- China

- /

- Entertainment

- /

- SZSE:300113

Exploring Hidden Potential in Global Markets with 3 Undiscovered Gems

Reviewed by Simply Wall St

Amidst a backdrop of robust U.S. equity index performances, with the Nasdaq Composite reaching new heights and positive movements in the S&P 500 and Russell 2000, global markets are navigating shifts in monetary policies and economic indicators. As investors assess these dynamics, identifying stocks with strong fundamentals and growth potential becomes crucial, particularly those that may be overlooked yet poised to benefit from current market trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| Q P Group Holdings | 5.68% | -1.99% | -0.40% | ★★★★★★ |

| Natural Food International Holding | NA | 5.61% | 32.98% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Lungyen Life Service | 5.26% | 1.68% | -3.57% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Pizu Group Holdings | 41.45% | -2.37% | -15.01% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Hangzhou Shunwang Technology CoLtd (SZSE:300113)

Simply Wall St Value Rating: ★★★★★★

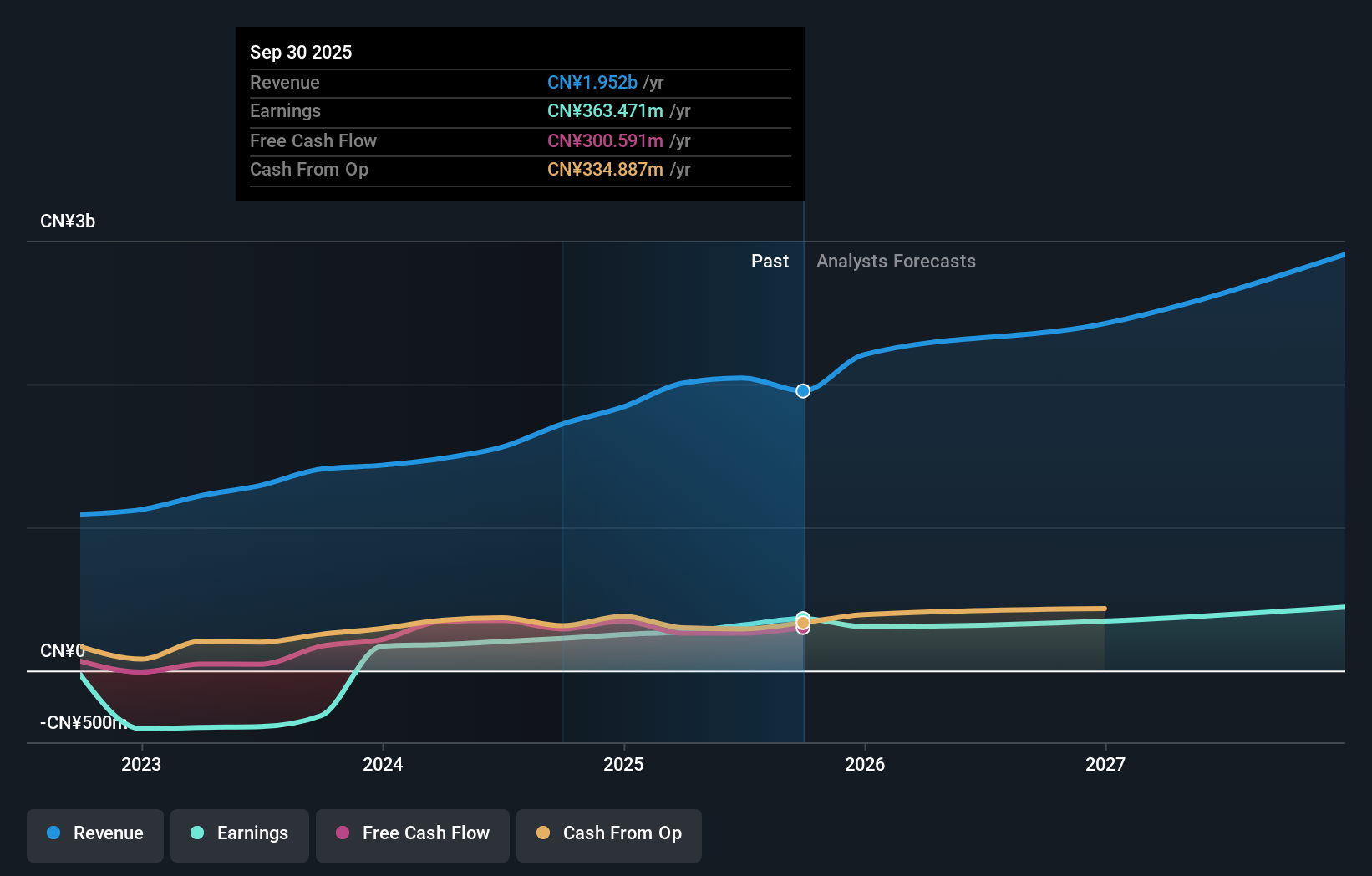

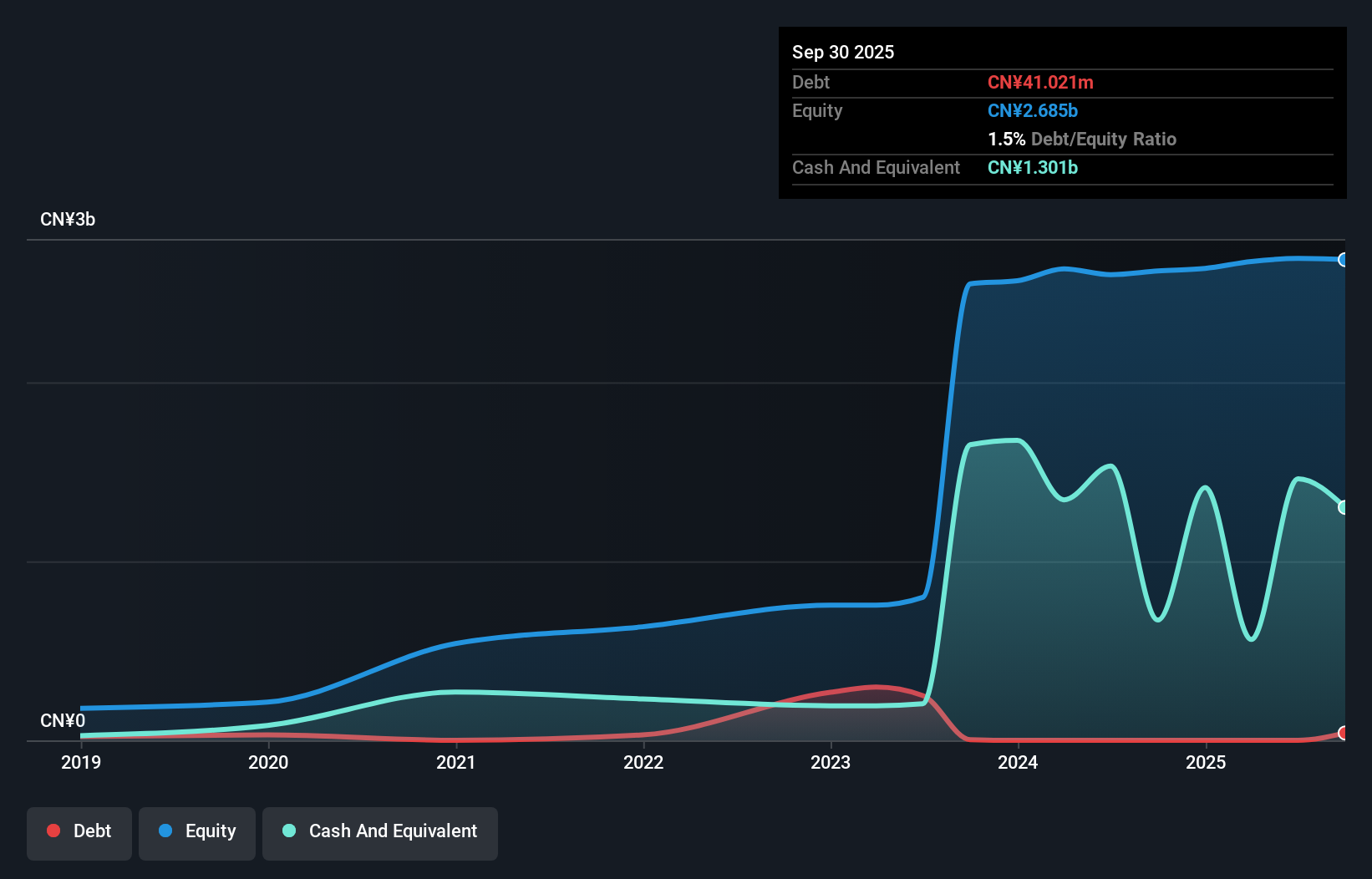

Overview: Hangzhou Shunwang Technology Co., Ltd operates in the Internet gaming sector both within China and internationally, with a market cap of CN¥14.08 billion.

Operations: Hangzhou Shunwang Technology Co., Ltd generates revenue primarily from its Internet gaming operations. The company's gross profit margin has shown variability, reflecting changes in cost structure and pricing strategies.

Hangzhou Shunwang Technology, a nimble player in the tech space, has demonstrated impressive earnings growth of 49% over the past year, outpacing the Entertainment industry's 4%. With no debt on its books for five years and high-quality earnings, it seems well-positioned financially. The company approved a cash dividend of CNY 0.90 per share for 2024 and recently elected Zhao Yuheng as an independent director. These moves suggest strategic governance enhancements alongside shareholder returns. As profits are forecasted to grow at a steady pace of 3% annually, Shunwang appears poised for continued stability in its operations.

Shenzhen Zesum Technology (SZSE:301486)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Zesum Technology Co., Ltd. is involved in the research, design, development, manufacture, and sale of precision electronic components in China with a market capitalization of approximately CN¥9.80 billion.

Operations: Shenzhen Zesum Technology generates revenue primarily from its electronic components and parts segment, totaling approximately CN¥1.07 billion. The company's market capitalization stands at around CN¥9.80 billion.

Shenzhen Zesum Technology, a nimble player in the electronics sector, showcases a mixed bag of financials. It boasts high-quality earnings and no debt burden compared to five years ago when its debt-to-equity ratio was 7.6%. However, its net profit margin has slipped to 7.2% from last year's 12.8%. Despite this dip, earnings grew by 8.4% over the past year, outpacing the industry average of 2.8%. The company recently approved a cash dividend of CNY4 per ten shares for 2024 at its AGM on May 9, reflecting shareholder confidence despite volatile share prices recently observed over three months.

- Get an in-depth perspective on Shenzhen Zesum Technology's performance by reading our health report here.

Gain insights into Shenzhen Zesum Technology's past trends and performance with our Past report.

JustSystems (TSE:4686)

Simply Wall St Value Rating: ★★★★★★

Overview: JustSystems Corporation focuses on planning, developing, and providing software and related services primarily in Japan, with a market capitalization of ¥250.79 billion.

Operations: The primary revenue stream for JustSystems Corporation comes from its software-related business, generating ¥46.56 billion. The company's net profit margin is a key financial metric to consider in evaluating its profitability.

With a steady 3.6% annual earnings growth over five years, JustSystems showcases its robust financial health, further highlighted by its debt-free status and positive free cash flow. Despite this, the company's recent 10% earnings growth fell short of the software industry's average of 13.5%. The firm announced a dividend increase to ¥12 per share for fiscal year ending March 2025, up from ¥10 previously. Notably, JustSystems' high-quality past earnings and consistent profitability underline its potential as an attractive investment in the tech landscape despite competitive pressures.

- Dive into the specifics of JustSystems here with our thorough health report.

Understand JustSystems' track record by examining our Past report.

Turning Ideas Into Actions

- Discover the full array of 3077 Global Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hangzhou Shunwang Technology CoLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300113

Hangzhou Shunwang Technology CoLtd

Engages in the Internet gaming business in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion