As Japan’s stock markets rise, bolstered by a weakening yen and steady interest rates from the Bank of Japan, investors are increasingly looking towards high-growth tech stocks for potential opportunities. In this dynamic environment, identifying strong stocks often involves focusing on companies with robust innovation capabilities and solid market positioning to capitalize on favorable economic conditions.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Material Group | 17.82% | 28.74% | ★★★★★☆ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Avant Group (TSE:3836)

Simply Wall St Growth Rating: ★★★★☆☆

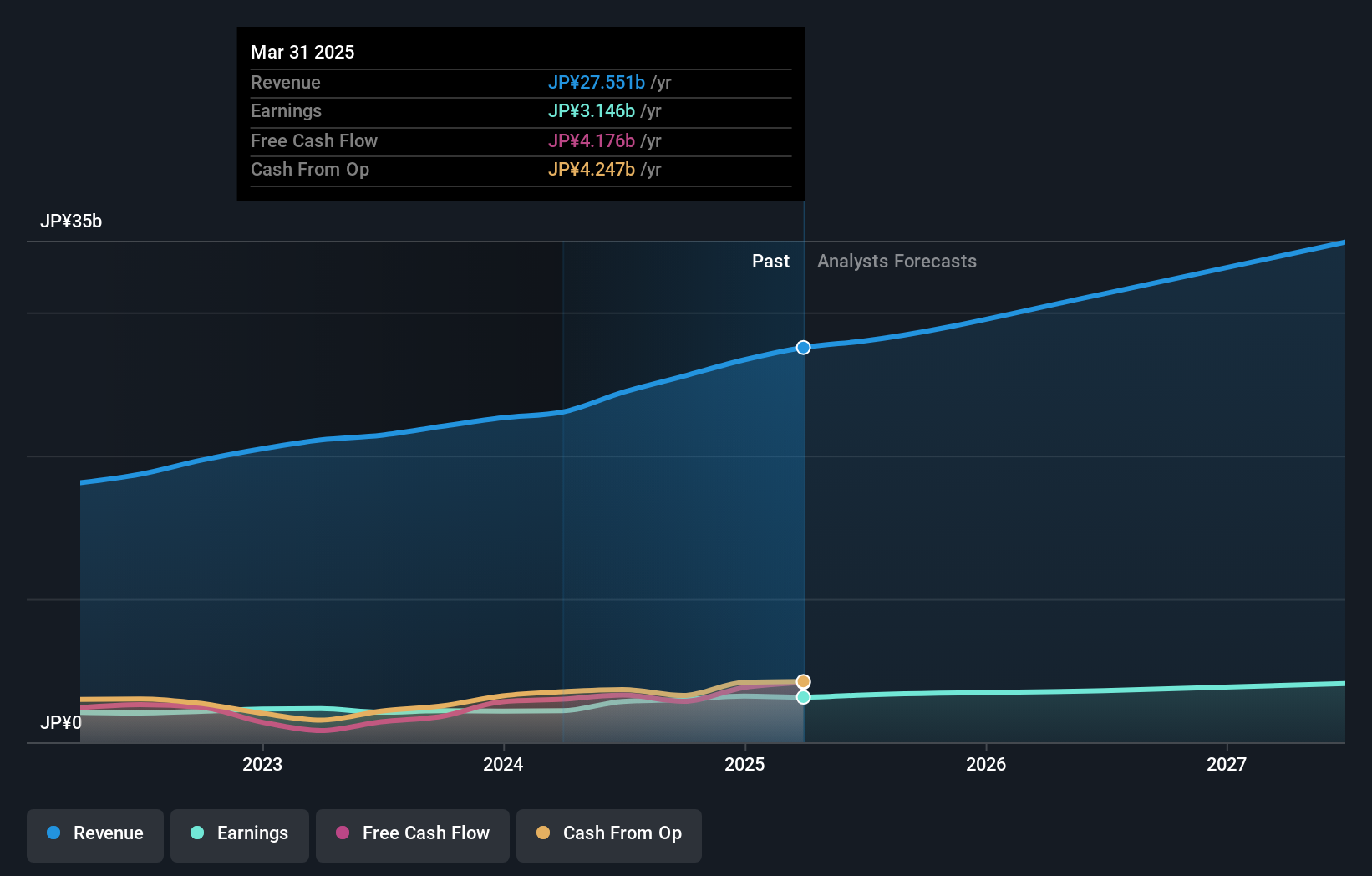

Overview: Avant Group Corporation, through its subsidiaries, provides accounting, business intelligence, and outsourcing services with a market cap of ¥78.21 billion.

Operations: Avant Group generates revenue primarily from its Digital Transformation Promotion Business (¥8.85 billion), Management Solutions Business (¥8.52 billion), and Group Governance Business (¥7.54 billion).

Avant Group, reflecting a robust trajectory in Japan's tech sector, recently upped its dividend to ¥19.00 from last year's ¥15.00, signaling confidence in sustained profitability with a projection to increase it further to ¥25.00 next year. This optimism is underpinned by their latest financial guidance forecasting substantial growth with net sales expected at JPY 28.8 billion and operating profit at JPY 4.9 billion for the upcoming fiscal year. Notably, Avant has also actively returned value to shareholders by repurchasing shares worth ¥477.64 million earlier this year, enhancing shareholder value amidst its strategic expansions. In terms of innovation and market positioning, Avant stands out with its commitment to R&D spending which not only fuels its above-market revenue growth forecast of 15.8% annually but also supports an earnings surge of 17.9% per annum—figures that surpass general market expectations in Japan significantly (4.3% and 8.6%, respectively). These investments have evidently paid off as evidenced by their earnings growth outpacing the IT industry average significantly over the past year (36%). This aggressive focus on R&D likely positions Avant well for future technological advancements and market demands, maintaining its competitive edge in a rapidly evolving industry landscape.

- Delve into the full analysis health report here for a deeper understanding of Avant Group.

Explore historical data to track Avant Group's performance over time in our Past section.

Safie (TSE:4375)

Simply Wall St Growth Rating: ★★★★☆☆

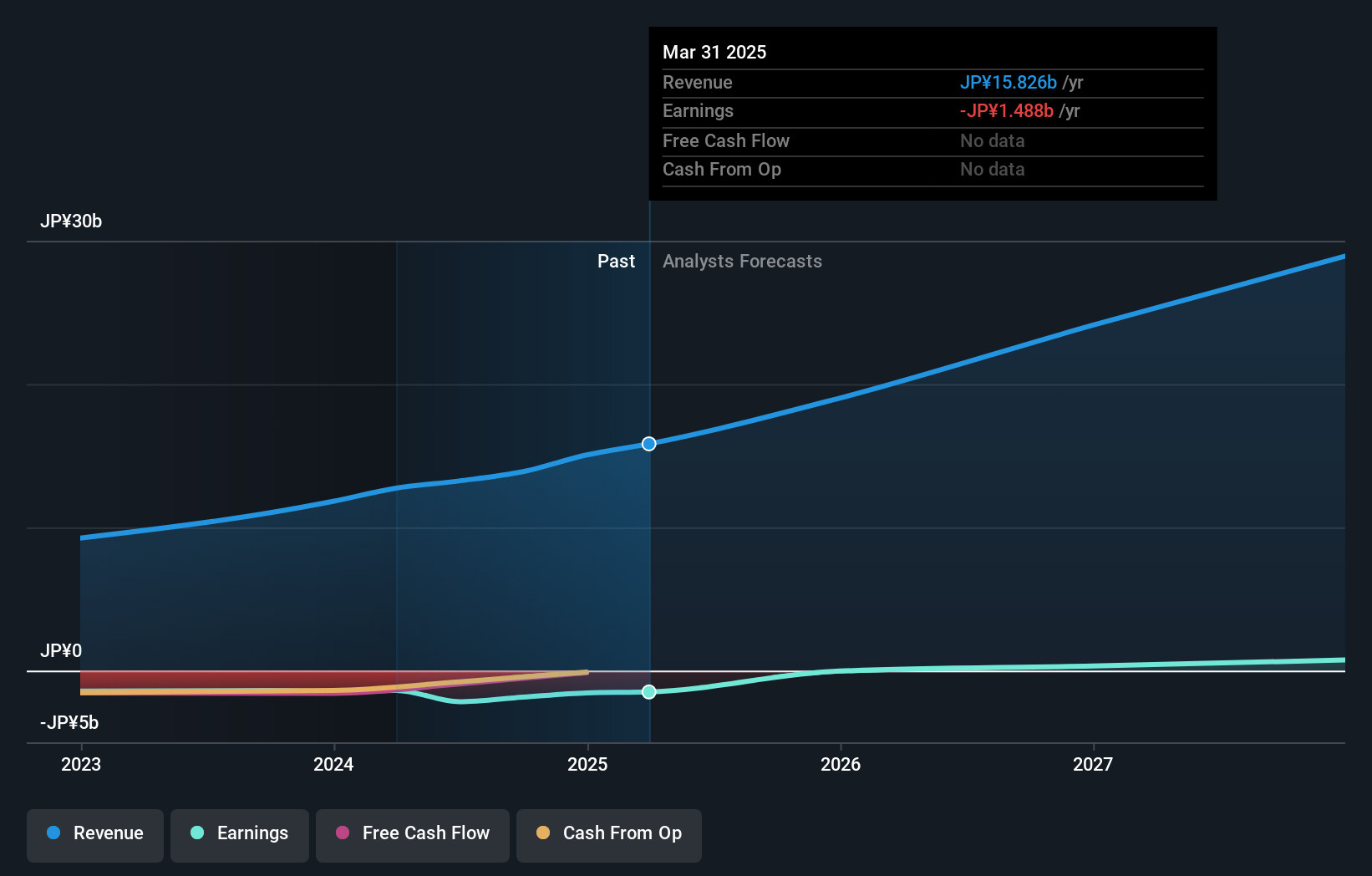

Overview: Safie Inc. develops and operates a cloud-based video recording platform under the Safie brand in Japan, with a market cap of ¥44.70 billion.

Operations: Safie Inc. generates revenue primarily through its cloud-based video recording platform in Japan. The company's cost structure includes technology infrastructure and customer support expenses.

Safie, a contender in Japan's high-growth tech landscape, has shown notable financial dynamics with an expected earnings surge of 98.5% per year. This growth trajectory is bolstered by a significant 17.9% annual increase in revenue, outpacing the broader Japanese market's growth rate of 4.3%. The company's commitment to innovation is evident from its R&D expenses which are strategically aligned to support these ambitious growth figures. Moreover, recent activities including the Q2 earnings announcement set for August underscore Safie’s proactive engagement with market expectations and investor communications. These elements collectively highlight Safie’s robust potential in harnessing technology advancements while maintaining a strong competitive stance within the industry.

- Dive into the specifics of Safie here with our thorough health report.

Assess Safie's past performance with our detailed historical performance reports.

Bengo4.comInc (TSE:6027)

Simply Wall St Growth Rating: ★★★★★★

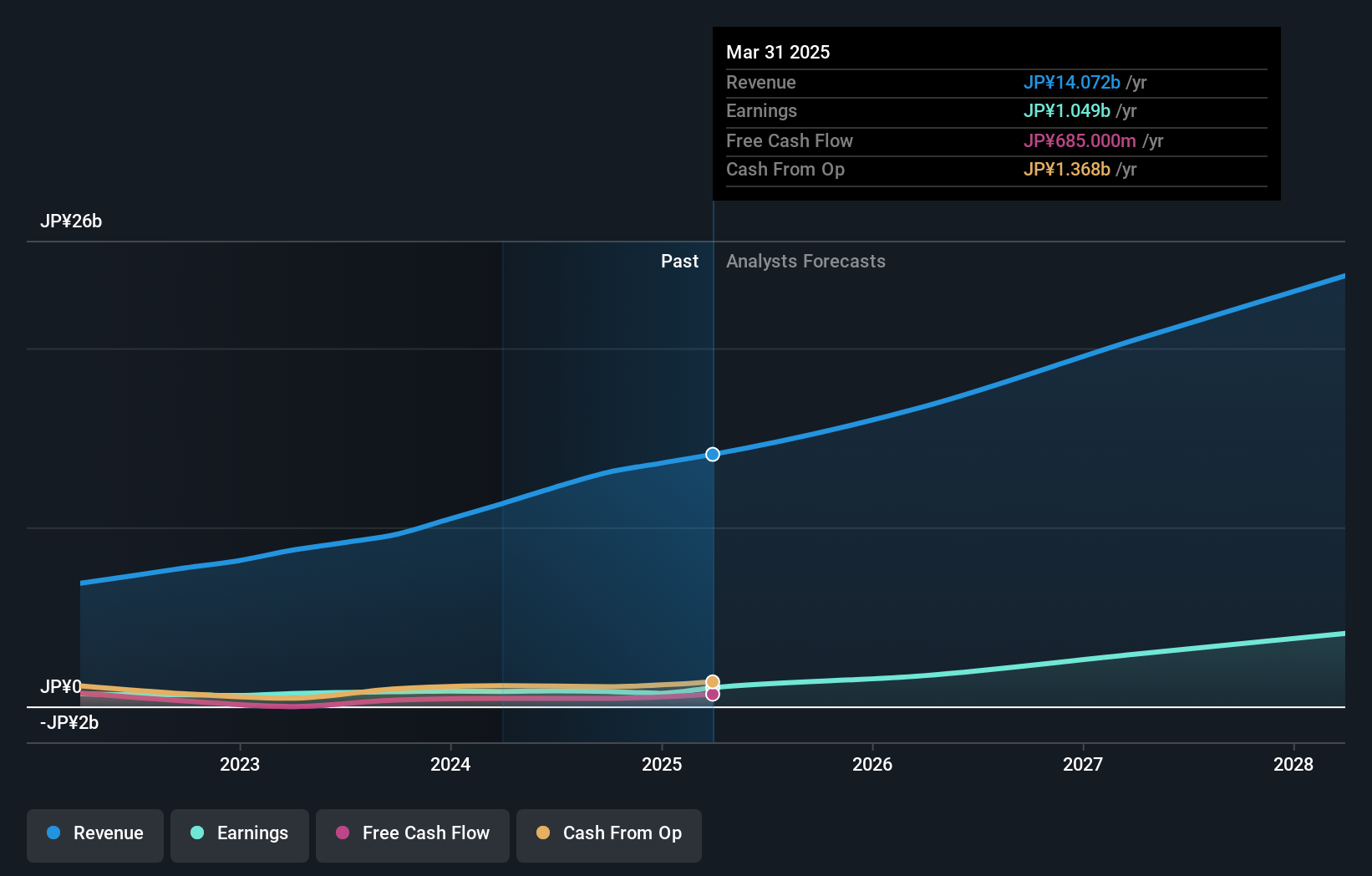

Overview: Bengo4.com, Inc. provides online professional consultancy services in Japan and has a market cap of ¥70.08 billion.

Operations: Bengo4.com, Inc. generates revenue primarily from its Media and IT/Solutions segments, with ¥4.61 billion and ¥7.62 billion respectively. The company focuses on providing online professional consultancy services in Japan.

Bengo4.comInc, amidst Japan’s tech sphere, is distinguishing itself with a projected revenue growth of 20.8% annually, outstripping the broader market's 4.3%. This surge is underpinned by its innovative AI tool, Legal Brain, enhancing legal research efficiency—a critical asset given current labor shortages in corporate legal sectors. Furthermore, with R&D expenses climbing to represent 46.8% of their revenue stream, the firm is heavily investing in technological advancements to stay ahead in a competitive landscape. These strategic moves could significantly shape Bengo4.comInc's trajectory in leveraging tech for specialized services while navigating through market volatilities effectively.

- Navigate through the intricacies of Bengo4.comInc with our comprehensive health report here.

Gain insights into Bengo4.comInc's past trends and performance with our Past report.

Summing It All Up

- Click through to start exploring the rest of the 120 Japanese High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4375

Safie

Develops and operates a cloud-based video recording platform under the Safie brand in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives