In a global market environment where major indices have shown mixed performance, with the Nasdaq Composite reaching new highs while small-cap stocks underperformed, investors are keeping a close eye on economic indicators and central bank actions. The Federal Reserve's anticipated rate cut and signs of a cooling labor market in the U.S. add layers of complexity to investment decisions, especially for small-cap companies that often feel the impact of economic shifts more acutely. In such conditions, identifying promising opportunities requires focusing on stocks that demonstrate resilience and potential for growth despite broader market challenges—qualities that can transform lesser-known companies into undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Indo Tech Transformers | 1.82% | 23.41% | 58.49% | ★★★★★☆ |

| TechNVision Ventures | 14.35% | 20.69% | 63.60% | ★★★★★☆ |

| Magadh Sugar & Energy | 50.50% | 6.14% | 14.35% | ★★★★☆☆ |

| REDtone Digital Berhad | 8.13% | 30.43% | 35.72% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SiS Distribution (Thailand) (SET:SIS)

Simply Wall St Value Rating: ★★★★★☆

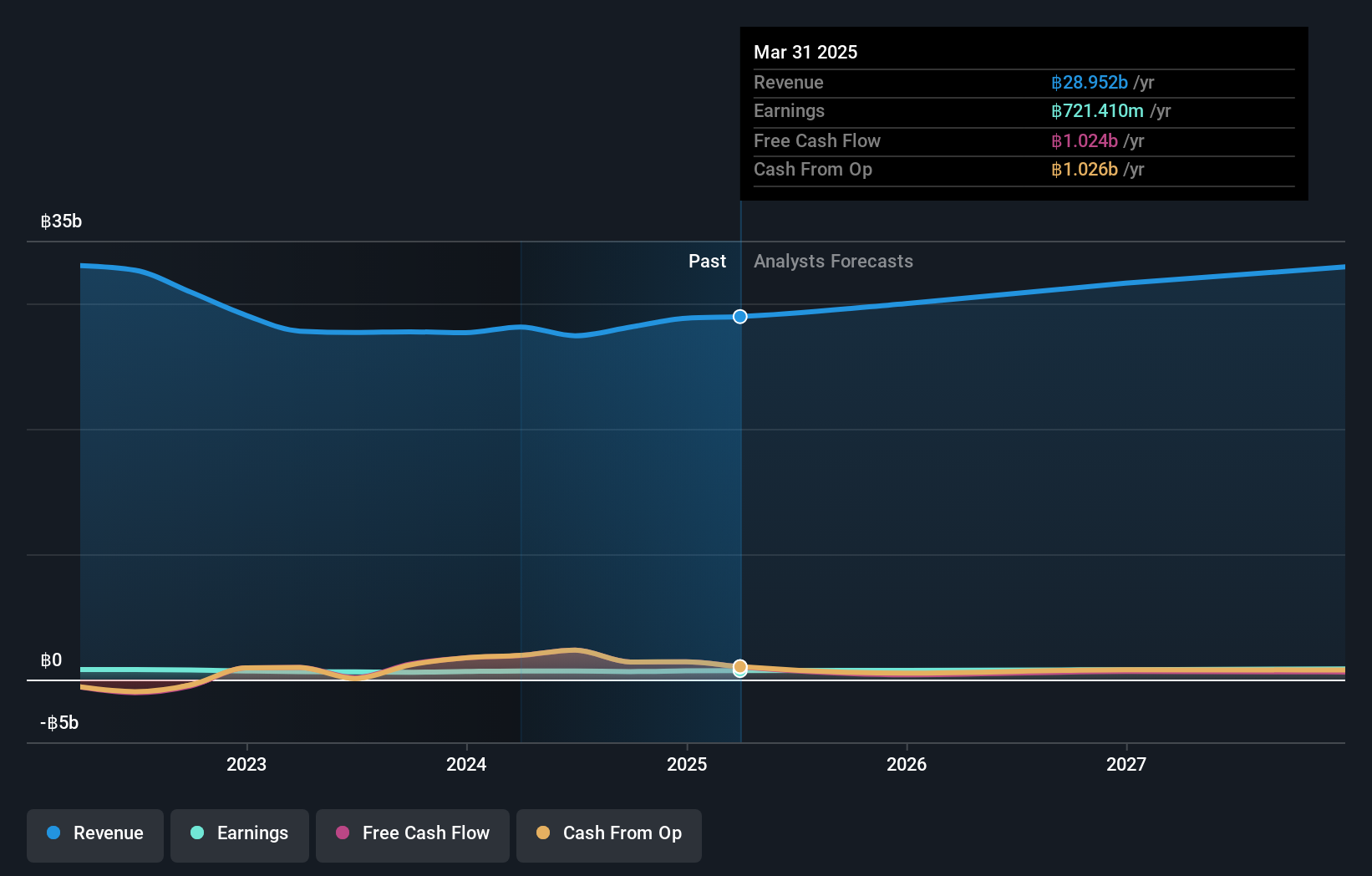

Overview: SiS Distribution (Thailand) Public Company Limited, along with its subsidiaries, operates in the distribution of computer components, smartphones, and office automation equipment in Thailand and has a market cap of THB10.51 billion.

Operations: SiS Distribution (Thailand) generates revenue primarily from consumer products, which contribute THB8.37 billion, followed by commercial products at THB6.36 billion and phones at THB5.25 billion. The company also earns from value-added products amounting to THB5.29 billion.

SiS Distribution, a notable player in the electronics distribution sector, is trading at 56.2% below its estimated fair value, offering potential upside. Despite a high net debt to equity ratio of 51.4%, the company shows resilience with earnings growth of 9.8% over the past year, outpacing the industry average of 6.8%. The firm has successfully reduced its debt to equity ratio from 88% to 69.2% over five years and maintains well-covered interest payments with an EBIT coverage of 15.7 times interest expenses, indicating robust financial management despite recent volatility in share price and net income figures showing THB119 million for Q3 compared to THB161 million last year.

WingArc1st (TSE:4432)

Simply Wall St Value Rating: ★★★★★★

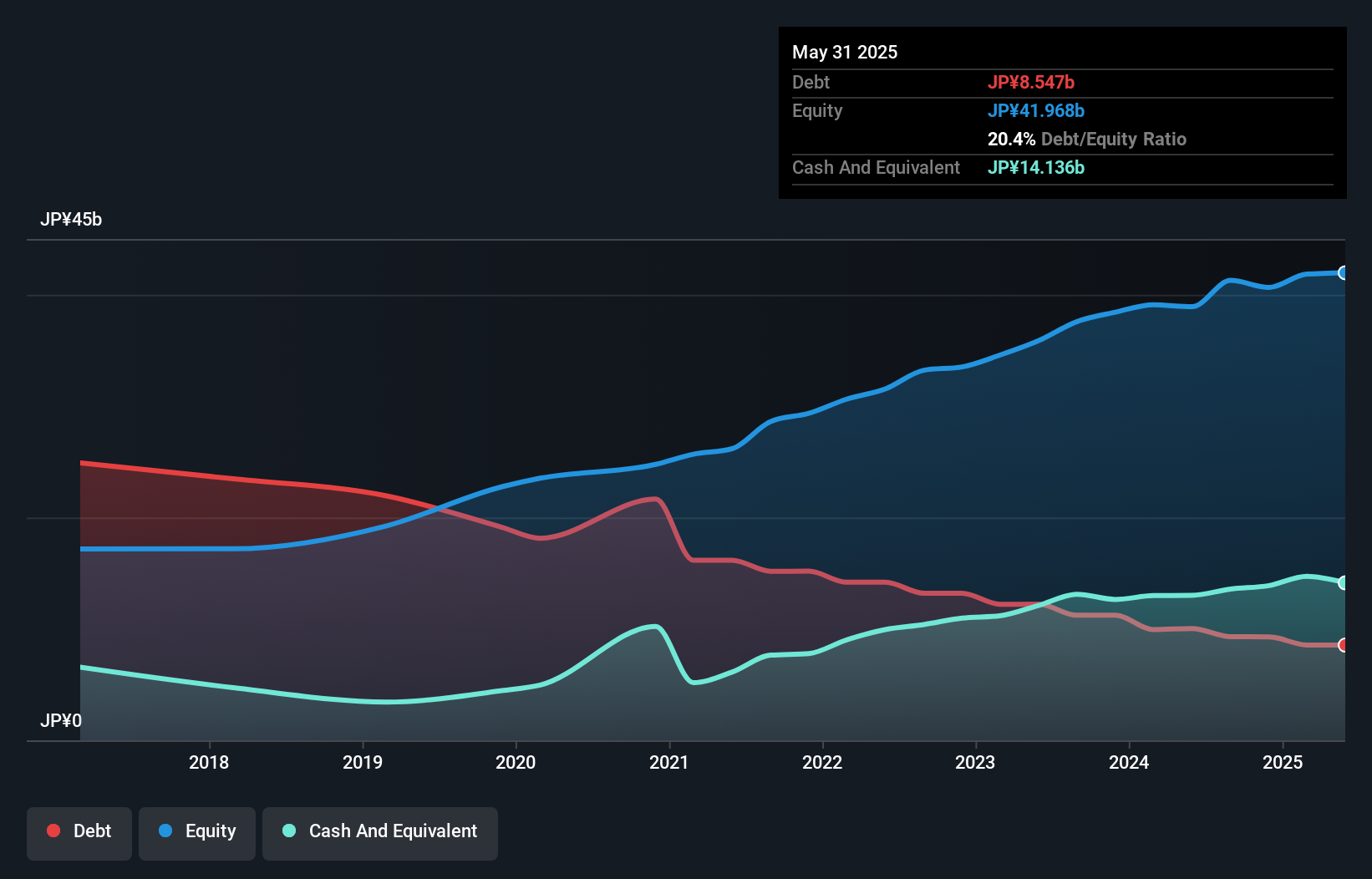

Overview: WingArc1st Inc. is a Japanese company that develops and sells software and services, with a market cap of ¥122.06 billion.

Operations: The company generates revenue primarily through its software and services offerings. It reported a gross profit margin of 65% in the latest financial period.

WingArc1st, a notable player in the tech industry, has shown consistent earnings growth of 13% annually over the last five years. Despite not outpacing its industry peers recently with a 12.3% increase compared to the sector's 13.5%, it still boasts high-quality past earnings and strong interest coverage, ensuring financial stability. The company's debt-to-equity ratio has impressively decreased from 92.8% to 22.5%, reflecting prudent financial management over time. Trading at a value perceived to be below its fair estimate by about 25%, WingArc1st seems poised for future growth with projected annual earnings increases of approximately 12.68%.

- Navigate through the intricacies of WingArc1st with our comprehensive health report here.

Assess WingArc1st's past performance with our detailed historical performance reports.

Sumitomo Riko (TSE:5191)

Simply Wall St Value Rating: ★★★★★★

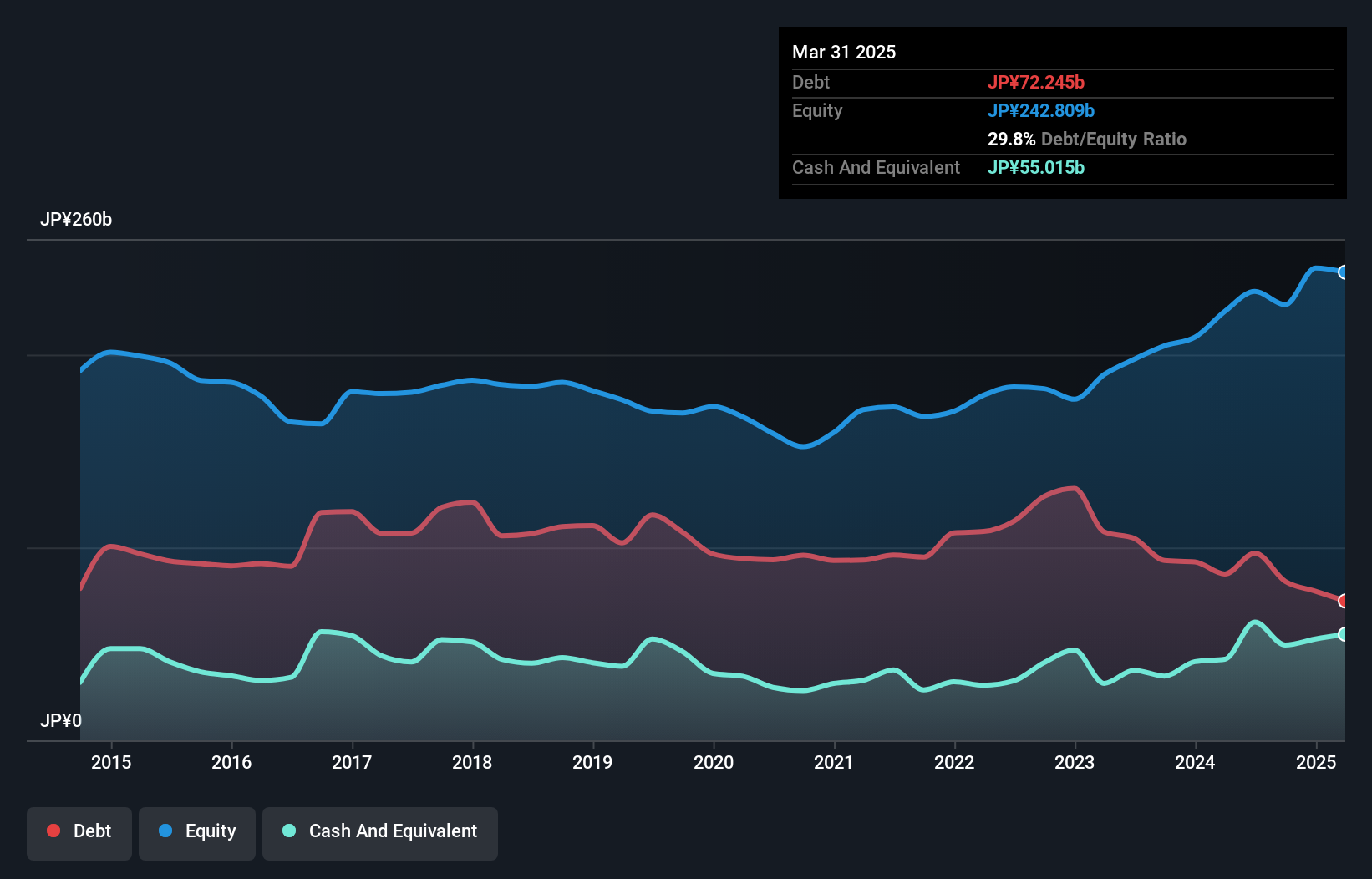

Overview: Sumitomo Riko Company Limited specializes in the manufacture and sale of automotive parts, with a market cap of ¥162.49 billion.

Operations: The company generates revenue primarily from the manufacture and sale of automotive parts. It has a market capitalization of ¥162.49 billion.

Sumitomo Riko, a player in the auto components sector, has shown promising financial health. Over the past five years, its debt to equity ratio improved from 63.6% to 36.5%, indicating a stronger balance sheet position. The company's net debt to equity ratio of 14.6% is considered satisfactory and interest payments are well covered by EBIT at 25.7 times coverage, reflecting solid earnings quality. Despite earnings growth of 32% last year surpassing industry averages, future prospects appear challenging with forecasts suggesting a decline of about 6.6% per year over the next three years; however, it trades at approximately 26% below estimated fair value, hinting at potential undervaluation opportunities for investors looking deeper into this niche market player.

Seize The Opportunity

- Navigate through the entire inventory of 4512 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if WingArc1st might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4432

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion