- China

- /

- Electronic Equipment and Components

- /

- SZSE:301556

High Growth Tech Stocks in Asia Featuring Vobile Group and Two Others

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by mixed economic signals, with U.S. small-cap indexes like the S&P MidCap 400 and Russell 2000 showing notable gains, investors are closely watching Asian tech stocks for potential growth opportunities. In this dynamic environment, identifying high-growth tech stocks in Asia requires a keen understanding of market trends and economic indicators that can influence performance, such as innovation capabilities and adaptability to shifting trade policies.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Fositek | 28.67% | 35.10% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.44% | 23.48% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| PharmaResearch | 25.04% | 26.89% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.05% | 87.21% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Vobile Group (SEHK:3738)

Simply Wall St Growth Rating: ★★★★☆☆

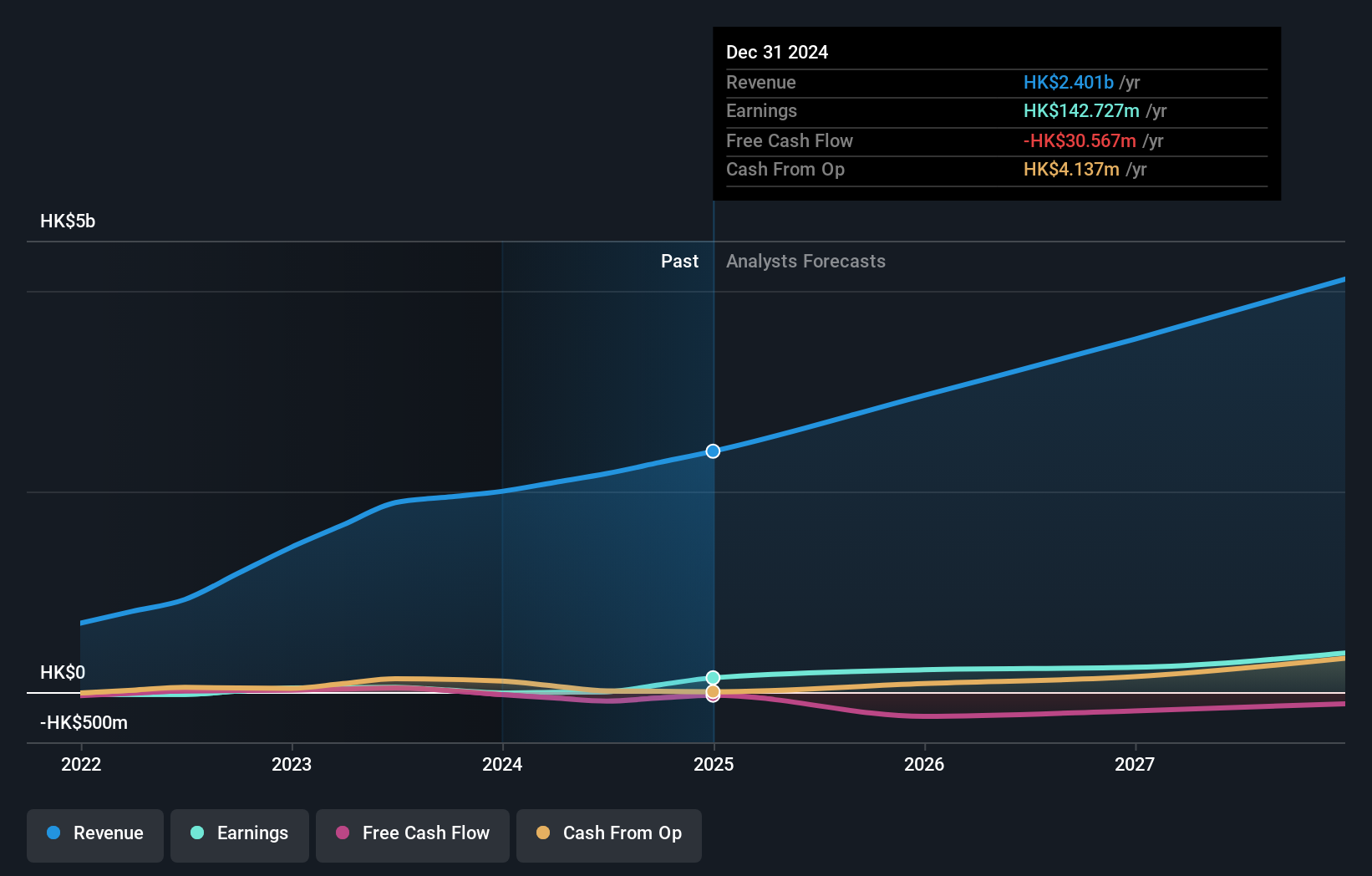

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and internationally, with a market cap of HK$8.46 billion.

Operations: The company generates revenue primarily through its SaaS offerings for digital content asset protection and transactions, amounting to HK$2.40 billion.

Vobile Group's strategic moves, including a recent alliance with Shanghai Film Group and several equity offerings totaling over HKD 1 billion, underscore its aggressive expansion in digital cultural content. This growth trajectory is supported by a notable 23% revenue increase in Q1 2025 compared to the previous year, with mainland China revenues up by 21%. The company's commitment to innovation is evident from its investment in R&D, crucial for staying competitive in the fast-evolving tech landscape. Despite challenges like lower than industry average return on equity projections (13.6%), Vobile's earnings are expected to surge by 28.55% annually, outpacing the Hong Kong market forecast of 10.3%. This blend of strategic partnerships and robust financial performance positions Vobile as a dynamic player in Asia’s tech scene, albeit with areas requiring careful navigation to maintain momentum.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

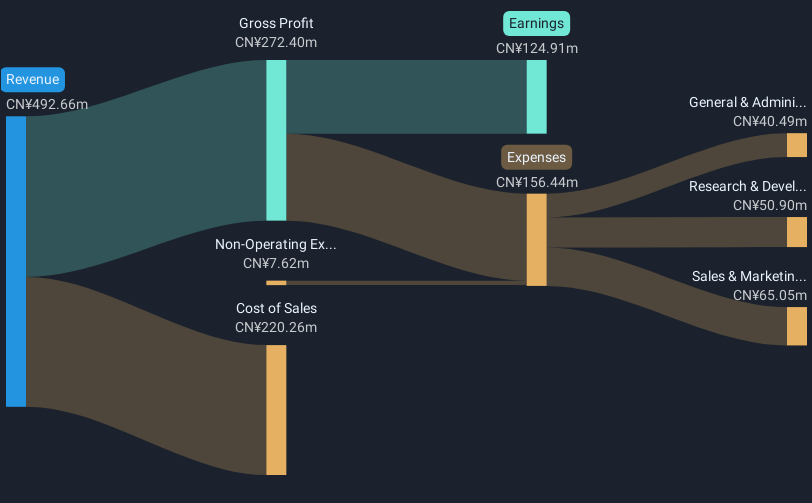

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector, focusing on innovative solutions and has a market capitalization of CN¥7.96 billion.

Operations: Zhejiang Top Cloud-agri Technology Co., Ltd. specializes in the agricultural technology sector, offering innovative solutions to enhance farming practices. The company generates revenue through its advanced technological products and services designed for agriculture, contributing significantly to its market presence.

Zhejiang Top Cloud-agri Technology, despite its niche focus on agricultural tech, is making significant strides in the high-growth tech sector in Asia. With a robust 26.4% annual revenue growth and an even more impressive projected earnings increase of 29% per year, the company is outperforming many regional counterparts. Recent affirmations of dividends at CNY 5.865 per 10 shares highlight financial stability and shareholder confidence. Additionally, amendments to its bylaws reflect a dynamic approach to governance, aligning with its innovative drive in deploying advanced technologies for agricultural enhancements. This strategic positioning not only underscores its commitment to growth but also enhances its potential in a critical sector that bridges technology with sustainable farming practices.

Future (TSE:4722)

Simply Wall St Growth Rating: ★★★★☆☆

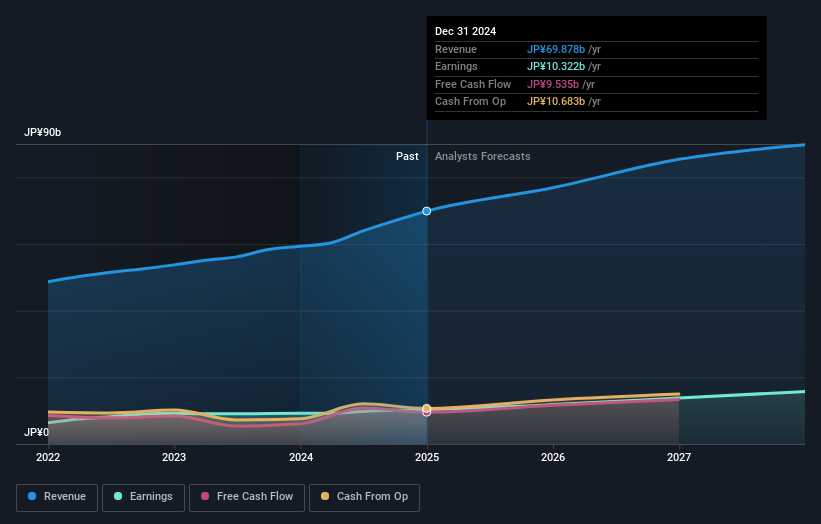

Overview: Future Corporation is a Japanese company specializing in IT consulting and services, with a market cap of ¥201.54 billion.

Operations: The company generates revenue primarily through its IT Consulting & Services segment, which includes package software and services, contributing ¥63.38 billion. Business Innovation adds another ¥8.85 billion to the total revenue stream.

Future Corporation is positioning itself as a resilient contender in Asia's tech industry, with its board recently resolving to utilize treasury stock for strategic equity plans, signaling confidence in its financial health and governance. This move coincides with an uptick in dividend payouts to JPY 23.00 per share, reflecting a robust financial strategy amidst a forecasted annual revenue growth of 9.9% and earnings growth of 13.9%. Notably, the company's R&D commitment is underscored by significant investments aimed at fostering innovation and maintaining competitive advantage in a rapidly evolving market landscape. These strategic decisions are set against a backdrop of solid performance metrics such as an expected operating profit of JPY 16,050 million for the fiscal year ending December 2025, illustrating Future's adept navigation through tech sector challenges while capitalizing on growth opportunities.

- Unlock comprehensive insights into our analysis of Future stock in this health report.

Gain insights into Future's historical performance by reviewing our past performance report.

Make It Happen

- Gain an insight into the universe of 487 Asian High Growth Tech and AI Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Top Cloud-agri TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301556

Zhejiang Top Cloud-agri TechnologyLtd

Zhejiang Top Cloud-agri Technology Co.,Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives