3 Stocks Estimated To Be 23.8% To 39.5% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating corporate earnings, AI competition fears, and shifting monetary policies, investors are keenly observing opportunities that may arise from current market volatility. Amidst this backdrop of economic uncertainty and mixed performance across major indices, identifying stocks that are trading below their intrinsic value can be a strategic move for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shihlin Electric & Engineering (TWSE:1503) | NT$175.50 | NT$350.30 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$89.80 | NT$179.26 | 49.9% |

| Old National Bancorp (NasdaqGS:ONB) | US$24.45 | US$48.78 | 49.9% |

| Decisive Dividend (TSXV:DE) | CA$5.96 | CA$11.91 | 50% |

| Hanwha Systems (KOSE:A272210) | ₩25200.00 | ₩50281.74 | 49.9% |

| AbbVie (NYSE:ABBV) | US$192.97 | US$385.39 | 49.9% |

| Verra Mobility (NasdaqCM:VRRM) | US$25.88 | US$51.66 | 49.9% |

| Sunstone Development (SHSE:603612) | CN¥15.99 | CN¥31.95 | 50% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$3.56 | HK$7.10 | 49.9% |

| Hua Hong Semiconductor (SEHK:1347) | HK$26.45 | HK$52.75 | 49.9% |

Here's a peek at a few of the choices from the screener.

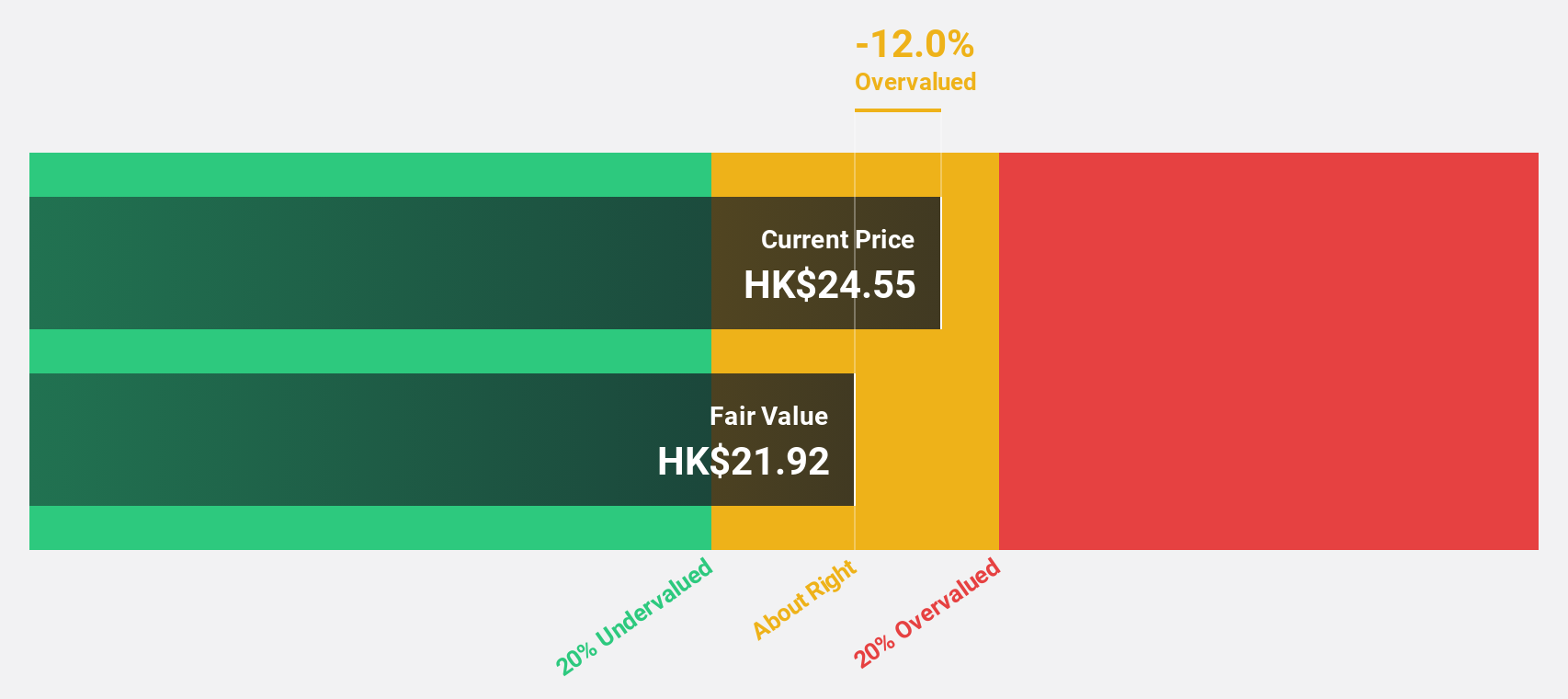

Binjiang Service Group (SEHK:3316)

Overview: Binjiang Service Group Co. Ltd. offers property management and related services in the People’s Republic of China, with a market cap of HK$5.39 billion.

Operations: Revenue Segments (in millions of CN¥): Property management services: 1,200; Community value-added services: 800; Consulting services: 300.

Estimated Discount To Fair Value: 23.8%

Binjiang Service Group is trading at HK$19.9, significantly below its estimated fair value of HK$26.12, suggesting it may be undervalued based on cash flows. Forecasts indicate annual earnings growth of 15%, outpacing the Hong Kong market's 11.4%. However, the company has an unstable dividend track record. Recent developments include a new agreement with Binjiang Real Estate for pre-delivery management services, which could enhance revenue streams and brand reputation.

- The analysis detailed in our Binjiang Service Group growth report hints at robust future financial performance.

- Dive into the specifics of Binjiang Service Group here with our thorough financial health report.

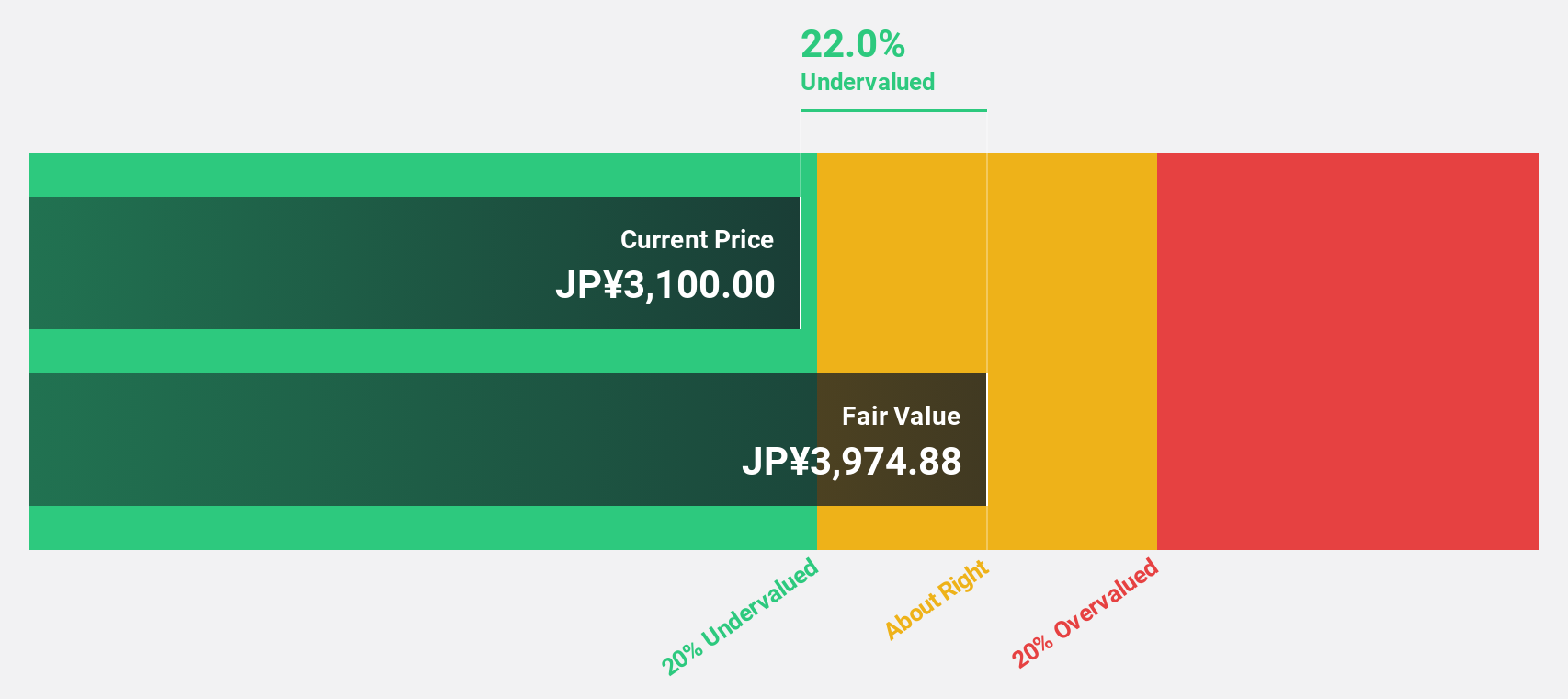

Global Security Experts (TSE:4417)

Overview: Global Security Experts Inc. is a cybersecurity education company based in Japan with a market capitalization of ¥41.27 billion.

Operations: The company generates revenue through its cybersecurity education services in Japan.

Estimated Discount To Fair Value: 39.5%

Global Security Experts, trading at ¥5190, is valued below its estimated fair value of ¥8572.18, highlighting potential undervaluation based on cash flows. The company faces high debt levels but shows promising growth prospects with earnings expected to rise significantly over the next three years. Revenue is forecast to grow 17% annually, outpacing the JP market's 4.3%. Despite recent share price volatility, its return on equity is projected to be very high in three years.

- The growth report we've compiled suggests that Global Security Experts' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Global Security Experts' balance sheet health report.

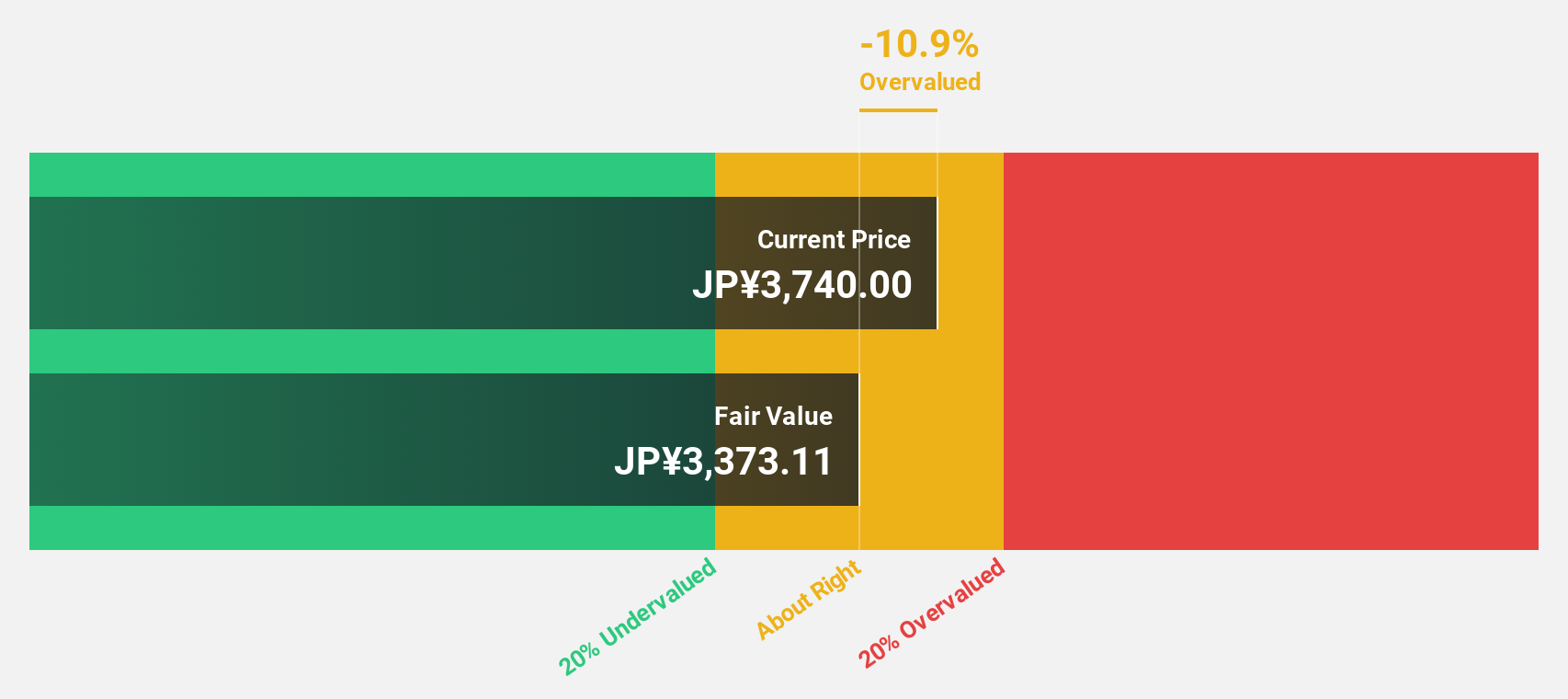

freee K.K (TSE:4478)

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥197.85 billion.

Operations: The company generates revenue primarily through its Platform Business segment, which reported ¥27.09 billion.

Estimated Discount To Fair Value: 37.5%

freee K.K., priced at ¥3365, trades significantly below its estimated fair value of ¥5380.93, suggesting undervaluation based on cash flows. Despite recent share price volatility, earnings are projected to grow substantially at 71.35% annually and become profitable within three years, surpassing average market growth. Revenue is anticipated to increase by 18.5% annually, exceeding the JP market's growth rate of 4.3%. However, its forecasted return on equity remains relatively low at 19.5%.

- Our earnings growth report unveils the potential for significant increases in freee K.K's future results.

- Get an in-depth perspective on freee K.K's balance sheet by reading our health report here.

Key Takeaways

- Investigate our full lineup of 924 Undervalued Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if freee K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4478

freee K.K

Engages in the provision of cloud-based accounting and HR software solutions in Japan.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)