As global markets navigate a period of economic uncertainty marked by rate cuts from central banks and mixed performances across major indices, growth stocks continue to demonstrate resilience, with the Nasdaq Composite reaching new highs. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong internal confidence in the business's potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 27% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

We'll examine a selection from our screener results.

Vimian Group (OM:VIMIAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market capitalization of SEK21.45 billion.

Operations: The company's revenue segments comprise Medtech (€112.75 million), Diagnostics (€20.32 million), Specialty Pharma (€163.45 million), and Veterinary Services (€56.11 million).

Insider Ownership: 11.1%

Vimian Group's earnings are forecast to grow significantly at 89.8% annually, outpacing the Swedish market. Despite recent profitability, the company experienced a net loss in Q3 2024 and substantial insider selling over three months, which may concern investors. Revenue is expected to rise by 14.1% annually, faster than the market average but below high growth benchmarks. Currently trading below estimated fair value, Vimian faces challenges with low future return on equity projections and past shareholder dilution.

- Delve into the full analysis future growth report here for a deeper understanding of Vimian Group.

- Our comprehensive valuation report raises the possibility that Vimian Group is priced lower than what may be justified by its financials.

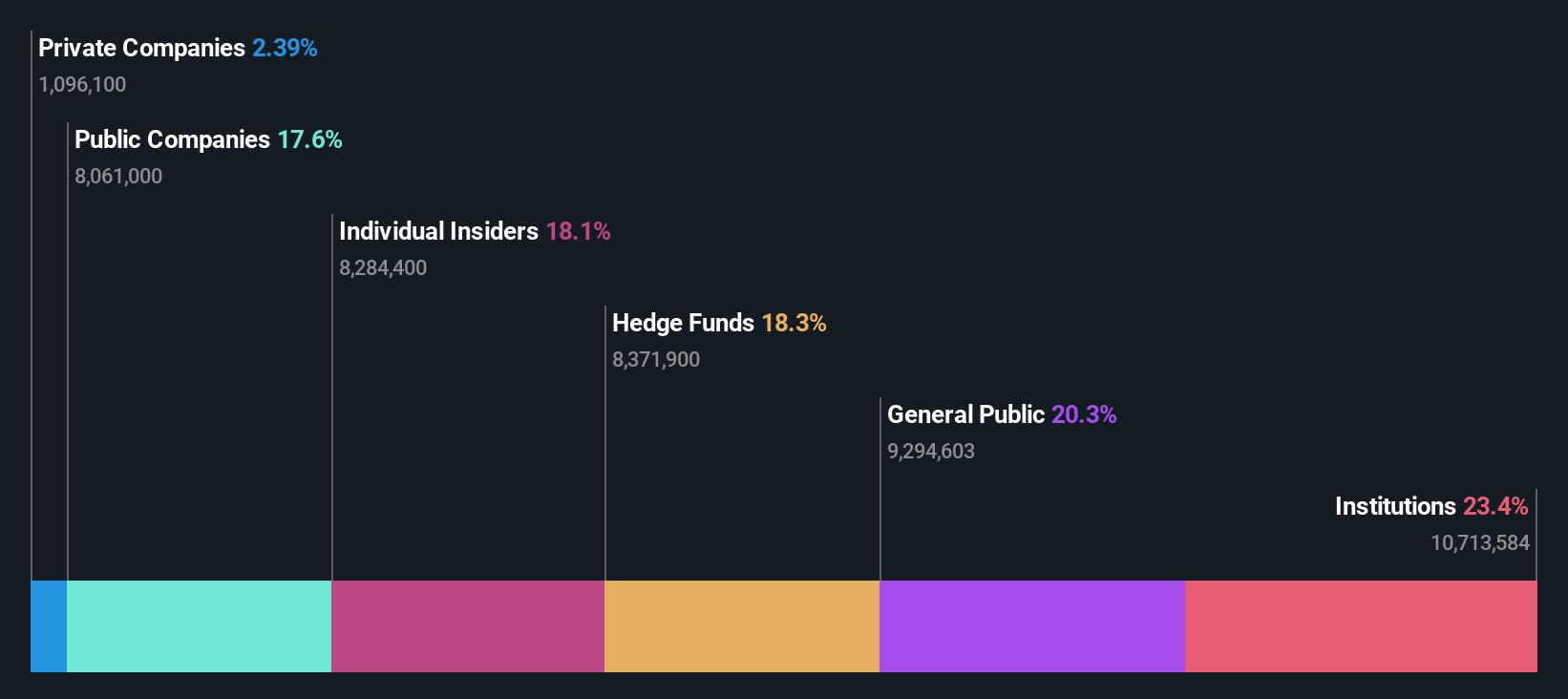

Digital Garage (TSE:4819)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital Garage, Inc. is a context company that operates both in Japan and internationally, with a market cap of approximately ¥170.65 billion.

Operations: The company's revenue segments include Platform Solutions at ¥23.29 billion and Long-Term Incubation at ¥11.93 billion, with Global Investment Incubation contributing ¥72 million.

Insider Ownership: 18.1%

Digital Garage is forecast to experience substantial earnings growth of 80.48% annually, with revenue expected to increase by 16% per year, surpassing the Japanese market's average. However, its return on equity is projected to remain low at 5.7%. Despite past shareholder dilution and a highly volatile share price, the stock appears undervalued, trading significantly below its estimated fair value. Recent organizational changes aim to enhance information security management within the company.

- Click here to discover the nuances of Digital Garage with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Digital Garage shares in the market.

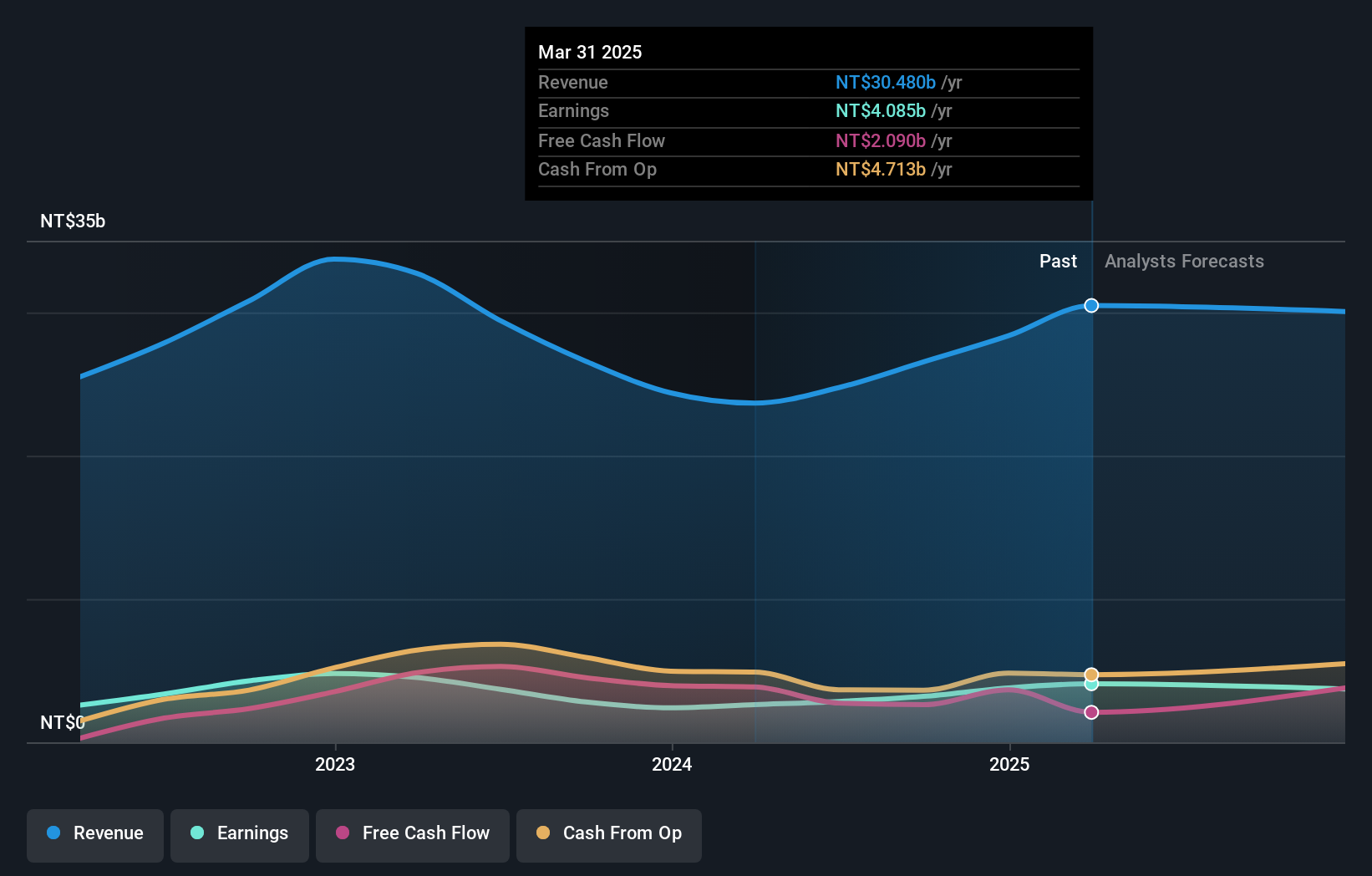

FuSheng Precision (TWSE:6670)

Simply Wall St Growth Rating: ★★★★☆☆

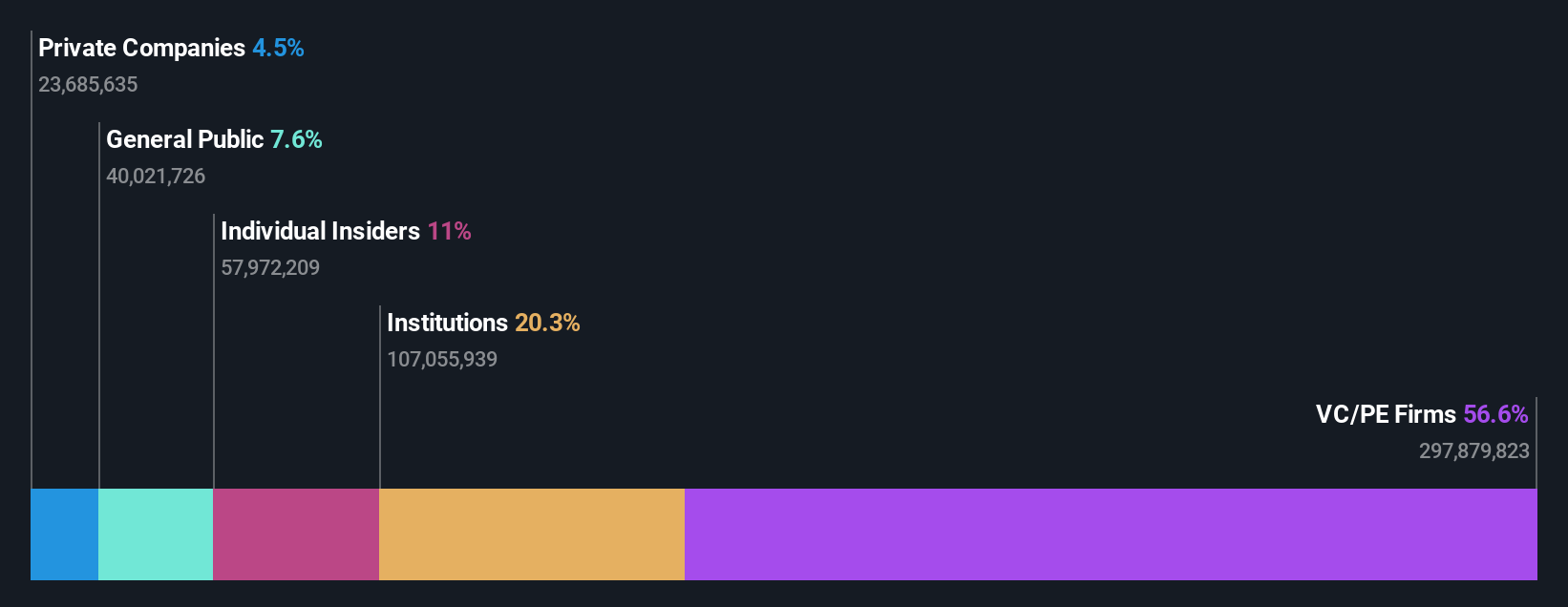

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market cap of NT$41.46 billion.

Operations: The company's revenue is primarily derived from its Golf Division, contributing NT$23.09 billion, and its Sports Assembly Division, which adds NT$2.44 billion.

Insider Ownership: 11.8%

FuSheng Precision's recent earnings report shows strong performance, with net income rising to TWD 827.11 million in Q3 2024 from TWD 470.29 million a year ago, driven by sales growth. The company's revenue is forecast to grow at 9.3% annually, outpacing the TW market average of 2.3%. Despite an unstable dividend history, FuSheng trades at a good value compared to peers and is significantly below its estimated fair value, indicating potential for future appreciation.

- Unlock comprehensive insights into our analysis of FuSheng Precision stock in this growth report.

- Our expertly prepared valuation report FuSheng Precision implies its share price may be lower than expected.

Seize The Opportunity

- Reveal the 1524 hidden gems among our Fast Growing Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6670

FuSheng Precision

Engages in the golf and sports equipment businesses in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives