As global markets navigate a complex landscape of trade negotiations and economic data, Asian indices have shown mixed performance with some regions experiencing gains while others face challenges. Amidst this backdrop, dividend stocks in Asia present an attractive option for investors seeking income stability; these stocks can offer reliable yields even when market conditions are uncertain.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.45% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.25% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.13% | ★★★★★★ |

| NCD (TSE:4783) | 4.10% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.32% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.34% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.38% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.34% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.45% | ★★★★★★ |

Click here to see the full list of 1208 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Justin Allen Holdings (SEHK:1425)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Justin Allen Holdings Limited is an investment holding company that manufactures and sells sleepwear and loungewear products across several countries including China, the USA, the UK, Ireland, Canada, and Spain with a market cap of HK$925 million.

Operations: Justin Allen Holdings Limited generates revenue of HK$1.07 billion from its apparel segment, which includes sleepwear and loungewear products.

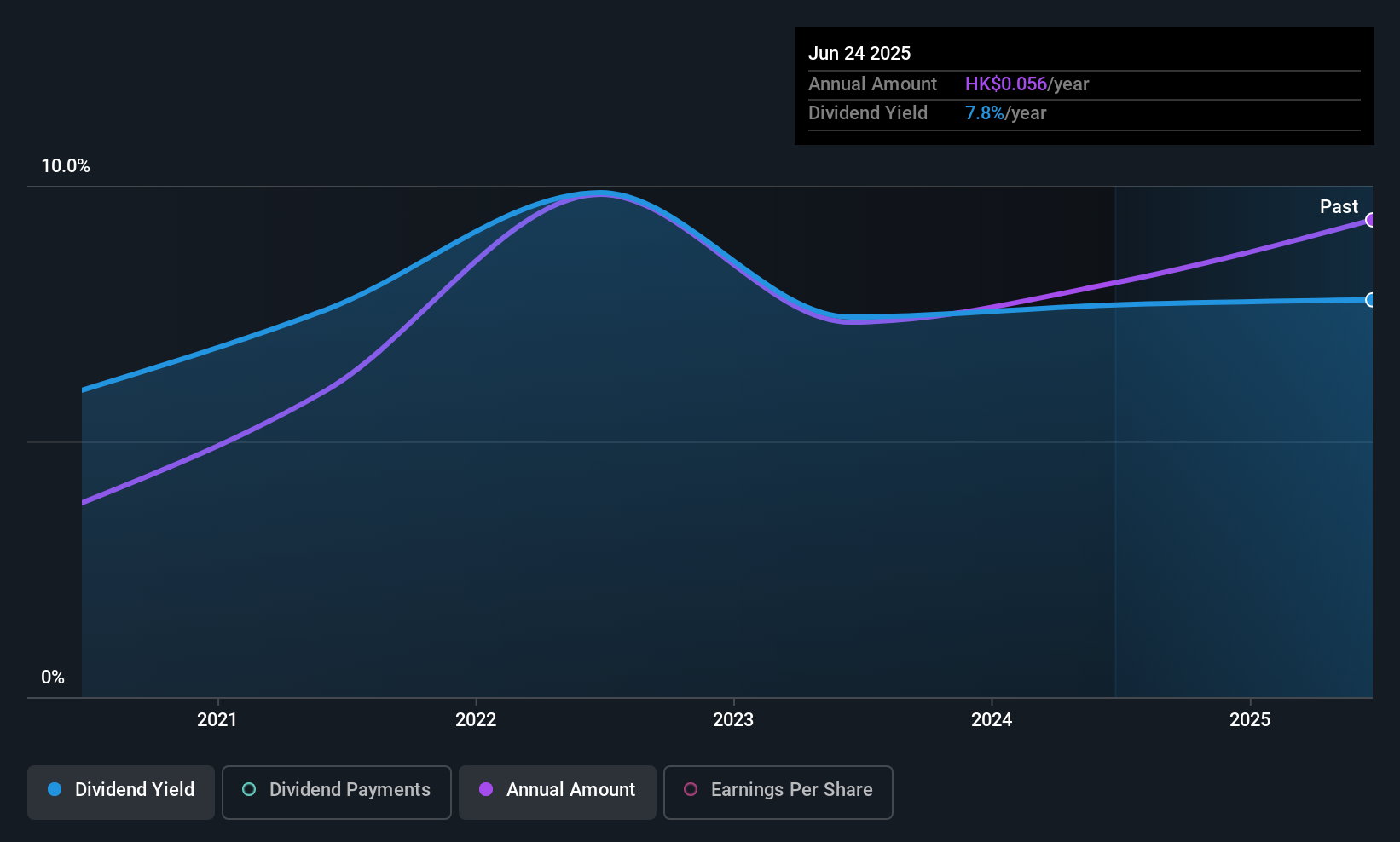

Dividend Yield: 7.6%

Justin Allen Holdings offers a dividend yield of 7.57%, placing it in the top 25% of Hong Kong market payers. Despite this, its dividend history has been unreliable and volatile over the past five years, with payments dropping more than 20% annually at times. The company's payout ratios are sustainable, with dividends covered by both earnings (41.1%) and cash flows (54.8%). Recently, it declared a final dividend of HK$0.056 per share for 2024 at its AGM on June 20, 2025.

- Click to explore a detailed breakdown of our findings in Justin Allen Holdings' dividend report.

- In light of our recent valuation report, it seems possible that Justin Allen Holdings is trading behind its estimated value.

Beijing Jiaman DressLtd (SZSE:301276)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Jiaman Dress Co., Ltd. focuses on the research, design, production, and sale of children's clothing, apparel, and home textile products in China with a market cap of CN¥2.53 billion.

Operations: Beijing Jiaman Dress Co., Ltd. generates its revenue from the development, design, production, and sale of children's clothing, apparel, and home textile products in China.

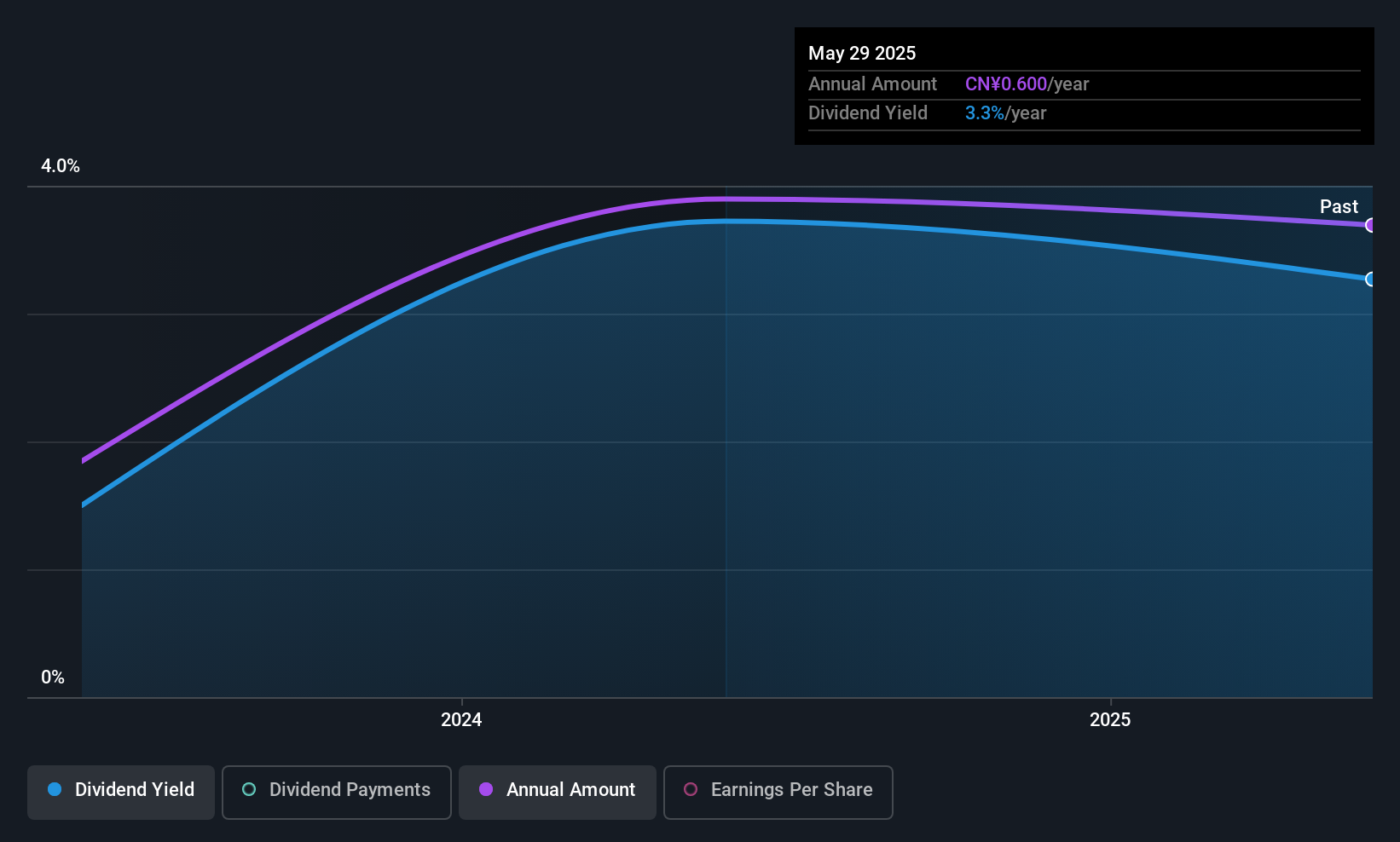

Dividend Yield: 3.1%

Beijing Jiaman Dress Ltd. offers a dividend yield of 3.07%, ranking it in the top 25% of payers in the Chinese market. Despite its brief two-year history of dividend payments, these have been stable and well-covered by earnings (payout ratio: 47.7%) and cash flows (cash payout ratio: 66%). However, recent approvals indicate a decrease in dividends for 2024 to CNY 0.72 per share, reflecting potential caution amid declining net income from CNY 53.15 million to CNY 44.6 million year-over-year.

- Navigate through the intricacies of Beijing Jiaman DressLtd with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Beijing Jiaman DressLtd's share price might be too pessimistic.

JFE Systems (TSE:4832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JFE Systems, Inc. is a Japanese company specializing in the planning, designing, developing, operating, and maintenance of information systems with a market capitalization of ¥61.47 billion.

Operations: JFE Systems, Inc. generates revenue through its comprehensive services in the information systems sector, which include planning, designing, developing, operating, and maintaining these systems in Japan.

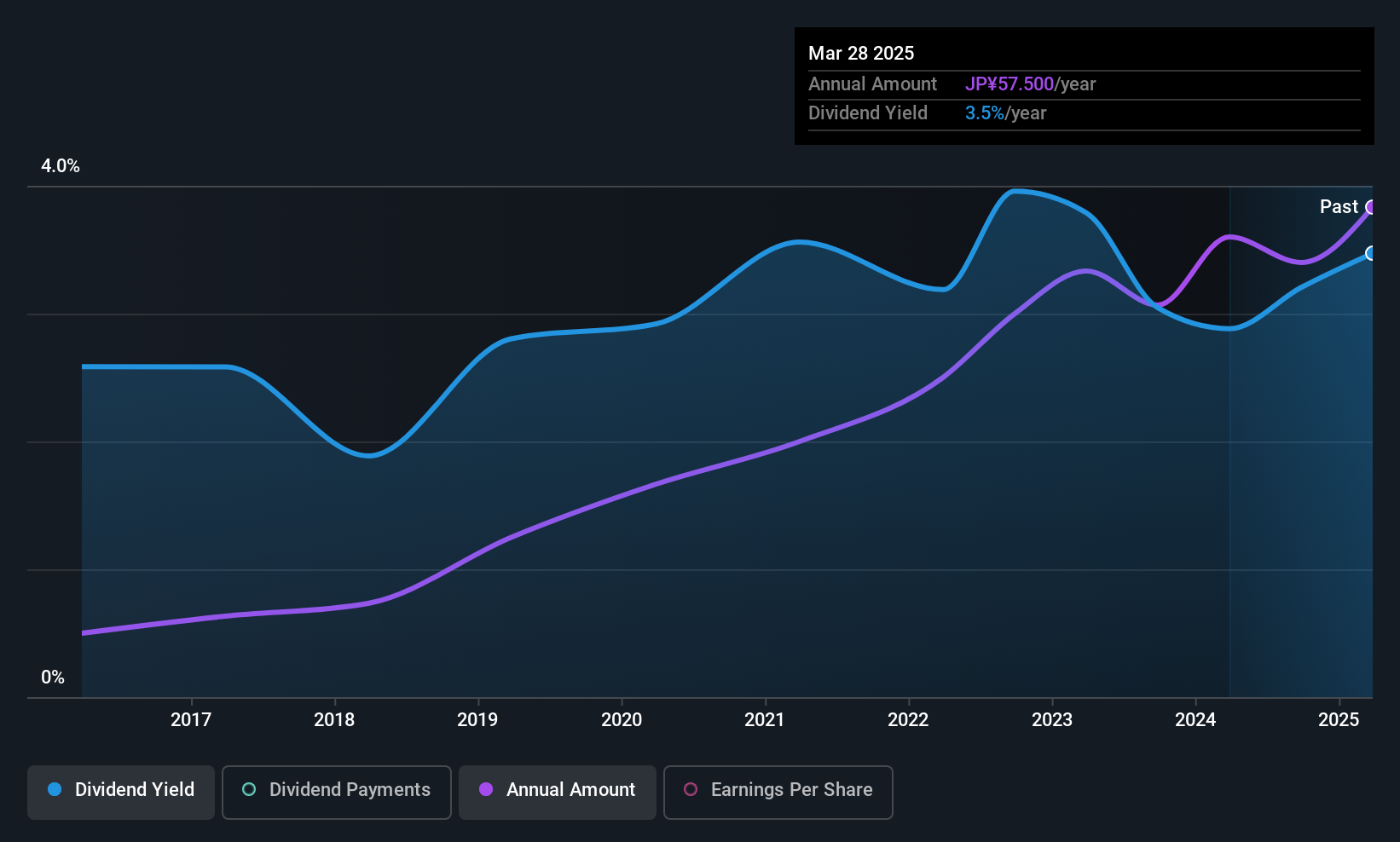

Dividend Yield: 3.5%

JFE Systems' dividend yield of 3.47% is below Japan's top quartile, but dividends are well-covered by earnings (payout ratio: 36.5%) and cash flows (cash payout ratio: 28.8%). Despite a history of volatility, recent increases to JPY 71 per share for FY2025 indicate potential stability. However, guidance suggests a reduction to JPY 40 per share for FY2026. The company's upcoming mid-term management plan could influence future dividend strategies amidst projected sales and profit growth.

- Delve into the full analysis dividend report here for a deeper understanding of JFE Systems.

- Insights from our recent valuation report point to the potential undervaluation of JFE Systems shares in the market.

Seize The Opportunity

- Dive into all 1208 of the Top Asian Dividend Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4832

JFE Systems

Provides engages in the planning, designing, developing, operating, and maintenance of information systems in Japan.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives