Cybozu (TSE:4776) Valuation in Focus Following Strong 2025 Profit and Sales Growth

Reviewed by Simply Wall St

Cybozu (TSE:4776) just reported a jump in both sales and net income for the first nine months of 2025, marking a clear improvement in profit and operations compared to last year.

See our latest analysis for Cybozu.

Cybozu’s strong results appear to have reinvigorated market confidence, as indicated by the impressive 25.46% share price return so far this year and a one-year total shareholder return of nearly 70%. This recent momentum is helping to offset weaker stretches earlier in the year, which suggests that investors now see greater growth potential ahead.

If Cybozu’s turnaround has you thinking more about what’s working in the sector, this is a great moment to discover fast growing stocks with high insider ownership

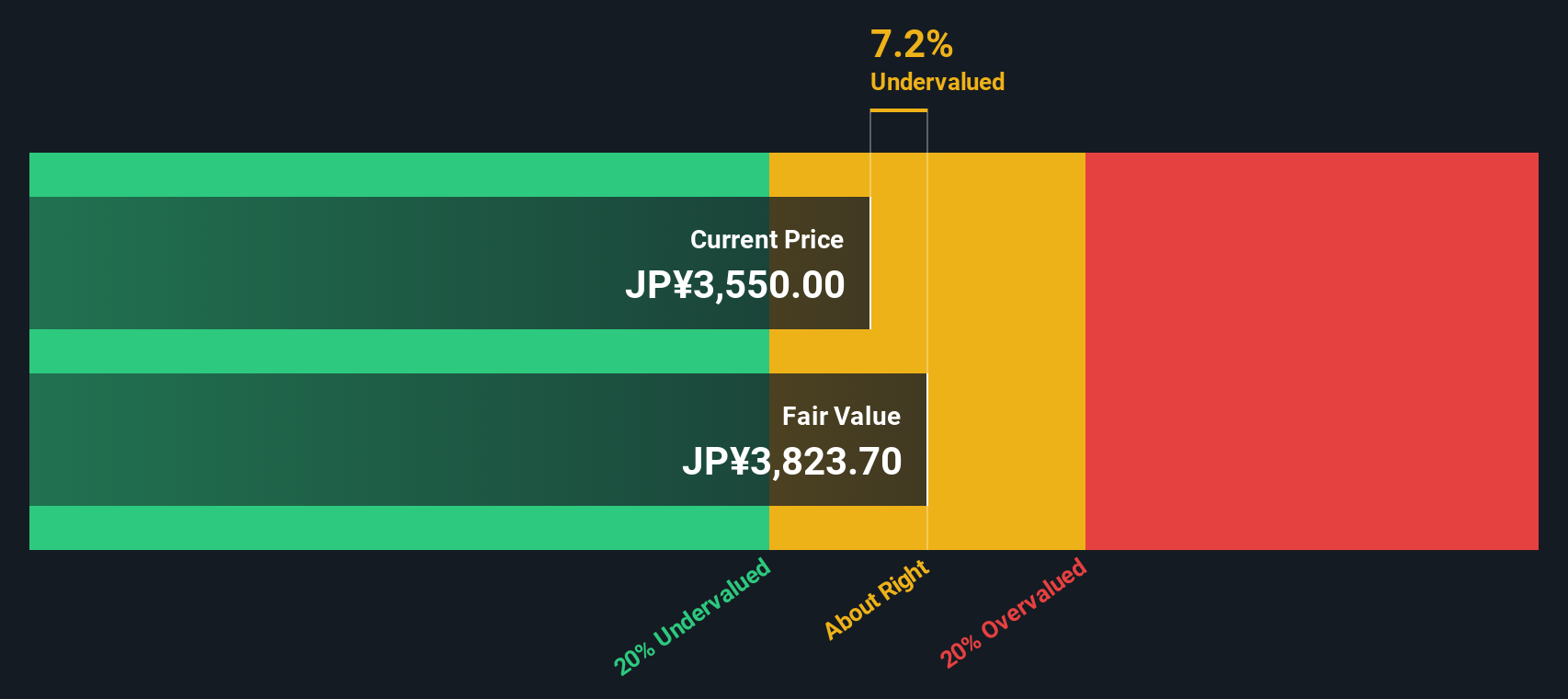

With Cybozu’s shares rallying and recent results beating expectations, the key question is whether investors are looking at an undervalued opportunity or if the market has already priced in the company’s accelerating growth.

Price-to-Earnings of 24.6x: Is it justified?

Cybozu’s shares are trading at a price-to-earnings (P/E) ratio of 24.6x, which suggests the market demands a higher premium for its recent profit growth relative to some peers.

The price-to-earnings ratio indicates how much investors are willing to pay for a company’s earnings. For software firms like Cybozu, this multiple reflects expected growth and profitability. A higher P/E can point to anticipated future gains or market enthusiasm.

Currently, Cybozu stands out with this P/E being significantly lower than its peer average of 54x. This may imply investors are undervaluing its recent turnaround or are cautious about whether such growth can be sustained. Compared to the broader JP Software industry average of 19.2x, the premium is notable and may hint at the company’s perceived quality or improved outlook. The company’s P/E also sits below the estimated Fair Price-to-Earnings Ratio of 26.5x, which could signal room for further upside if performance persists.

Explore the SWS fair ratio for Cybozu

Result: Price-to-Earnings of 24.6x (UNDERVALUED)

However, slowing momentum over the past quarter and uncertainty about sustaining recent profit growth could present challenges for the long-term bullish case for Cybozu.

Find out about the key risks to this Cybozu narrative.

Another View: What Does the SWS DCF Model Say?

While the price-to-earnings ratio suggests Cybozu is trading below both its peers and its projected fair ratio, our SWS DCF model presents a similar perspective. The shares are priced about 13.6% below our estimate of fair value. Does this alignment indicate that Cybozu’s upside remains, or are there cautionary signals investors should consider?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cybozu for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cybozu Narrative

If you’re looking for a different angle or want to dig into the numbers on your own terms, you can craft your own narrative and analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cybozu.

Looking for more investment ideas?

Stay ahead of the curve and don’t let the market’s biggest themes pass you by. Simply Wall Street’s screener helps you spot breakthrough opportunities quickly.

- Catch emerging payouts and steady income streams by checking out these 15 dividend stocks with yields > 3% offering yields above 3% for dependable returns.

- Uncover breakthrough tech opportunities and market movers among these 25 AI penny stocks for those keen on the AI sector’s explosive potential.

- Find tomorrow’s leaders before they’re in the spotlight with these 3579 penny stocks with strong financials boasting solid fundamentals and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4776

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success