Intimate Merger, Inc. (TSE:7072) Stocks Pounded By 31% But Not Lagging Market On Growth Or Pricing

Intimate Merger, Inc. (TSE:7072) shareholders that were waiting for something to happen have been dealt a blow with a 31% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 54% loss during that time.

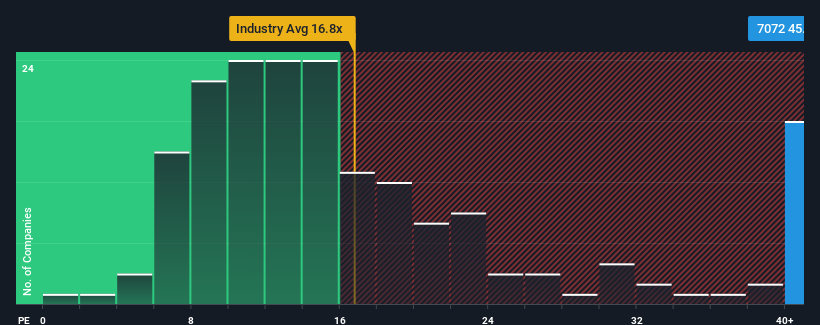

Even after such a large drop in price, Intimate Merger may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 45.6x, since almost half of all companies in Japan have P/E ratios under 13x and even P/E's lower than 9x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Intimate Merger's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Intimate Merger

Is There Enough Growth For Intimate Merger?

Intimate Merger's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 56%. Still, the latest three year period has seen an excellent 81% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

This is in contrast to the rest of the market, which is expected to grow by 9.8% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Intimate Merger is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Intimate Merger's P/E?

Intimate Merger's shares may have retreated, but its P/E is still flying high. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Intimate Merger revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - Intimate Merger has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

You might be able to find a better investment than Intimate Merger. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7072

Intimate Merger

Develops and sells data management platforms for marketing companies.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives