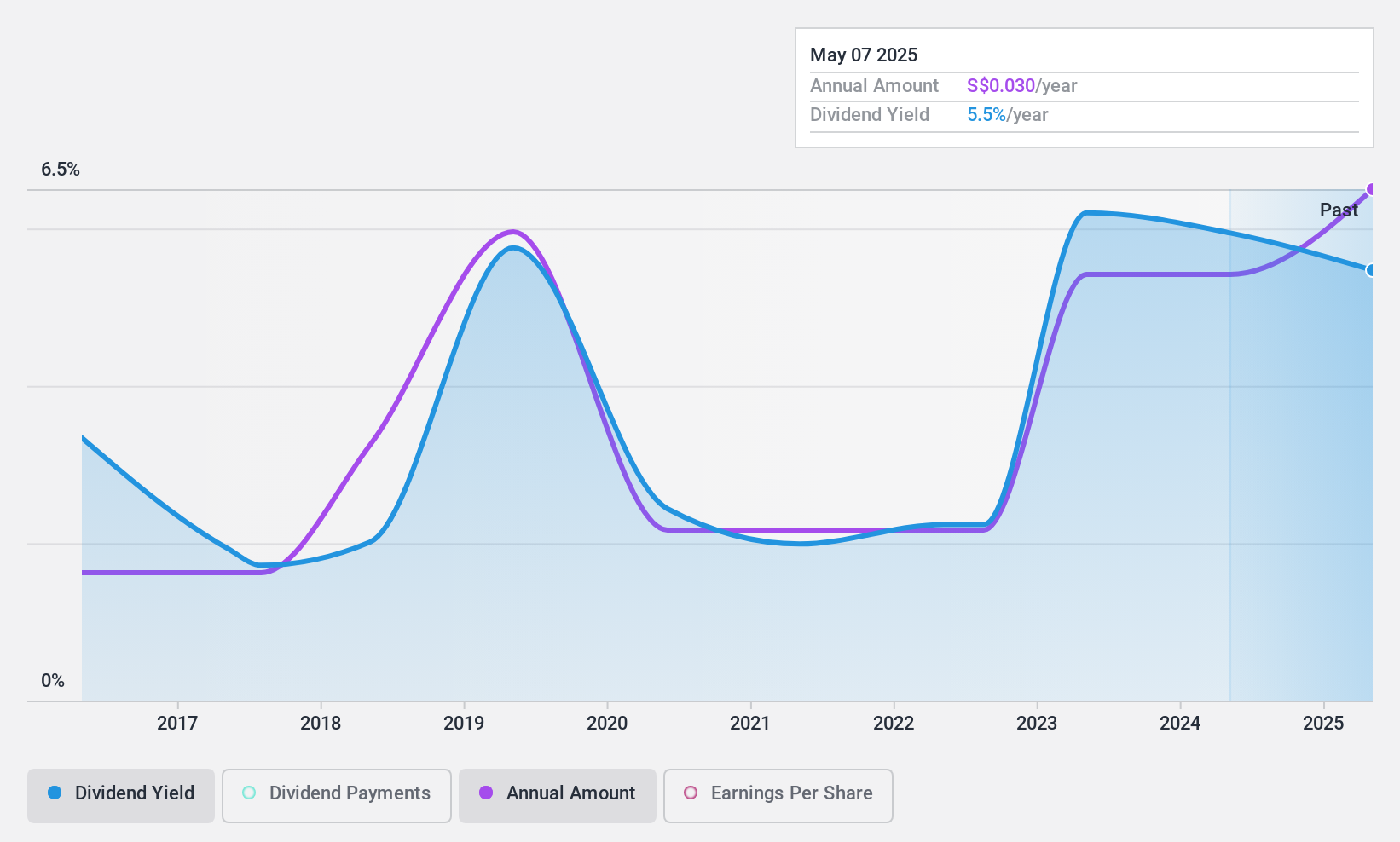

Dividend Yield: 5.6%

China Sunsine Chemical Holdings offers a dividend yield of 5.59%, which is below the top quartile in the Singapore market. Despite this, its dividends are well covered by both earnings and cash flow, with payout ratios of 21.1% and 34%, respectively. However, the company has an unstable dividend track record over the past decade, marked by volatility and unreliability in payments despite overall growth in payouts during that period.

- Click here to discover the nuances of China Sunsine Chemical Holdings with our detailed analytical dividend report.

- Our expertly prepared valuation report China Sunsine Chemical Holdings implies its share price may be lower than expected.

ENEOS Holdings (TSE:5020)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ENEOS Holdings, Inc. operates in the energy, oil and natural gas exploration and production, and metals sectors across Japan, China, Asia, and internationally with a market cap of ¥2.20 trillion.

Operations: ENEOS Holdings generates revenue from its Metal segment, which accounts for ¥1.07 billion, and its Oil and Natural Gas Exploration and Production segment, contributing ¥231.26 million.

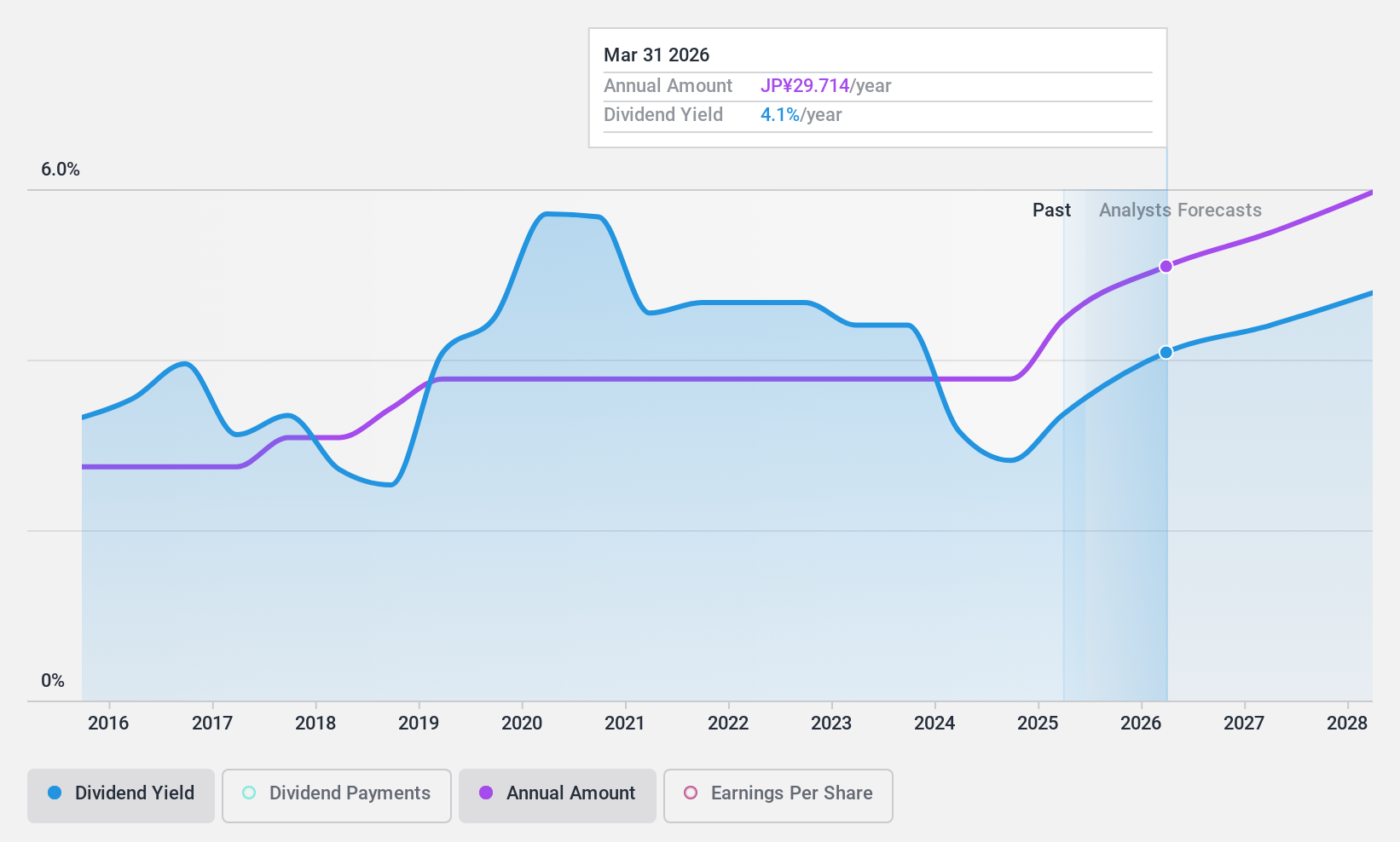

Dividend Yield: 3.3%

ENEOS Holdings provides a stable dividend yield of 3.28%, which is below the top quartile in Japan. The dividends are well covered by earnings and cash flows, with payout ratios of 38.5% and 26%, respectively, indicating sustainability. Despite high debt levels, the company has maintained reliable and growing dividend payments over the past decade. Recent board discussions suggest potential adjustments to future dividends following significant share buybacks totaling ¥118 billion since May 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of ENEOS Holdings.

- The analysis detailed in our ENEOS Holdings valuation report hints at an inflated share price compared to its estimated value.

Uchida Yoko (TSE:8057)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uchida Yoko Co., Ltd. offers government and education, office, and information system solutions both in Japan and internationally, with a market cap of ¥65.66 billion.

Operations: Uchida Yoko Co., Ltd.'s revenue is divided into three main segments: Information-Related at ¥139.85 billion, Office Related Business at ¥56.63 billion, and Public Related Business at ¥81.01 billion.

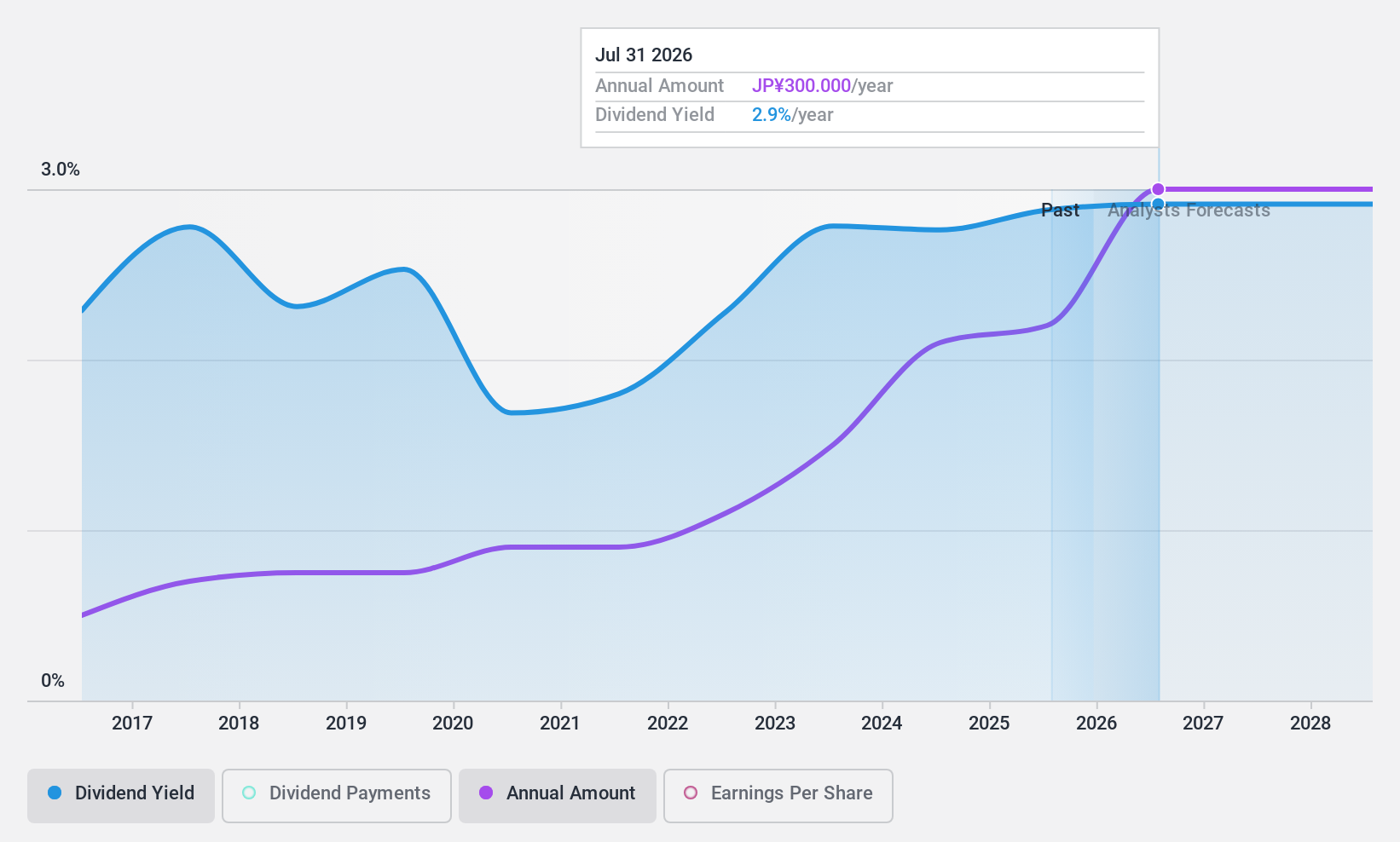

Dividend Yield: 3.3%

Uchida Yoko offers a reliable dividend yield of 3.3%, slightly below Japan's top quartile. The company's dividends are well-supported by earnings, with a payout ratio of 30.9%, and cash flows, at a cash payout ratio of 75.4%. Over the past decade, dividends have been stable and growing with minimal volatility. Uchida Yoko's price-to-earnings ratio is attractively low at 9.4x compared to the broader market, enhancing its value proposition for investors seeking income stability.

- Take a closer look at Uchida Yoko's potential here in our dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Uchida Yoko shares in the market.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1955 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8057

Uchida Yoko

Provides government and education, office, and information system solutions in Japan and internationally.

Flawless balance sheet established dividend payer.