- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5344

High Growth Tech Stocks Including Japan Business Systems And 2 Others

Reviewed by Simply Wall St

In recent weeks, global markets have shown a positive trajectory, with major U.S. stock indexes rebounding and European stocks rising sharply amid easing inflation concerns and strong bank earnings. This environment highlights the importance of identifying high-growth tech stocks that can capitalize on these favorable conditions, such as Japan Business Systems and two other notable companies in the sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 62.05% | 20.47% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.11% | 30.61% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Japan Business Systems (TSE:5036)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Business Systems, Inc. specializes in cloud integration and related services with a market capitalization of ¥39.85 billion.

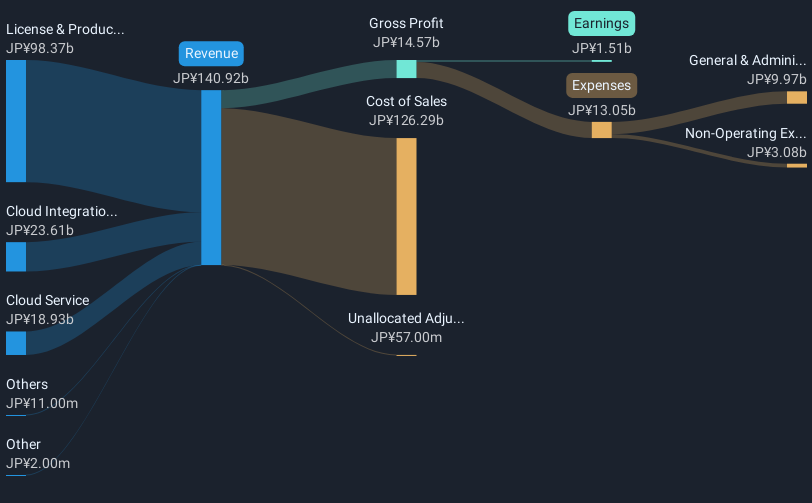

Operations: The company generates revenue primarily from cloud integration, cloud services, and licensing & products, with the latter being the largest contributor at ¥98.37 billion. Notably, its focus on cloud-related offerings positions it as a key player in this segment.

Japan Business Systems has demonstrated robust growth in a challenging environment, with revenue and earnings expanding by 24.9% and 24.62% annually, respectively. Despite a recent dip in profit margins to 1.1% from last year's 3%, the company's commitment to innovation is evident from its R&D investments, crucial for sustaining long-term competitiveness in the tech sector. Recent shareholder meetings reflect active engagement on corporate governance, though proposals aiming at drastic changes were rejected, suggesting stability in current management strategies. This backdrop of financial growth coupled with strategic governance practices positions Japan Business Systems intriguingly for future developments within the tech landscape.

- Get an in-depth perspective on Japan Business Systems' performance by reading our health report here.

Assess Japan Business Systems' past performance with our detailed historical performance reports.

MaruwaLtd (TSE:5344)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Maruwa Co., Ltd. is engaged in the production and sale of ceramics and electronic parts both domestically in Japan and internationally, with a market capitalization of ¥589.97 billion.

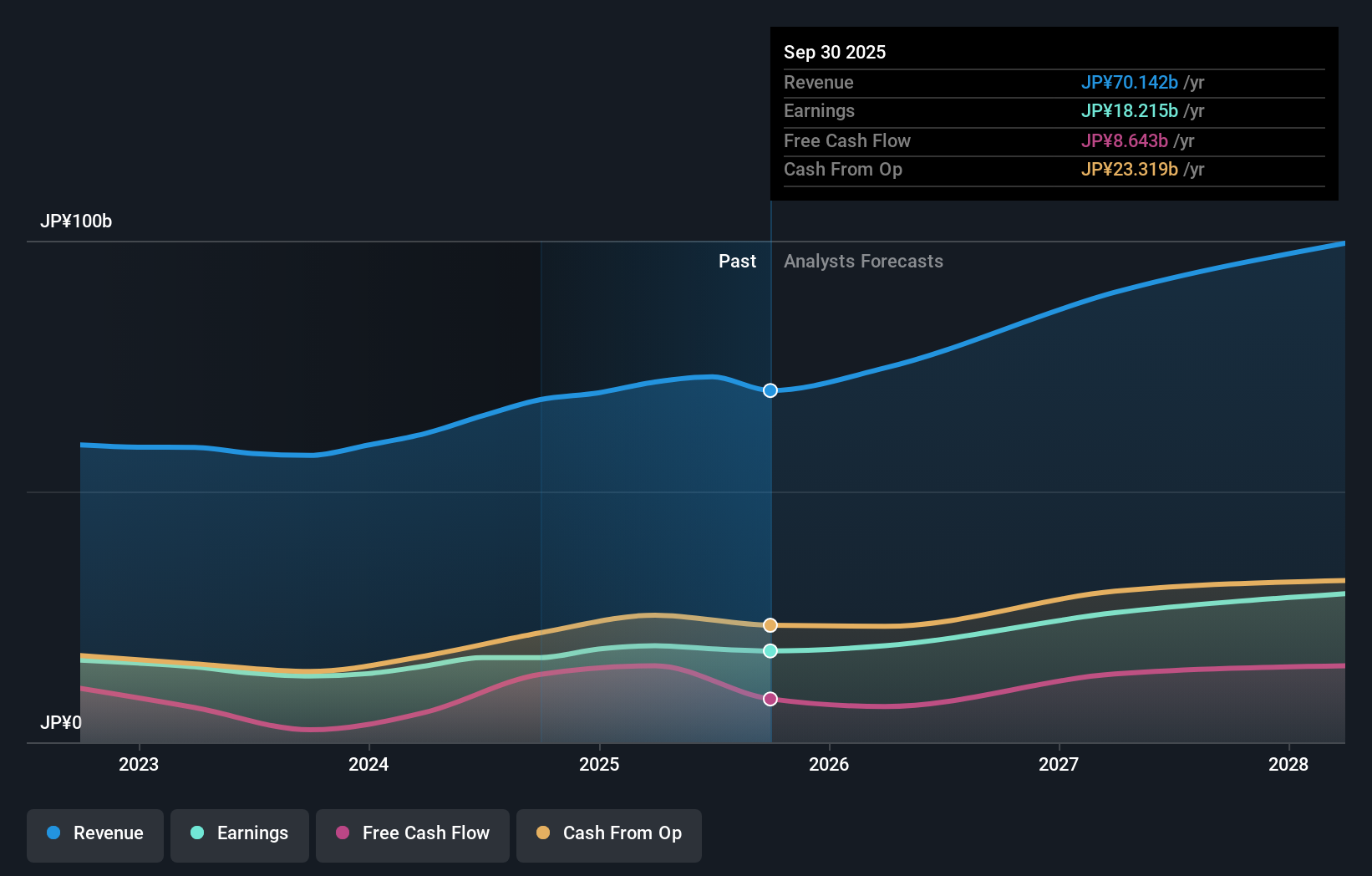

Operations: Maruwa generates revenue primarily through the production and sale of ceramics and electronic parts. The company operates both in Japan and internationally, leveraging its expertise in these sectors to cater to diverse markets.

Maruwa Co., Ltd. has shown a promising trajectory with annual revenue and earnings growth rates at 14.3% and 20.2%, respectively, outpacing the Japanese market averages of 4.3% and 8.1%. This performance is bolstered by significant R&D investments, which are crucial for maintaining competitive advantage in the rapidly evolving tech landscape. Recent financial results reveal a robust increase in sales to JPY 34.82 billion, up from JPY 28.06 billion last year, alongside a rise in net income to JPY 8.44 billion from JPY 6.78 billion, reflecting effective operational execution and market adaptation strategies.

Elite Material (TWSE:2383)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Elite Material Co., Ltd. is involved in the production and sale of copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across Taiwan, China, and international markets with a market cap of NT$206.44 billion.

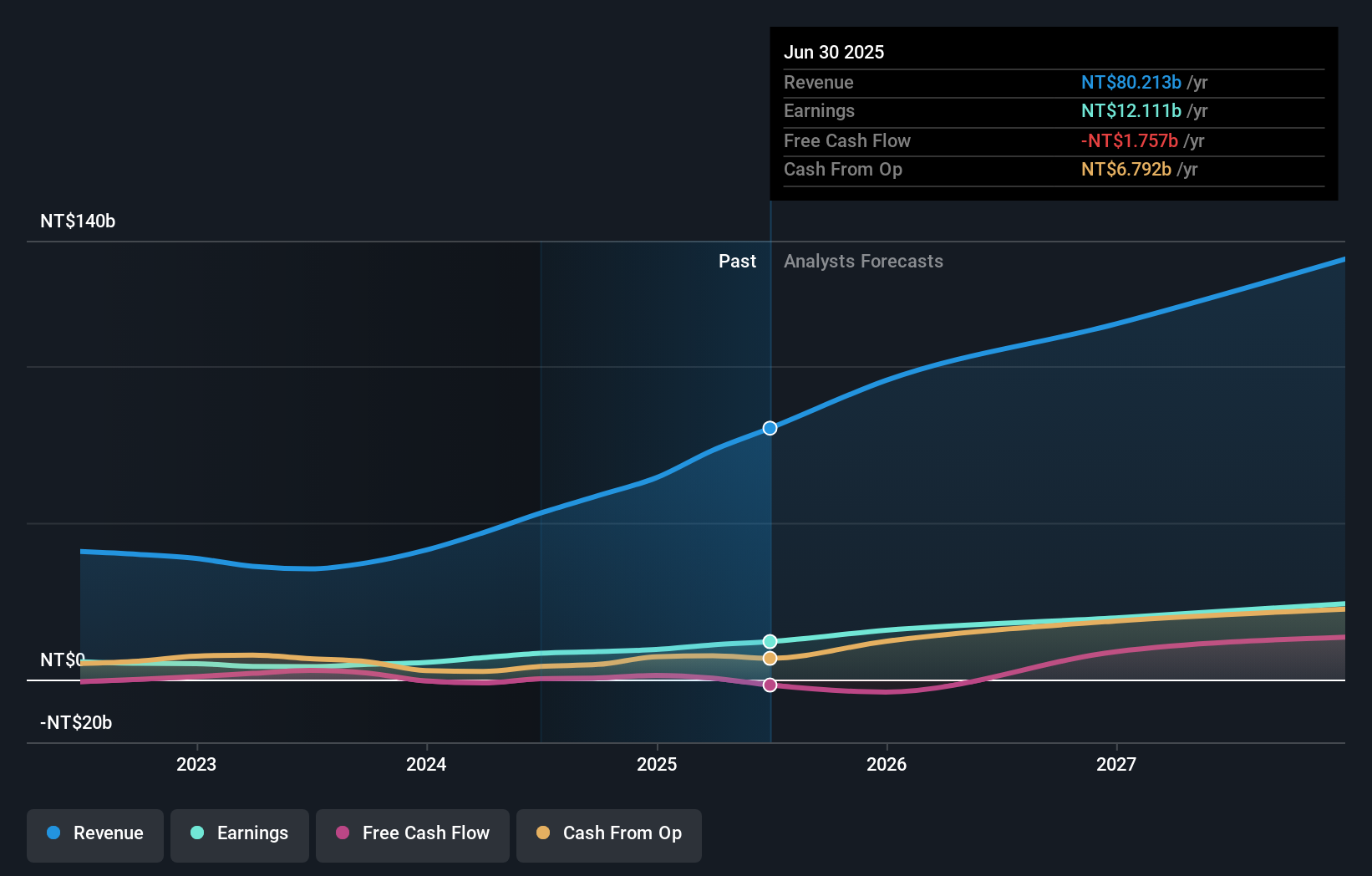

Operations: The company generates revenue primarily from its foreign departments, contributing NT$54.56 billion, while domestic operations add NT$14.61 billion. The business focuses on producing and selling copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across various markets.

Elite Material has demonstrated robust growth with a significant 83.4% increase in earnings over the past year, outstripping the electronics industry's average of 6.6%. This surge is supported by an aggressive expansion in sales, which saw a jump from TWD 28.41 billion to TWD 45.81 billion in nine months, reflecting a strategic alignment with market demands and innovation drives. The company's forward-looking R&D investments are pivotal, ensuring it stays ahead in technological advancements within the competitive tech landscape. At recent industry events, including presentations at JPMorgan and Citi's Taiwan Corporate Day, Elite Material highlighted these strategies which may bolster future prospects given its current trajectory of revenue and earnings growth at annual rates of 14.5% and 17.3%, respectively.

- Click here to discover the nuances of Elite Material with our detailed analytical health report.

Explore historical data to track Elite Material's performance over time in our Past section.

Where To Now?

- Take a closer look at our High Growth Tech and AI Stocks list of 1225 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5344

MaruwaLtd

Produces and sells ceramics and electronic parts in Japan and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives