- Japan

- /

- Interactive Media and Services

- /

- TSE:4449

High Growth Tech Stocks To Watch For Potential Upside

Reviewed by Simply Wall St

As global markets experience a mix of rising inflation and record-high stock indexes, with the Nasdaq Composite leading gains and small-cap stocks lagging behind larger indices, investors are closely monitoring economic indicators that suggest potential shifts in monetary policy. In such an environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and resilience amidst volatile market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Xspray Pharma | 127.78% | 104.91% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1207 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

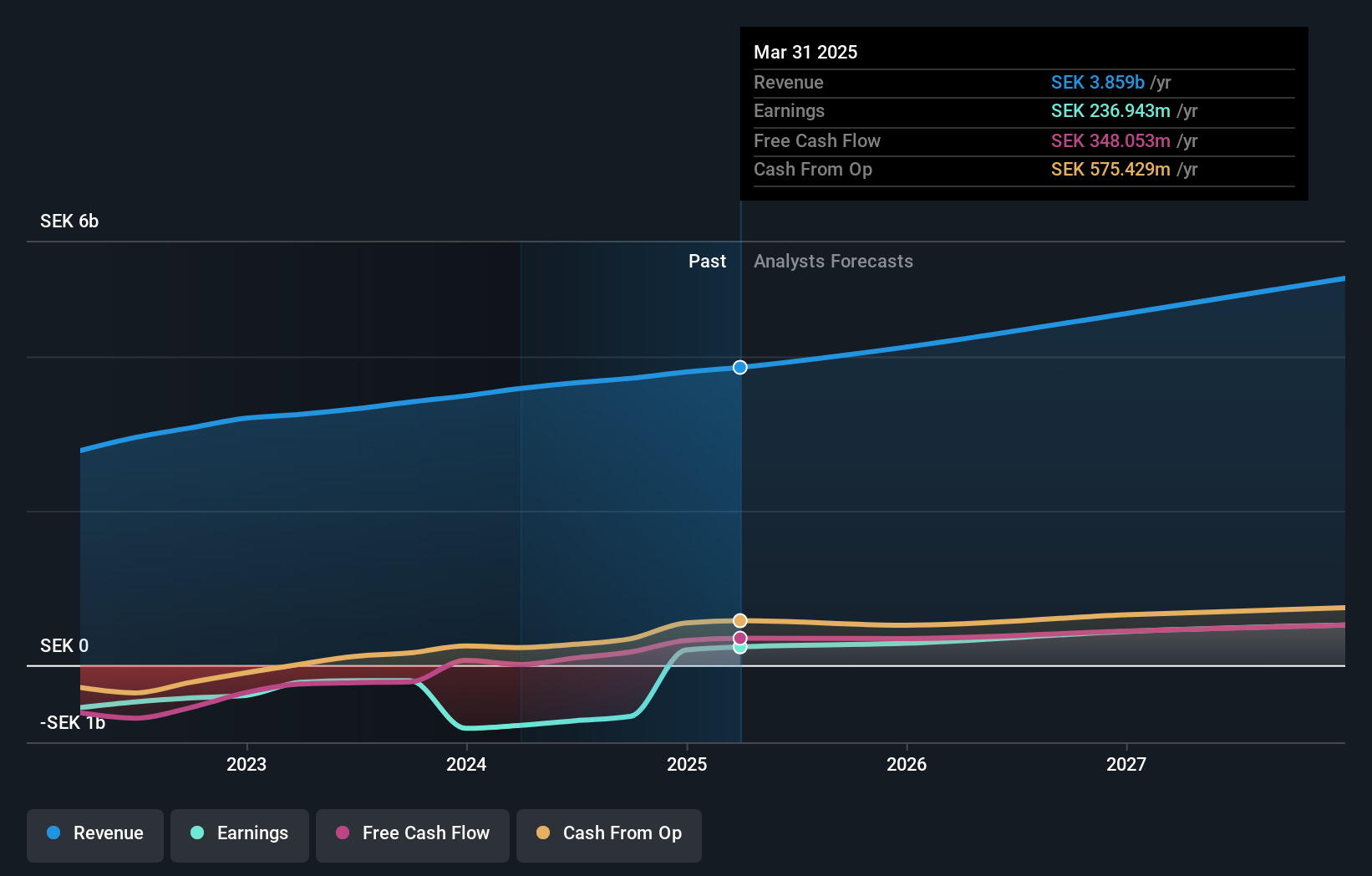

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services, with a market capitalization of SEK7.51 billion.

Operations: Storytel generates revenue primarily from its streaming services, contributing SEK3.38 billion, alongside book sales at SEK1.13 billion. The company focuses on digital content distribution through audiobooks and e-books, reflecting its core business operations in the media and entertainment sector.

Storytel, transitioning into profitability this year, showcases a robust 38% expected annual earnings growth over the next three years, outpacing the Swedish market's forecast of 10.5%. This surge follows a significant turnaround from last year's net loss to this year's SEK 196.71 million net income, supported by a solid revenue increase to SEK 3.8 billion. The partnership with Vodafone Turkey, tapping into over 20 million subscribers, not only boosts Storytel’s market presence but also aligns with strategic expansions in core markets, enhancing its competitive edge in the digital content realm.

- Take a closer look at Storytel's potential here in our health report.

Gain insights into Storytel's past trends and performance with our Past report.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

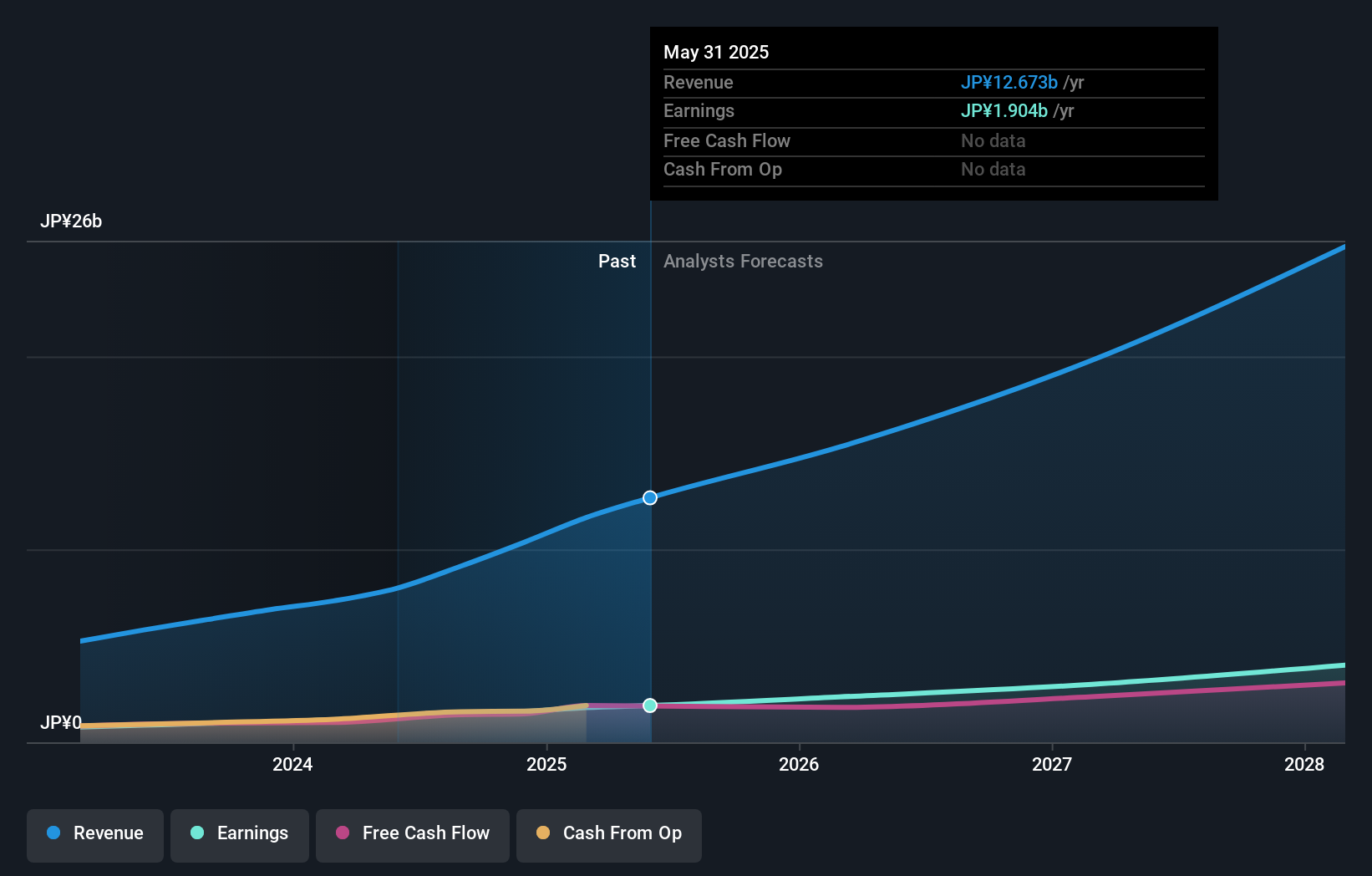

Overview: Baudroie, Inc. offers tailored IT solutions across Japan and has a market capitalization of ¥84.31 billion.

Operations: The company's primary revenue stream is its IT Infrastructure Business, generating ¥10.36 billion.

Baudroie, Inc. is making significant strides in the tech sector with a projected annual revenue growth of 29% and earnings growth of 28.6%, outpacing the Japanese market averages significantly. This robust performance is underpinned by aggressive R&D spending, which has been strategically allocated to foster innovations that keep them ahead in competitive markets. Recent corporate guidance anticipates net sales reaching JPY 11.4 billion and an operating profit of JPY 2.3 billion for FY ending February 2025, reflecting strong operational efficiency and market positioning. Moreover, their recent share repurchase program underscores a commitment to shareholder value and capital flexibility, enhancing investor confidence amidst volatile market conditions.

giftee (TSE:4449)

Simply Wall St Growth Rating: ★★★★★★

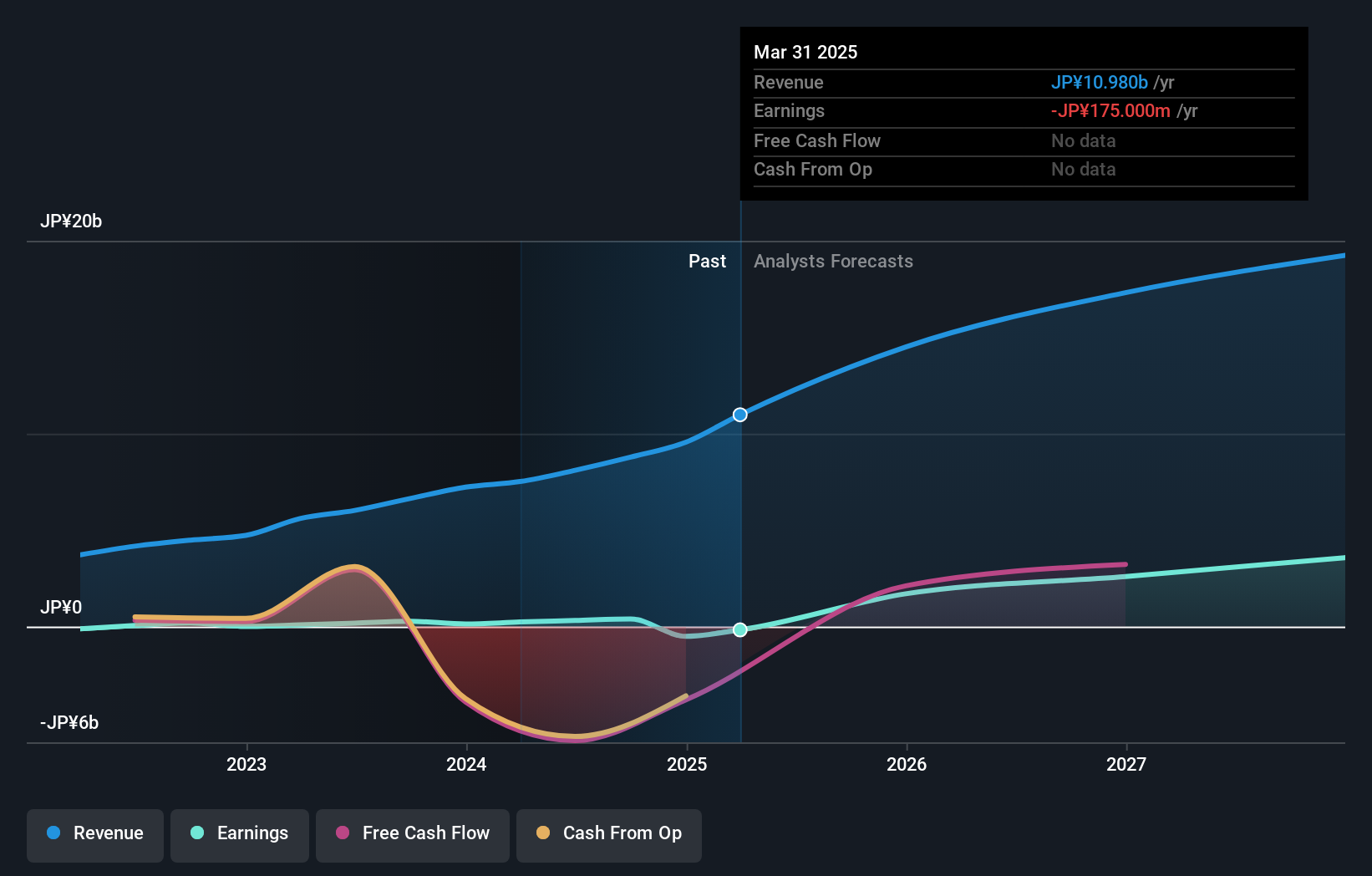

Overview: giftee Inc. operates within the Internet service sector in Japan with a market capitalization of ¥47.54 billion.

Operations: The company focuses on providing e-gift services, generating revenue primarily through transaction fees and corporate sales. The business model leverages digital platforms to facilitate gift exchanges, enhancing user experience and engagement. Gross profit margin has shown notable variations across recent periods, reflecting changes in cost structures or pricing strategies.

Giftee Inc. is navigating the tech landscape with an anticipated revenue growth of 20.1% annually, outstripping Japan's market average significantly. This growth trajectory is bolstered by a robust R&D focus, with recent earnings guidance projecting net sales at ¥14.3 billion and an operating profit of ¥2.4 billion for the fiscal year ending December 2025. Despite its current unprofitability and high share price volatility, giftee's strategic investments in innovation signal potential for future profitability, especially as it moves towards surpassing industry growth rates and achieving a forecasted Return on Equity of 24.1% in three years' time.

- Navigate through the intricacies of giftee with our comprehensive health report here.

Examine giftee's past performance report to understand how it has performed in the past.

Where To Now?

- Reveal the 1207 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4449

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)