Further weakness as Access (TSE:4813) drops 13% this week, taking one-year losses to 46%

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Access Co., Ltd. (TSE:4813) have tasted that bitter downside in the last year, as the share price dropped 46%. That falls noticeably short of the market decline of around 3.9%. On the bright side, the stock is actually up 32% in the last three years. More recently, the share price has dropped a further 24% in a month.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

We don't think that Access' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Access grew its revenue by 22% over the last year. We think that is pretty nice growth. Meanwhile, the share price is down 46% over twelve months, which is disappointing given the progress made. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

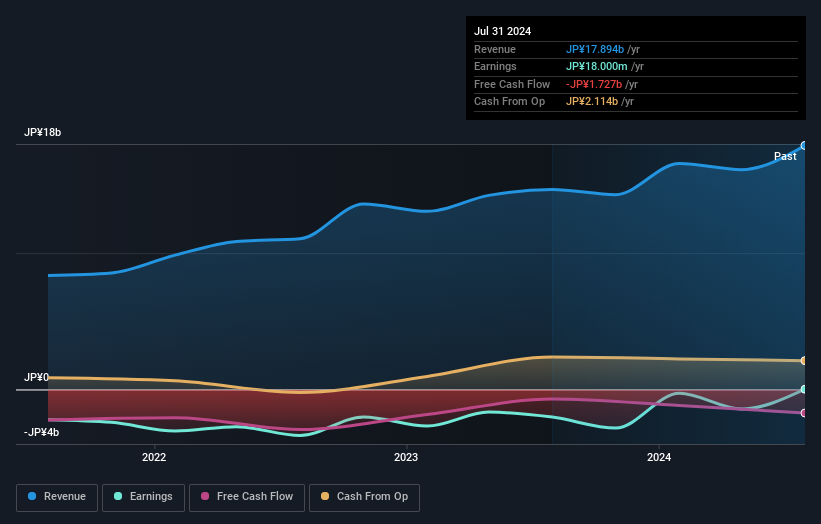

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Access' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market lost about 3.9% in the twelve months, Access shareholders did even worse, losing 46%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Access (1 can't be ignored!) that you should be aware of before investing here.

Of course Access may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4813

Access

Provides mobile and network software technologies to telecom carriers, consumer electronics manufacturers, broadcasting and publishing companies, automotive industry, and energy infrastructure providers worldwide.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives