NEC (TSE:6701) Set for Q2 2025 Earnings Call as Digital Innovation Drives Market Expansion

Reviewed by Simply Wall St

See the full analysis report here for a deeper understanding of NEC.

Competitive Advantages That Elevate NEC

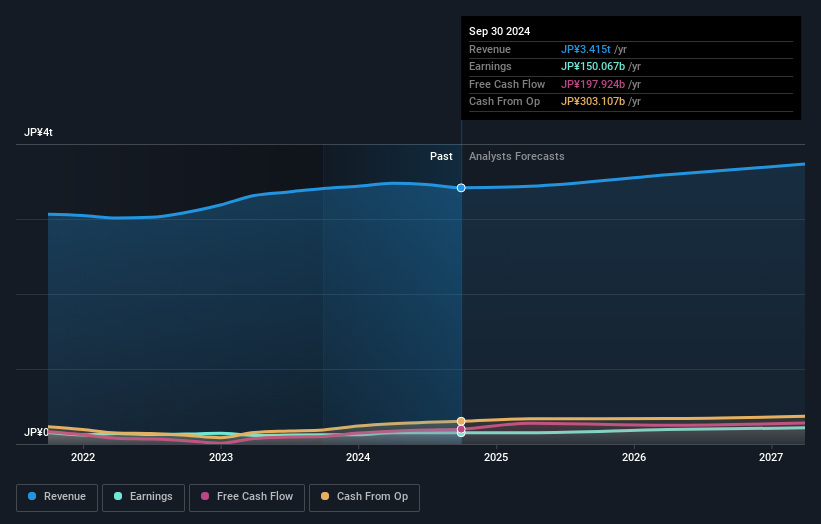

NEC has demonstrated impressive earnings growth of 21.6% over the past year, outperforming the IT industry average of 9.9%. This growth is bolstered by a net profit margin improvement to 4.4% from the previous year's 3.6%. The company's strategic focus on high-quality earnings and effective debt management, with interest payments covered 18.6 times by EBIT, underscores its financial health. Furthermore, NEC's current trading price of ¥13,160 is significantly below its estimated fair value of ¥22,190.62, suggesting a strong market positioning. Explore the current health of NEC and how it reflects on its financial stability and growth potential.

Challenges Constraining NEC's Potential

NEC faces challenges with a forecasted revenue growth of 3.1% per year, trailing the JP market's 4.2%. The expected annual profit growth of 12.7% is also not considered significant. Additionally, the company's Return on Equity stands at a modest 7.8%, below the ideal threshold of 20%. The dividend yield of 1.06% is relatively low compared to the top 25% of dividend payers in the JP market. These factors highlight areas where NEC could enhance its competitive edge. To learn about how NEC's valuation metrics are shaping its market position, check out our detailed analysis of NEC's Valuation.

Future Prospects for NEC in the Market

NEC is poised to capitalize on growth opportunities, with earnings forecasted to rise by 12.71% annually. The company is actively exploring emerging markets, which present substantial avenues for expansion. By investing in digital technologies, NEC aims to enhance operational efficiency and customer engagement, aligning with global trends. These initiatives could significantly bolster NEC's market position and drive future growth. See what the latest analyst reports say about NEC's future prospects and potential market movements.

Competitive Pressures and Market Risks Facing NEC

NEC is navigating economic headwinds and supply chain disruptions, which pose risks to production timelines and consumer spending. The company acknowledges these challenges and is preparing for potential impacts from macroeconomic conditions. Additionally, NEC's Price-To-Earnings Ratio of 23.4x suggests it is considered expensive compared to the JP IT industry average of 16.9x. These factors necessitate a vigilant approach to maintaining market share and profitability. To gain deeper insights into NEC's historical performance, explore our detailed analysis of past performance.

See what the latest analyst reports say about NEC's future prospects and potential market movements.

Explore the current health of NEC and how it reflects on its financial stability and growth potential.Conclusion

NEC has shown remarkable earnings growth and improved profitability, which, coupled with its strategic debt management, positions it well for financial stability. The company faces challenges in achieving competitive revenue growth and improving its return on equity and dividend yield. Nonetheless, NEC's focus on digital innovation and emerging market expansion presents promising growth avenues. The current trading price of ¥13,160, significantly below its fair value of ¥22,190.62, suggests that the market may not fully recognize NEC's potential, providing an opportunity for investors as the company navigates economic challenges and strives for enhanced market positioning.

Summing It All Up

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if NEC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:6701

NEC

Provides information and communication technology solutions in Japan and internationally.

Flawless balance sheet with solid track record.