Does OBIC’s New Share Buyback Boost Capital Efficiency for Investors in TSE:4684?

Reviewed by Sasha Jovanovic

- OBIC Co.,Ltd. recently authorized a share repurchase program, with plans to buy back up to 6,000,000 shares, representing 1.36% of its outstanding share capital excluding treasury stock, at a total cost of ¥30,000 million, valid through March 31, 2026.

- This move is designed to enhance capital efficiency and introduce flexibility for adapting to evolving business conditions, underscoring a shareholder-focused approach to capital management.

- Let's explore how the share buyback authorization shapes OBIC Ltd.'s investment narrative with a focus on capital efficiency improvements.

These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is OBICLtd's Investment Narrative?

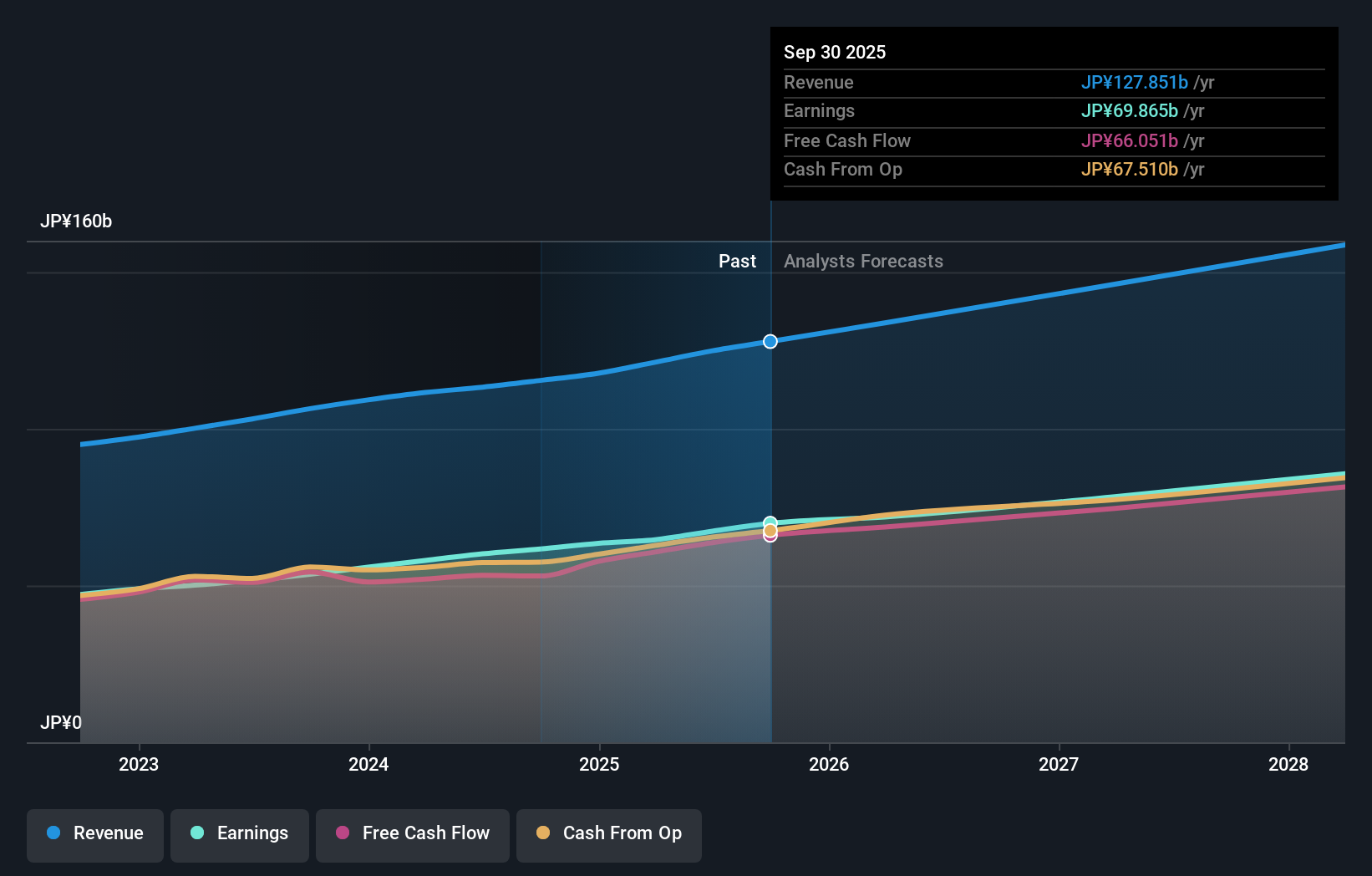

Being a shareholder in OBIC Co., Ltd. often begins with trust in the company’s earnings quality and continuing profit growth. The latest share buyback authorization affirms a robust shareholder focus, potentially increasing capital efficiency at a time when the company’s return on equity is below market averages and board independence is limited. This announcement could provide a minor near-term catalyst by supporting the share price, especially as OBIC is trading at a premium to both its peers and consensus price targets. However, with dividends trending lower and revenue, while healthy, growing only modestly, it’s important to consider how management aligns capital allocation with future profitable growth. The buyback adds flexibility but may not be enough to shift the biggest risks: a relatively high valuation and ongoing competitive industry pressures.

In contrast, the company’s high price-to-earnings ratio is something investors should be aware of. OBICLtd's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on OBICLtd - why the stock might be worth as much as ¥3213!

Build Your Own OBICLtd Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OBICLtd research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free OBICLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OBICLtd's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4684

OBICLtd

Provides system integration, system support, office automation, and package software services in Japan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives