Fujitsu (TSE:6702) Valuation Spotlight After Strategic Partnership Targets AI-Driven Network Expansion

Reviewed by Simply Wall St

Fujitsu (TSE:6702) just signed a strategic partnership with 1Finity and Arrcus to push the boundaries of next-generation network infrastructure. This is more than a simple agreement between firms; it is a move aimed squarely at solving one of today's biggest challenges for tech companies: the explosion of data as AI services become more embedded in society. By teaming up with Arrcus and 1Finity, Fujitsu is looking to make it easier and more cost-effective for businesses to manage the heavy lifting required to connect data centers, cloud platforms, next-generation wireless, and all the places AI needs to operate.

This newly announced deal follows a period of strong performance for Fujitsu's stock. Over the past year, shares have jumped 30%, and year-to-date growth sits just above that mark, which indicates renewed investor interest as AI-driven opportunities increase. Looking further back, the company has delivered notable long-term gains. With momentum building, this partnership could be another step in aligning Fujitsu more closely with the demands of global enterprise tech.

After a year of strong performance and this latest strategic move, the key question remains: are we looking at an undervalued stock with further potential, or is the market already accounting for all the future AI growth?

Most Popular Narrative: 5.5% Undervalued

According to the most widely followed narrative, Fujitsu is considered undervalued, with analysts estimating its fair value to be about 5.5% higher than the current share price. This assessment rests on expectations of sustained earnings growth and expanding profit margins over the next several years.

“Strong acceleration in demand for digital transformation and modernization, particularly in Japan (revenue up 6% year over year, order backlog up 13%, and pipeline expected to expand more than 15 percent), positions Fujitsu to capture sustained multi-year growth as more enterprises and government sectors upgrade infrastructure. This supports top-line expansion over the medium to long term.”

Curious about which future growth levers are fueling this bullish call? Discover the number one financial trend analysts think will propel earnings, and how ambitious profit targets shape their view of fair value. The real surprises are hidden in the details of their projections. Find out what could drive the next big move for Fujitsu.

Result: Fair Value of ¥3,847.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing international sales or heavy reliance on Japan's market could threaten Fujitsu's ability to sustain long-term growth and earnings momentum.

Find out about the key risks to this Fujitsu narrative.Another View: What About the Price Tag?

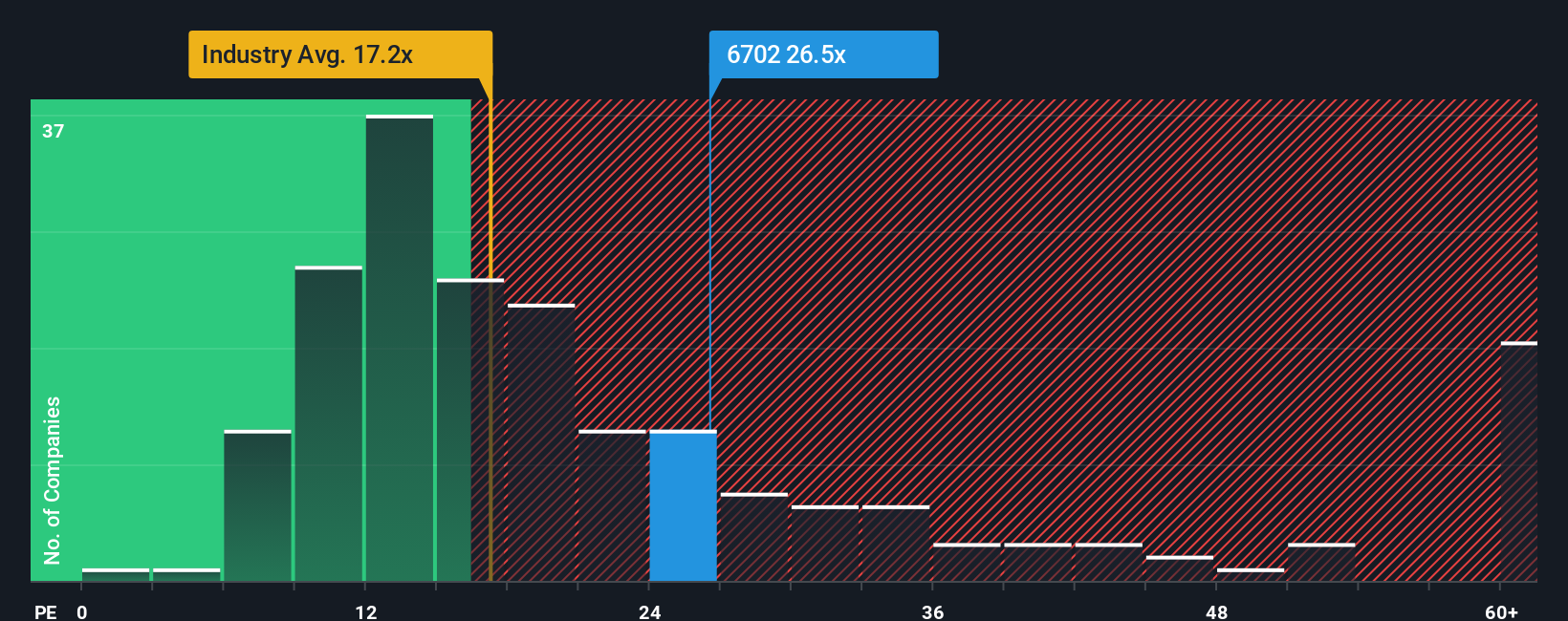

Looking at things differently, some investors compare Fujitsu’s current valuation with the rest of the JP IT industry. On this measure, the company looks expensive rather than cheap, so is the market expecting more than what’s already forecast?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fujitsu Narrative

If you want a fresh perspective or like getting hands-on with the data, crafting your own Fujitsu story takes less than three minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Fujitsu.

Looking for More Informed Investment Ideas?

Don’t let opportunity pass you by. The Simply Wall Street Screener arms you with fresh strategies beyond Fujitsu, helping you zero in on smart, next-level investments that fit your goals.

- Uncover the world’s smartest tech upstarts by scanning penny stocks with strong financials. penny stocks with strong financials reveals hidden gems before they break out.

- Tap into the future of medicine by tracking breakthroughs in healthcare artificial intelligence with healthcare AI stocks. This gives you exposure to the next generation of health innovators.

- Supercharge your search for potential bargains by targeting undervalued stocks based on cash flows. undervalued stocks based on cash flows keeps you ahead of the value curve.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:6702

Fujitsu

Engages in providing digital services in Japan, Europe, Americas, the Asia Pacific, East Asia, and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives