BOC Hong Kong Holdings And 2 Other Prominent Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate the evolving landscape of political developments and economic indicators, major indices such as the S&P 500 have reached new highs amid optimism for potential trade deals and AI investments. In this climate of cautious optimism, dividend stocks like BOC Hong Kong Holdings offer investors a potential source of steady income, making them an attractive option in times when growth stocks are leading but value shares remain competitive.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

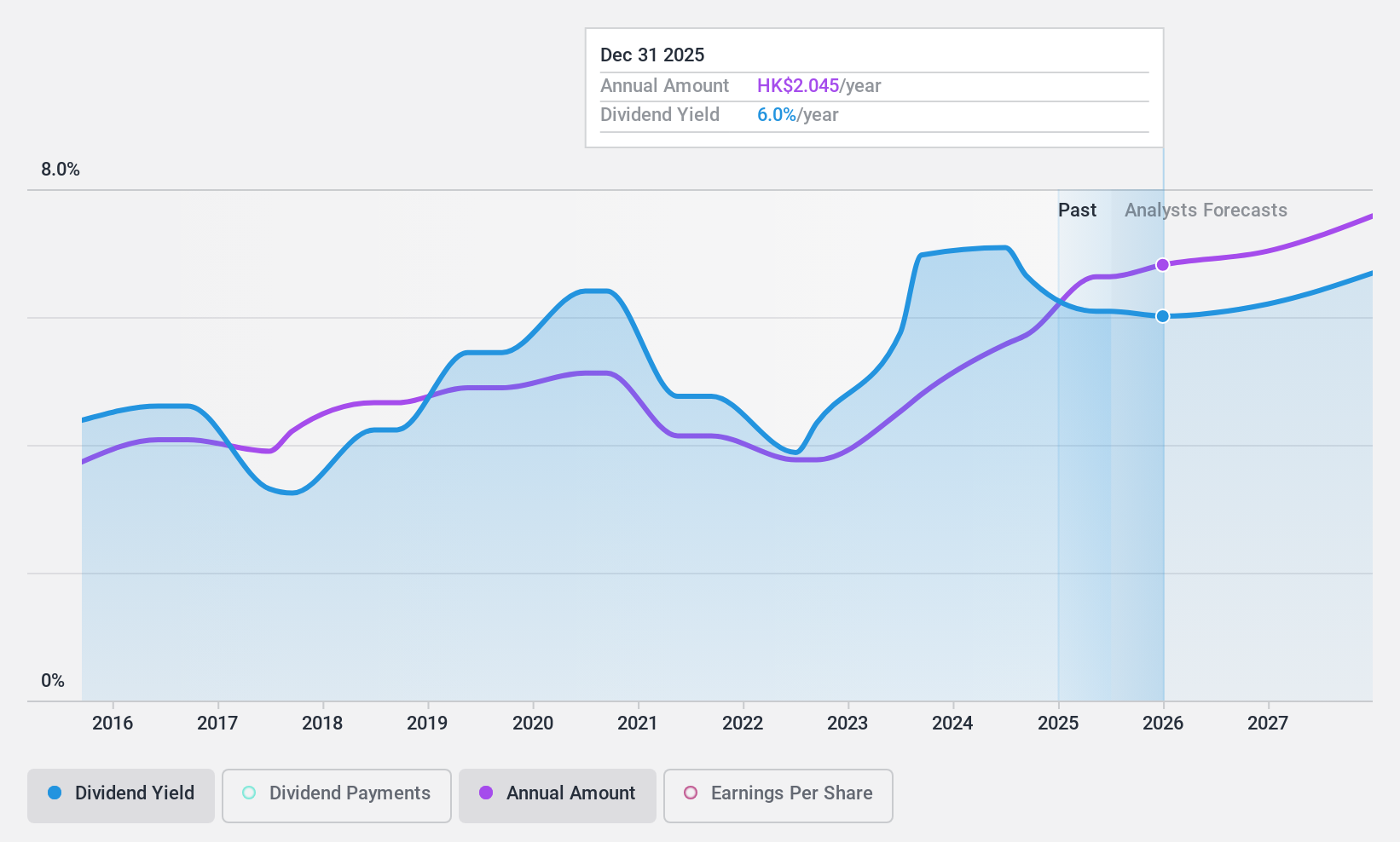

BOC Hong Kong (Holdings) (SEHK:2388)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BOC Hong Kong (Holdings) Limited is an investment holding company that offers banking and financial services to corporate and individual clients in Hong Kong, China, and internationally, with a market cap of HK$264.85 billion.

Operations: BOC Hong Kong (Holdings) Limited generates revenue from several segments including Personal Banking (HK$23.39 billion), Corporate Banking (HK$18.46 billion), Treasury (HK$13.62 billion), and Insurance (HK$1.50 billion).

Dividend Yield: 6.8%

BOC Hong Kong (Holdings) offers a dividend yield of 6.85%, which is below the top quartile in Hong Kong but is supported by a reasonable payout ratio of 50.7%. Despite past volatility and an unstable track record, dividends have grown over the last decade. Earnings growth of 18% last year supports future payouts, though concerns remain with low bad loan allowances at 90%. Recent board changes are unlikely to impact dividend policy significantly.

- Take a closer look at BOC Hong Kong (Holdings)'s potential here in our dividend report.

- In light of our recent valuation report, it seems possible that BOC Hong Kong (Holdings) is trading beyond its estimated value.

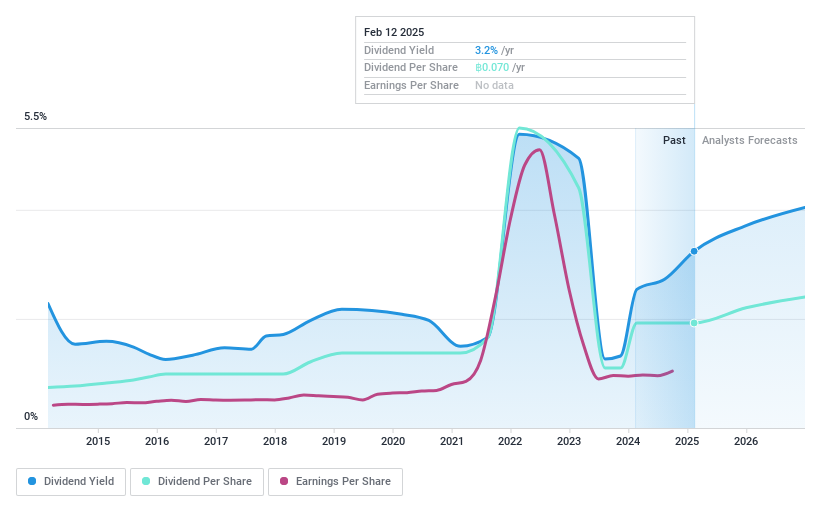

Chularat Hospital (SET:CHG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chularat Hospital Public Company Limited operates clinics and hospitals in Thailand with a market cap of THB25.08 billion.

Operations: Chularat Hospital Public Company Limited generates revenue primarily from Healthcare Facilities & Services, amounting to THB8.73 billion.

Dividend Yield: 3.1%

Chularat Hospital has shown strong earnings growth, with a recent 8.5% increase in net income, supporting its dividend payments. Despite a reasonable payout ratio of 67.1%, the dividends have been unreliable and volatile over the past decade, with fluctuations exceeding 20%. The dividend yield of 3.07% is low compared to top market payers in Thailand. However, dividends are covered by both earnings and cash flows, indicating sustainability despite their historical instability.

- Click here and access our complete dividend analysis report to understand the dynamics of Chularat Hospital.

- Our valuation report unveils the possibility Chularat Hospital's shares may be trading at a premium.

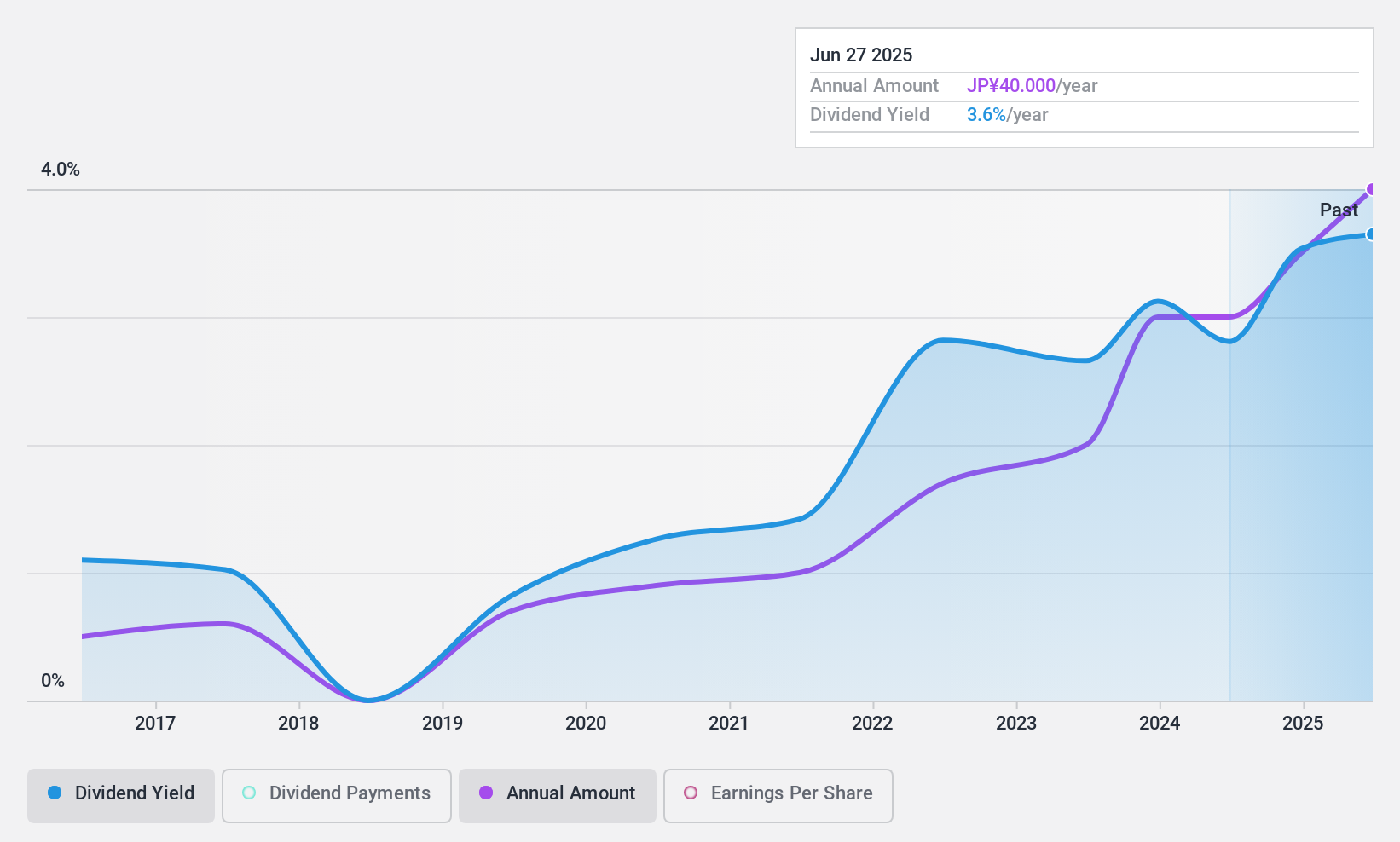

Intelligent Wave (TSE:4847)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Intelligent Wave Inc. offers system development services and system products both in Japan and internationally, with a market cap of ¥28.98 billion.

Operations: Intelligent Wave Inc.'s revenue primarily comes from its Software & Programming segment, which generates ¥14.90 billion.

Dividend Yield: 3.2%

Intelligent Wave's dividends have been reliable and stable over the past decade, supported by a reasonable payout ratio of 54.1% and covered by both earnings and cash flows, with a cash payout ratio of 75.9%. Despite strong earnings growth of 43.1% last year, its dividend yield of 3.16% is below the top tier in Japan's market. Trading at 24.7% below estimated fair value suggests potential for capital appreciation alongside its consistent dividend payments.

- Navigate through the intricacies of Intelligent Wave with our comprehensive dividend report here.

- Our valuation report here indicates Intelligent Wave may be undervalued.

Next Steps

- Click here to access our complete index of 1981 Top Dividend Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOC Hong Kong (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2388

BOC Hong Kong (Holdings)

An investment holding company, provides banking and related financial services to corporate and individual customers in Hong Kong, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives