David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that NCD Co., Ltd. (TSE:4783) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for NCD

What Is NCD's Net Debt?

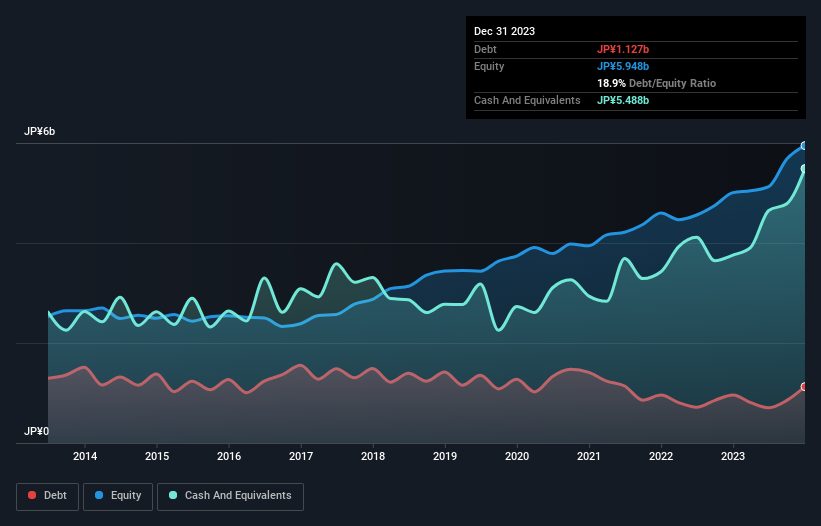

As you can see below, at the end of December 2023, NCD had JP¥1.13b of debt, up from JP¥959.0m a year ago. Click the image for more detail. However, its balance sheet shows it holds JP¥5.49b in cash, so it actually has JP¥4.36b net cash.

How Healthy Is NCD's Balance Sheet?

According to the last reported balance sheet, NCD had liabilities of JP¥5.26b due within 12 months, and liabilities of JP¥2.73b due beyond 12 months. Offsetting these obligations, it had cash of JP¥5.49b as well as receivables valued at JP¥3.34b due within 12 months. So it can boast JP¥834.0m more liquid assets than total liabilities.

This short term liquidity is a sign that NCD could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that NCD has more cash than debt is arguably a good indication that it can manage its debt safely.

On top of that, NCD grew its EBIT by 59% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since NCD will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. NCD may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, NCD produced sturdy free cash flow equating to 56% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While it is always sensible to investigate a company's debt, in this case NCD has JP¥4.36b in net cash and a decent-looking balance sheet. And it impressed us with its EBIT growth of 59% over the last year. So is NCD's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that NCD is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if NCD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4783

NCD

Engages in the system development, support and service, and parking system businesses in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.