In a week marked by volatility and uncertainty across global markets, U.S. stocks faced pressure from AI competition fears and mixed corporate earnings results, while European indices benefited from strong earnings and an ECB rate cut. Amid these dynamic conditions, investors often look to dividend stocks as a source of reliable income, with their potential for steady payouts providing a buffer against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.06% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.25% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Moriroku Holdings Company (TSE:4249)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Moriroku Holdings Company, Ltd. operates in Japan's resin-processed products and chemicals sectors with a market cap of ¥29.56 billion.

Operations: Moriroku Holdings Company, Ltd. generates revenue through its Chemical Business, which contributes ¥28.40 billion, and its Resin Processed Products Business, which accounts for ¥124.25 billion.

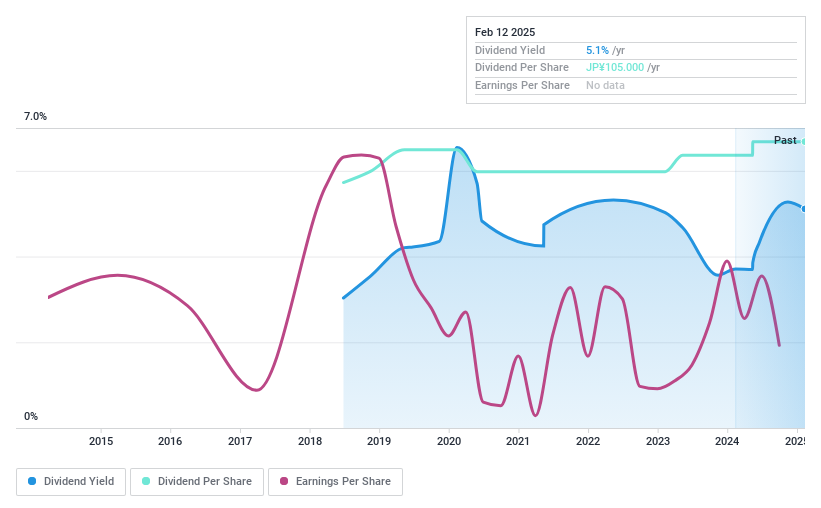

Dividend Yield: 5.2%

Moriroku Holdings Company has demonstrated a commitment to increasing dividends, recently raising its second-quarter payout to ¥52.5 per share from ¥50. Despite being in the top 25% of dividend payers in Japan, its seven-year dividend history shows volatility with occasional drops over 20%. The payout ratio is manageable at 67.6%, and the cash payout ratio is low at 27.3%, indicating dividends are well-covered by earnings and cash flows, though reliability remains a concern.

- Navigate through the intricacies of Moriroku Holdings Company with our comprehensive dividend report here.

- Our valuation report here indicates Moriroku Holdings Company may be overvalued.

Hisaka Works (TSE:6247)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hisaka Works, Ltd. manufactures and sells industrial machinery globally, with a market cap of ¥29.12 billion.

Operations: Hisaka Works, Ltd.'s revenue is primarily derived from its Heat Exchanger segment at ¥15.69 billion, followed by the Process Engineering segment at ¥14.95 billion and the Valve segment at ¥4.93 billion.

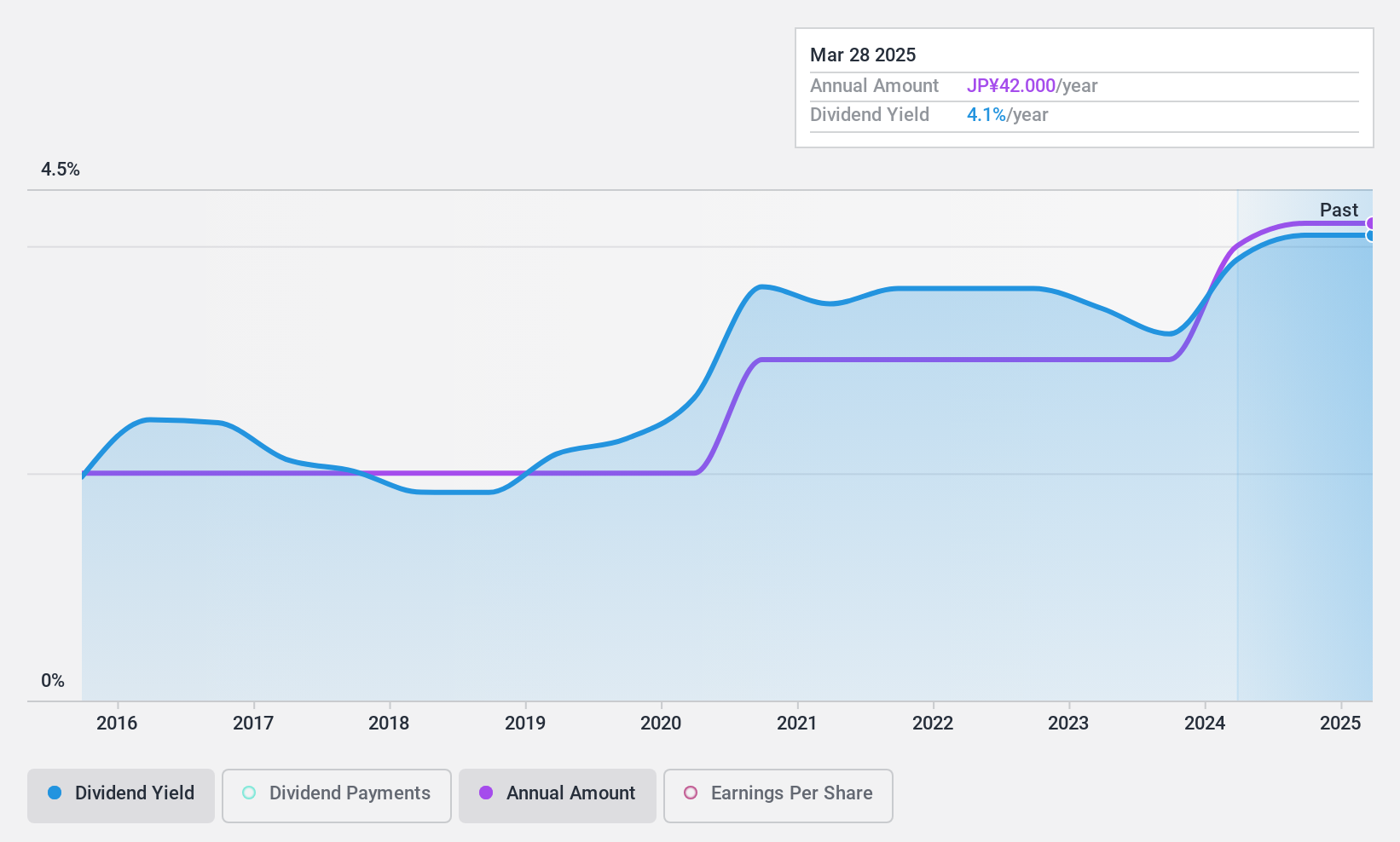

Dividend Yield: 4%

Hisaka Works' dividend yield of 3.98% ranks it among the top 25% in Japan, supported by a stable and growing dividend history over the past decade. Despite a low payout ratio of 45.9%, indicating earnings coverage, dividends aren't backed by free cash flow, raising sustainability concerns. Recent share buybacks totaling ¥1.05 billion could signal confidence but don't address cash flow issues impacting dividend reliability despite its attractive price-to-earnings ratio of 11x compared to the market average.

- Take a closer look at Hisaka Works' potential here in our dividend report.

- According our valuation report, there's an indication that Hisaka Works' share price might be on the expensive side.

Uchida Yoko (TSE:8057)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Uchida Yoko Co., Ltd. offers government and education, office, and information system solutions both in Japan and internationally, with a market cap of ¥67.21 billion.

Operations: Uchida Yoko Co., Ltd.'s revenue segments include Information-Related at ¥142.23 billion, Public Related Business at ¥77.10 billion, and Office-Related at ¥57.58 billion.

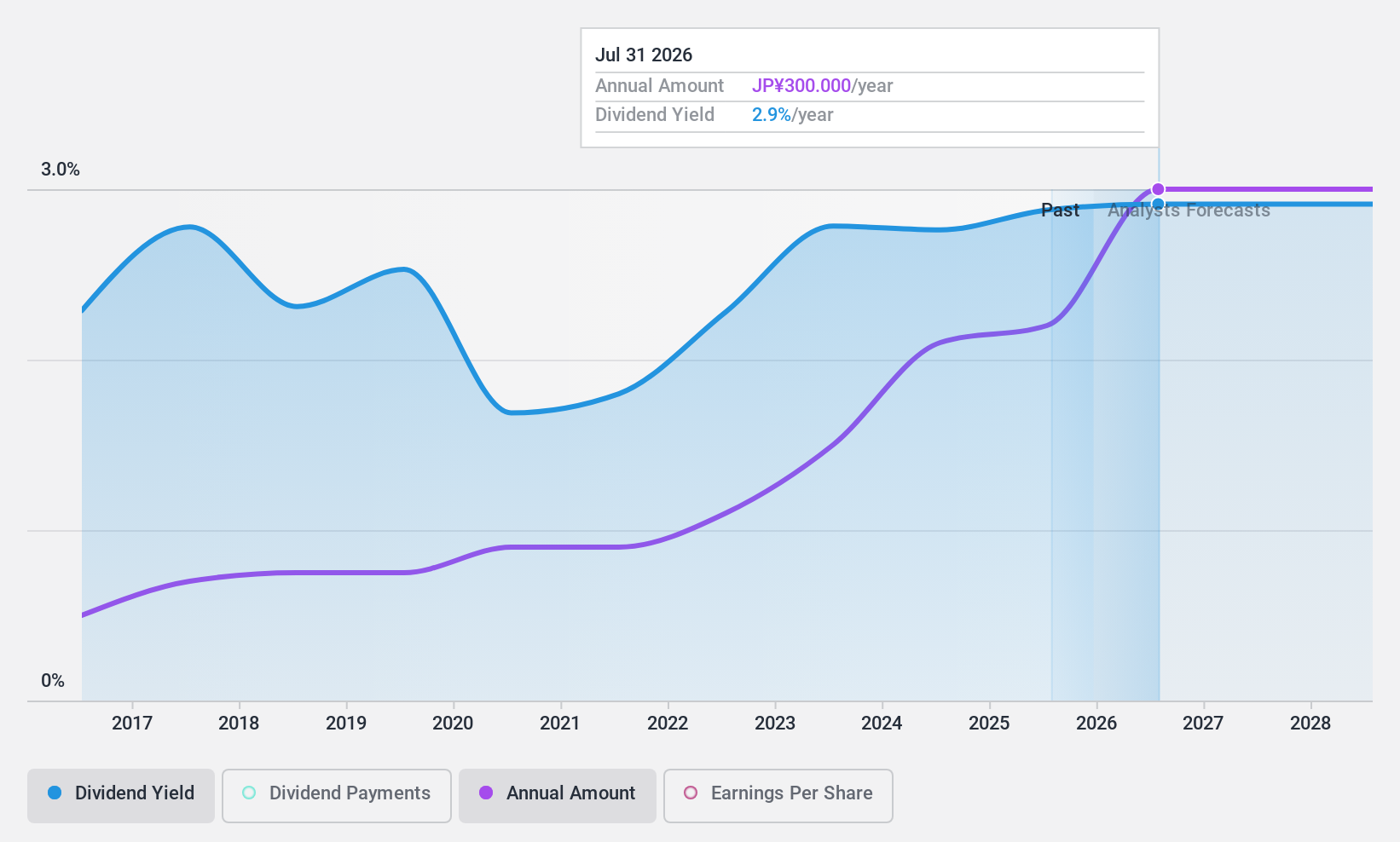

Dividend Yield: 3.2%

Uchida Yoko offers a stable dividend yield of 3.23%, with consistent growth over the past decade. Dividends are well-covered by earnings, indicated by a low payout ratio of 36.3%, and supported by cash flows despite a higher cash payout ratio of 75.5%. While its yield is below the top quartile in Japan, Uchida Yoko trades at an attractive price-to-earnings ratio of 11.3x, suggesting good value relative to peers and industry standards.

- Get an in-depth perspective on Uchida Yoko's performance by reading our dividend report here.

- Our valuation report here indicates Uchida Yoko may be undervalued.

Key Takeaways

- Gain an insight into the universe of 1940 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8057

Uchida Yoko

Engages in providing government and education, office, and information system solutions in Japan and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion