- South Korea

- /

- Interactive Media and Services

- /

- KOSDAQ:A067160

Exploring High Growth Tech Stocks In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of monetary policy adjustments, with the Nasdaq Composite reaching new highs amidst broader index declines, the technology sector continues to capture investor interest. In this environment, identifying high-growth tech stocks involves assessing companies that demonstrate strong innovation and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1262 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Soop (KOSDAQ:A067160)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Soop Co., Ltd., along with its subsidiaries, functions as an entertainment company in South Korea and has a market capitalization of ₩1.06 billion.

Operations: The company generates revenue primarily from its Internet Business segment, amounting to ₩411.83 million.

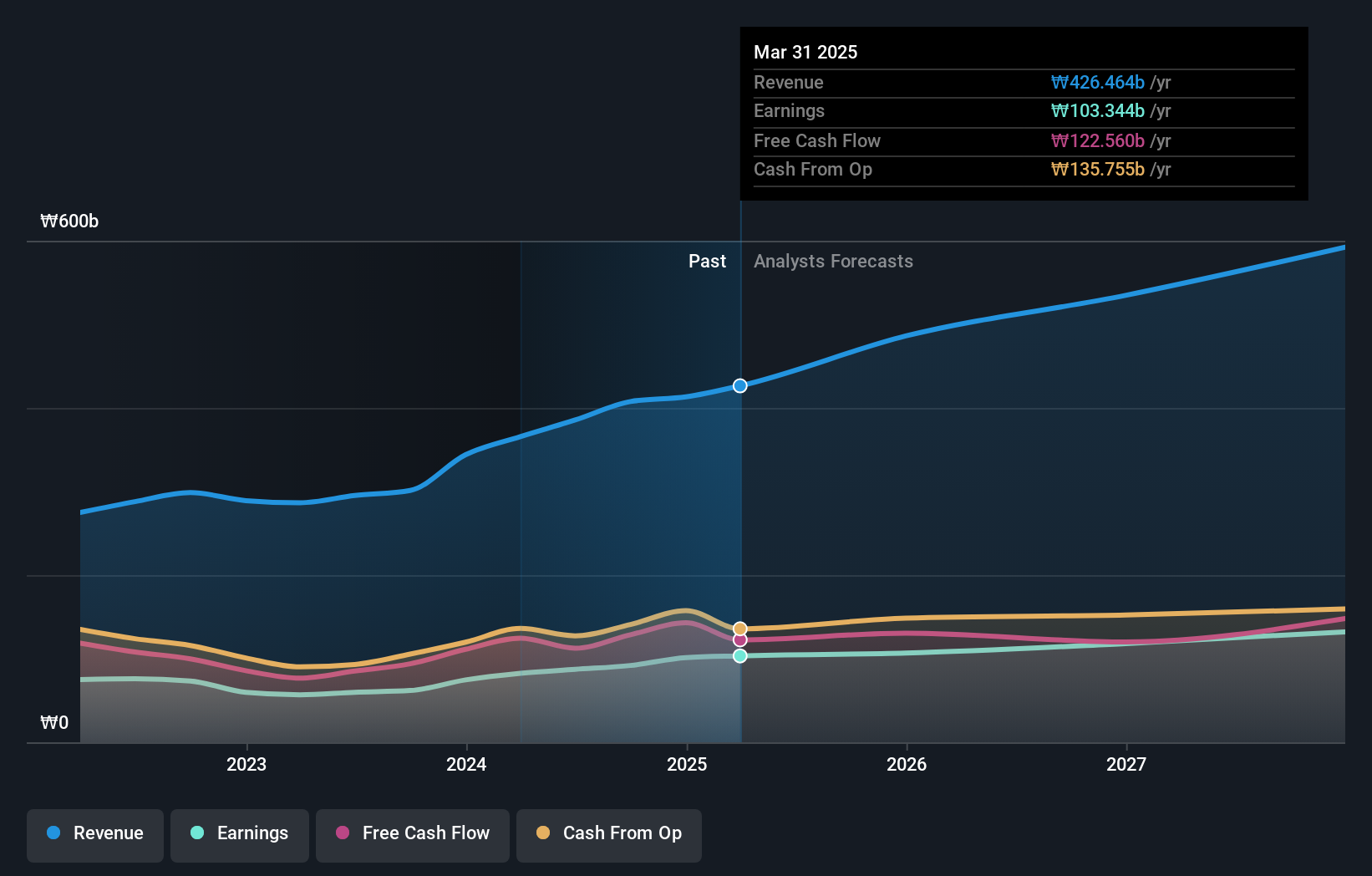

Soop has demonstrated robust performance with a third-quarter sales increase to KRW 27.36 billion, up from KRW 23.02 billion year-over-year, and net income rising to KRW 23.89 billion from KRW 19.24 billion. This growth trajectory is underscored by a notable annual earnings growth of 48.5%, significantly outpacing the industry average of 9.3%. At the recent JPMorgan Global TMT Conference, Soop highlighted innovations that may further leverage their position in interactive media and services, despite forecasts suggesting revenue growth at 10.9% per year might lag behind the high-growth threshold of 20%. With an anticipated earnings increase of approximately 12.7% annually, surpassing Korea's market projection of 12.3%, and a strong return on equity expected at 21.7% in three years, Soop is positioning itself as a resilient contender amidst evolving market dynamics.

- Get an in-depth perspective on Soop's performance by reading our health report here.

Understand Soop's track record by examining our Past report.

Modern Times Group MTG (OM:MTG B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Modern Times Group MTG AB operates game franchise services across multiple regions including Sweden, the UK, Germany, and the US, with a market cap of approximately SEK11.16 billion.

Operations: The company generates revenue primarily from its gaming franchise services, with broadcasting contributing SEK5.89 billion. It operates across various regions, including Europe and the US.

Modern Times Group MTG, amidst a challenging financial backdrop with a recent quarterly sales dip to SEK 1.44 billion from SEK 1.49 billion year-over-year and net income falling to SEK 174 million from SEK 194 million, remains committed to strategic growth through mergers and acquisitions. The acquisition of Plarium Global Ltd underscores this strategy, aiming to leverage synergies within the gaming sector and expand into new genres like casual and mid-core IP games. Despite these efforts, MTG's projected revenue growth at 4.1% annually trails the high-growth benchmark of 20%, yet outpaces the Swedish market's average of 1.2%. This suggests a cautious optimism for MTG’s future in enhancing its portfolio and market position through targeted acquisitions and internal development initiatives.

Finatext Holdings (TSE:4419)

Simply Wall St Growth Rating: ★★★★★☆

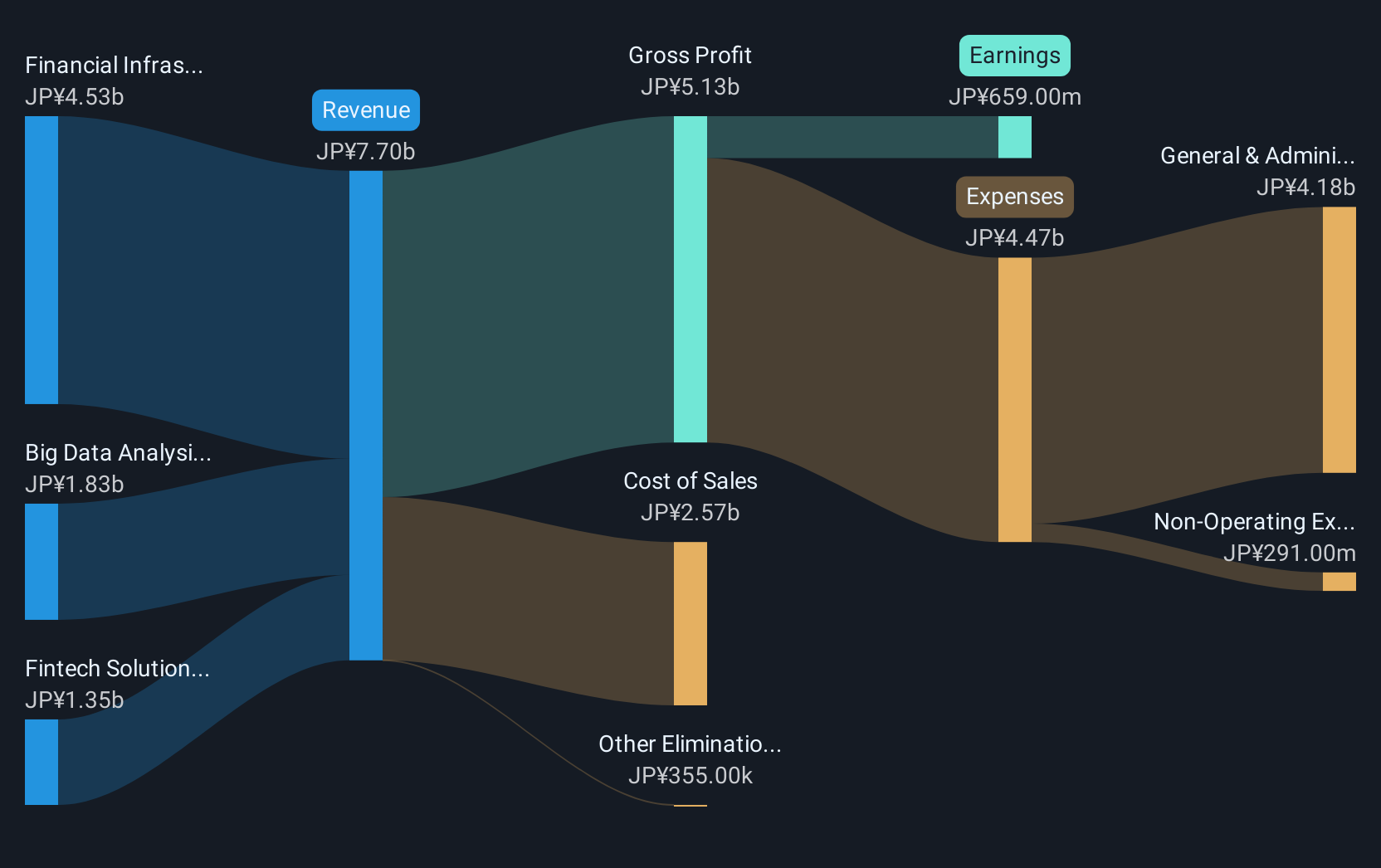

Overview: Finatext Holdings Ltd. operates in Japan, focusing on fintech solutions, big data analysis, and financial infrastructure businesses with a market cap of ¥52.46 billion.

Operations: Finatext Holdings Ltd. generates revenue primarily through its Financial Infrastructure Business, contributing ¥3.81 billion, followed by the Big Data Analysis Business at ¥1.56 billion and the Fintech Solution Business at ¥1.38 billion. The company's focus on these sectors positions it within Japan's evolving financial technology landscape.

Finatext Holdings, with its recent pivot towards profitability and a robust annual earnings growth forecast at 47.1%, demonstrates significant potential in the tech sector. This year marked their transition to profitability, complemented by a revenue surge expected at 25.3% annually, outpacing the Japanese market's growth of 4.1%. Despite shareholder dilution over the past year, Finatext's aggressive R&D investment underscores its commitment to innovation—crucial for sustaining long-term competitiveness in technology's rapidly evolving landscape. The upcoming Q2 earnings call could provide further insights into how these investments are translating into tangible products and market expansion.

Next Steps

- Embark on your investment journey to our 1262 High Growth Tech and AI Stocks selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A067160

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives