3 Stocks Estimated To Be Up To 39% Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are increasingly focused on identifying opportunities within a fluctuating landscape. Amid these conditions, stocks that are estimated to be trading below their intrinsic value offer potential for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Lindab International (OM:LIAB) | SEK227.40 | SEK453.69 | 49.9% |

| California Resources (NYSE:CRC) | US$52.09 | US$104.09 | 50% |

| Geovis TechnologyLtd (SHSE:688568) | CN¥40.77 | CN¥81.12 | 49.7% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$21.46 | MX$42.66 | 49.7% |

| Super Group (JSE:SPG) | ZAR23.21 | ZAR46.16 | 49.7% |

| WEX (NYSE:WEX) | US$173.16 | US$346.09 | 50% |

| Foxtons Group (LSE:FOXT) | £0.594 | £1.19 | 49.9% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2725.00 | ¥5408.67 | 49.6% |

| DPC Dash (SEHK:1405) | HK$65.00 | HK$129.82 | 49.9% |

| Sinch (OM:SINCH) | SEK31.33 | SEK62.49 | 49.9% |

Let's uncover some gems from our specialized screener.

Vimian Group (OM:VIMIAN)

Overview: Vimian Group AB (publ) operates in the global animal health industry and has a market cap of SEK23.70 billion.

Operations: The company's revenue is derived from four main segments: Medtech (€112.75 million), Diagnostics (€20.32 million), Specialty Pharma (€163.45 million), and Veterinary Services (€56.11 million).

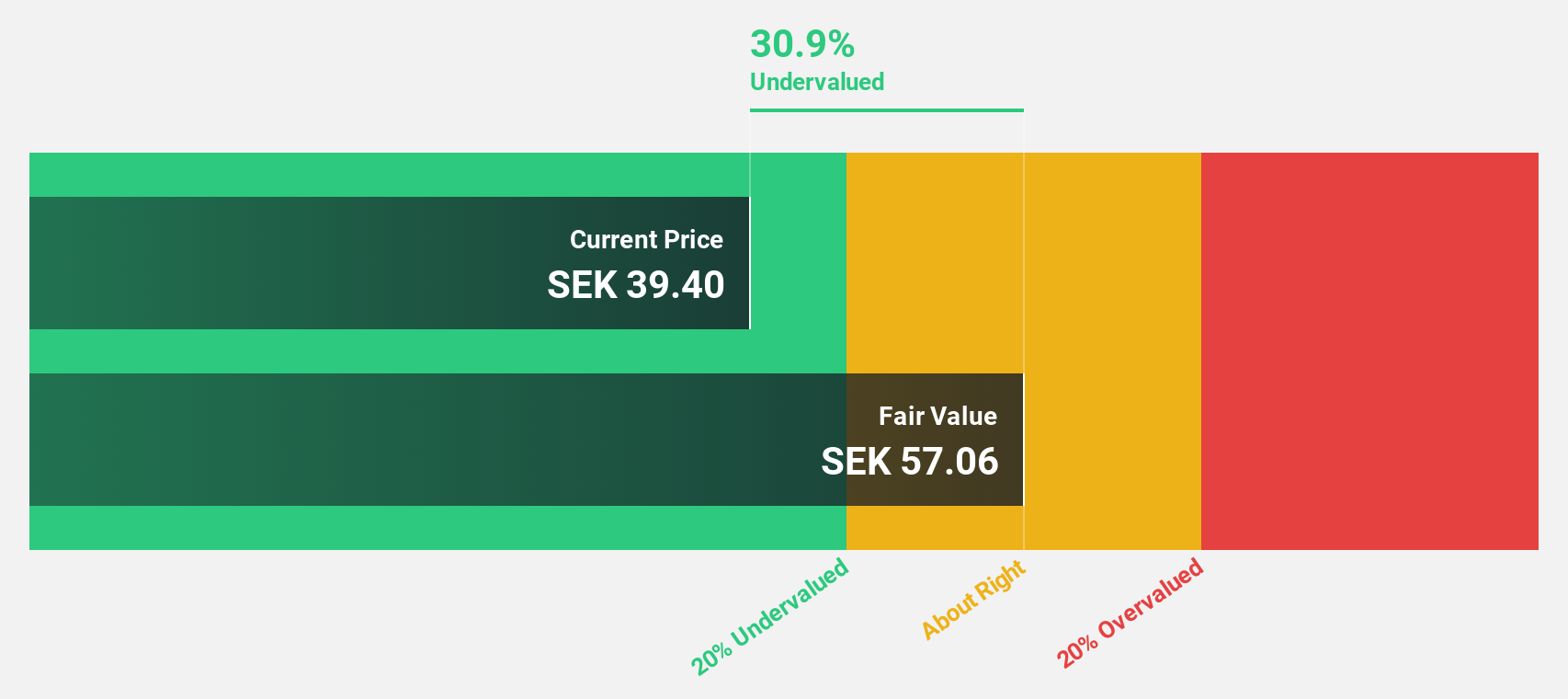

Estimated Discount To Fair Value: 19.1%

Vimian Group is trading at SEK45.3, below its estimated fair value of SEK55.97, suggesting it may be undervalued based on cash flows. Despite recent net losses in Q3 2024, the company has shown strong revenue growth and forecasts significant earnings growth of 94.1% annually over the next three years, outpacing the Swedish market's 15.8%. However, past shareholder dilution and low future return on equity (9.1%) are potential concerns for investors.

- Our growth report here indicates Vimian Group may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Vimian Group.

Kotobuki Spirits (TSE:2222)

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that produces and sells sweets, with a market capitalization of approximately ¥319.07 billion.

Operations: The company's revenue segments include Shukrei at ¥27.03 billion, Casey Shii at ¥18.88 billion, Kujukushima at ¥6.56 billion, Sales Subsidiaries at ¥7.06 billion, and Kotobuki Confectionery/Tajima Kotobuki at ¥13.19 billion.

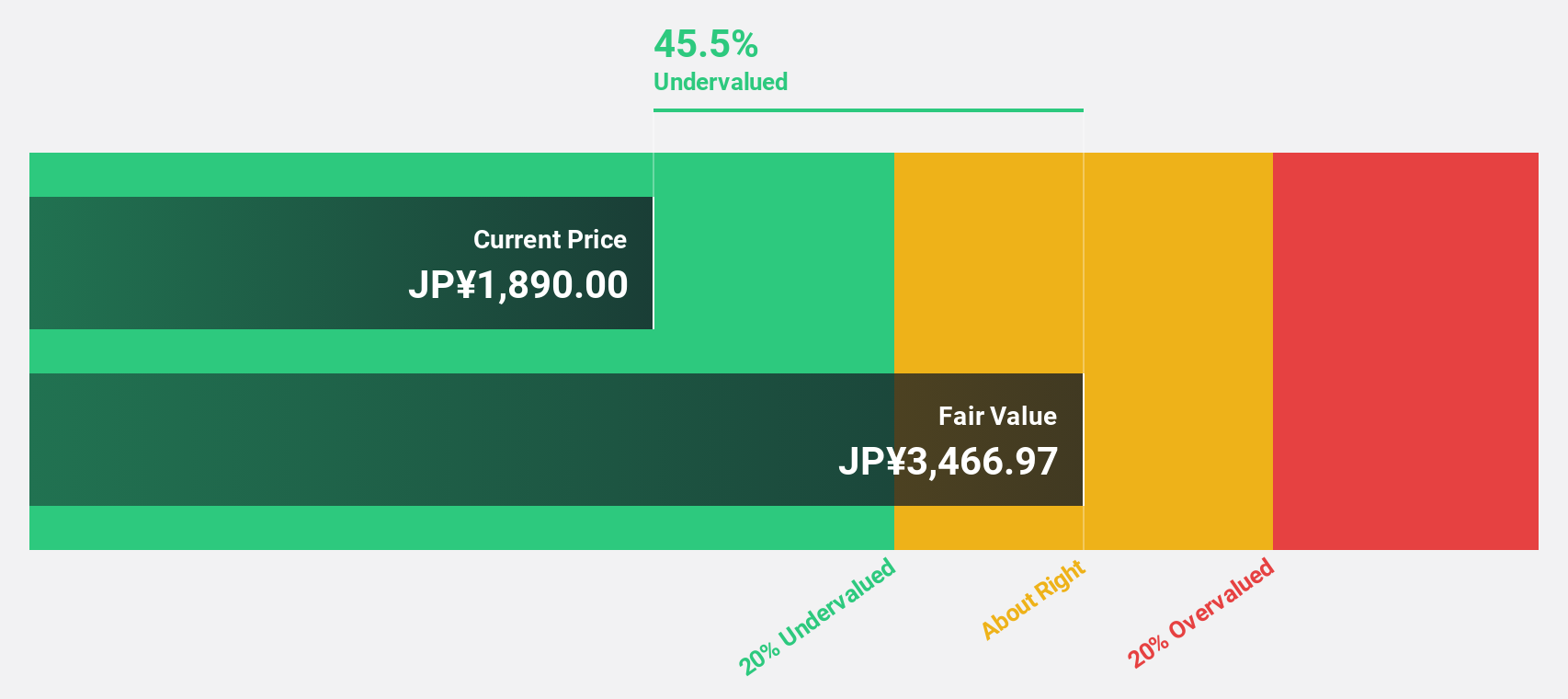

Estimated Discount To Fair Value: 39%

Kotobuki Spirits, trading at ¥2095.5, is significantly undervalued with a fair value estimate of ¥3434.73. The company's earnings grew by 33.7% last year and are forecast to grow 12.8% annually, surpassing the JP market's growth rate of 8.7%. Despite revenue growth being slower than 20% per year, its projected return on equity is robust at 28.1%, making it an attractive proposition for investors focused on cash flow valuation metrics.

- Upon reviewing our latest growth report, Kotobuki Spirits' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Kotobuki Spirits stock in this financial health report.

Trend Micro (TSE:4704)

Overview: Trend Micro Incorporated is a company that develops and sells security-related software for computers and related services both in Japan and internationally, with a market cap of ¥1.06 trillion.

Operations: The company's revenue segments are distributed as follows: ¥84.17 billion from Japan, ¥63.59 billion from Europe, ¥70.46 billion from the Americas, and ¥126.28 billion from the Asia Pacific region.

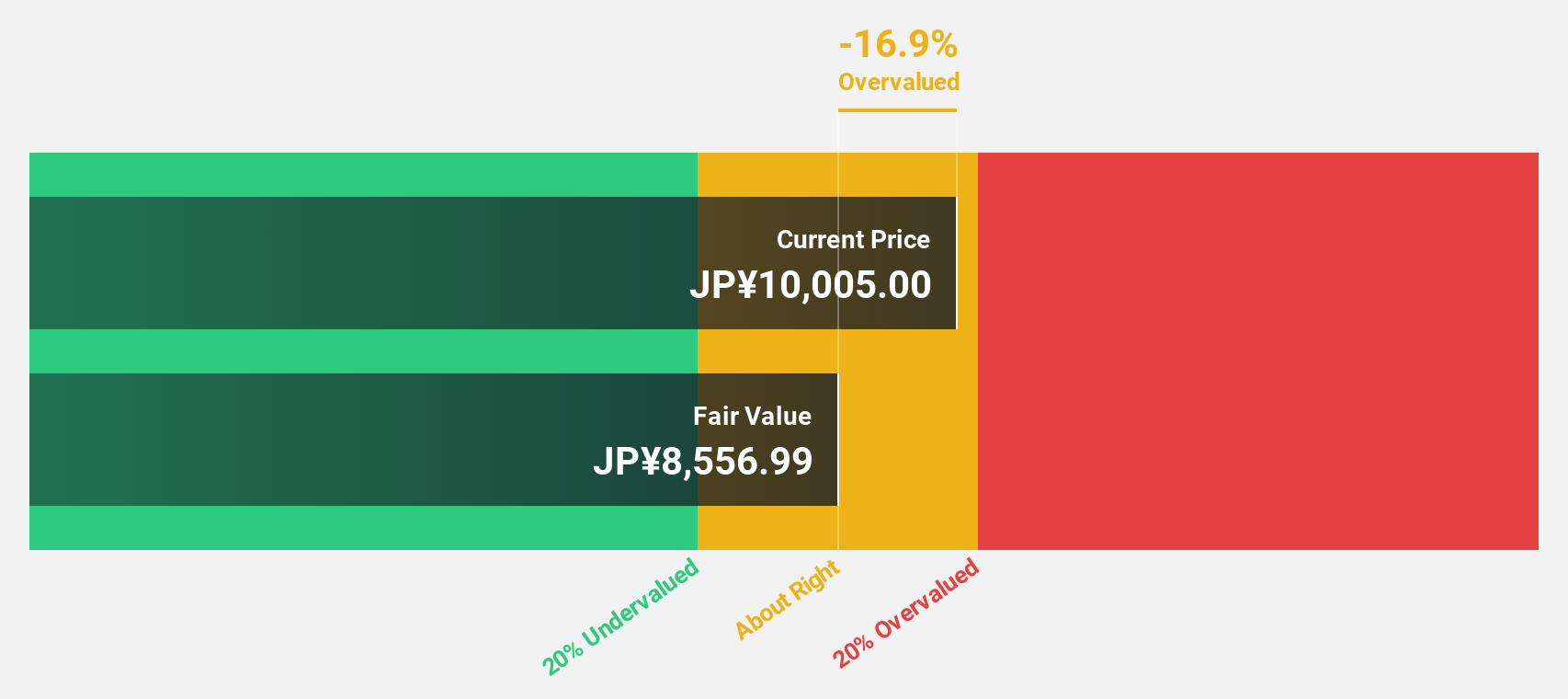

Estimated Discount To Fair Value: 37.3%

Trend Micro, priced at ¥8157, is trading significantly below its fair value estimate of ¥13013.24, highlighting potential undervaluation based on cash flows. Despite a dip in profit margins from 11.2% to 6.4%, earnings are set to grow at 21.52% annually, outpacing the JP market's 8.7%. Recent innovations like Trend Micro Check and strategic partnerships underscore its commitment to AI-driven cybersecurity solutions amidst acquisition interest due to stock underperformance and yen depreciation.

- Our expertly prepared growth report on Trend Micro implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Trend Micro's balance sheet by reading our health report here.

Next Steps

- Discover the full array of 939 Undervalued Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with high growth potential.