- New Zealand

- /

- Software

- /

- NZSE:GTK

Exploring High Growth Tech Stocks in January 2025

Reviewed by Simply Wall St

As global markets continue their upward trajectory, driven by optimism surrounding AI advancements and potential trade resolutions, major indices like the S&P 500 have reached new heights, reflecting a broader positive sentiment. In this environment of technological enthusiasm and economic shifts, identifying high-growth tech stocks requires a focus on companies with strong innovation capabilities and adaptability to rapidly evolving market trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

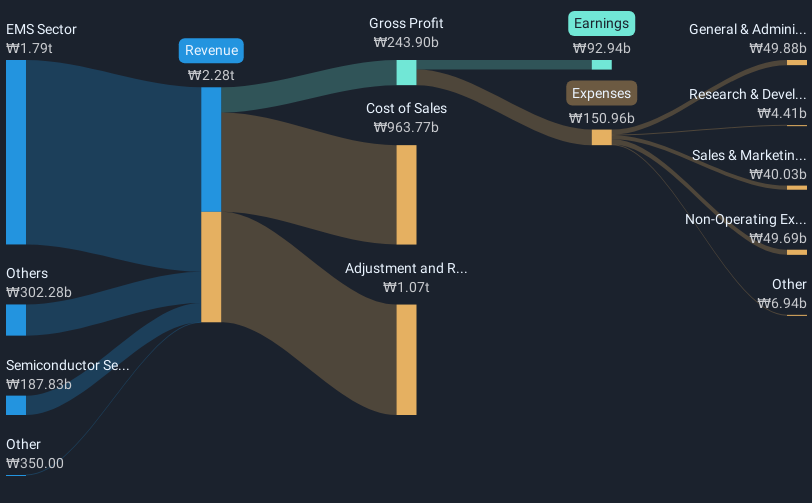

Overview: Seojin System Co., Ltd specializes in telecom equipment, repeaters, mechanical products, and LED and other equipment, with a market cap of ₩1.40 trillion.

Operations: Seojin System Co., Ltd generates revenue primarily from the EMS sector, contributing ₩1.79 trillion, and the semiconductor sector, adding ₩187.83 billion.

Seojin SystemLtd has demonstrated robust financial performance with an annual revenue growth rate of 35.4% and earnings growth of 39.9%, significantly outpacing the Communications industry's average. This surge is propelled by their strategic focus on innovative technologies, which is evident from their substantial R&D investment, aligning with industry shifts towards more advanced tech solutions. Despite a challenging debt position not well-covered by operating cash flow, the company's aggressive growth strategy and high return on equity forecast at 22.5% highlight its potential in a competitive market. With earnings expected to grow significantly over the next three years, Seojin SystemLtd stands out for its dynamic approach to scaling operations and enhancing shareholder value through focused sector advancements.

Gentrack Group (NZSE:GTK)

Simply Wall St Growth Rating: ★★★★☆☆

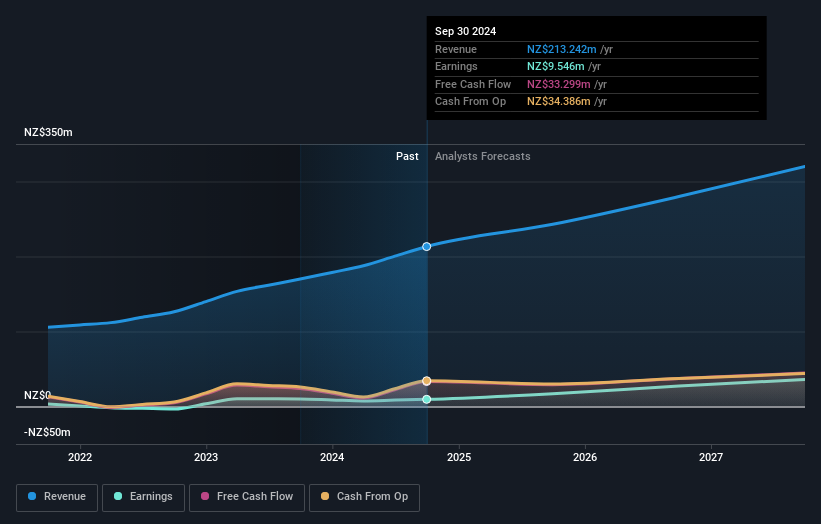

Overview: Gentrack Group Limited specializes in creating, integrating, and maintaining enterprise billing and customer management software for the energy, water utility, and airport sectors with a market cap of NZ$1.34 billion.

Operations: Gentrack Group generates revenue primarily from its utility and airport segments, with the utility segment contributing NZ$181.31 million and the airport segment adding NZ$31.93 million. The company's focus is on providing software solutions tailored to billing and customer management needs in these industries.

Gentrack Group has shown a promising trajectory with an annual revenue growth of 12.6% and an impressive earnings increase of 29.7%, outstripping the New Zealand market's average. This growth is supported by a significant R&D commitment, evident from their recent financial disclosures showing R&D expenses aligning closely with revenue gains. Despite a slight dip in net income from NZD 10.05 million to NZD 9.55 million last year, the firm's strategic investments in technology innovation position it well within the competitive tech landscape, particularly as it leverages these advancements to enhance service offerings across global markets.

- Delve into the full analysis health report here for a deeper understanding of Gentrack Group.

Understand Gentrack Group's track record by examining our Past report.

Safie (TSE:4375)

Simply Wall St Growth Rating: ★★★★☆☆

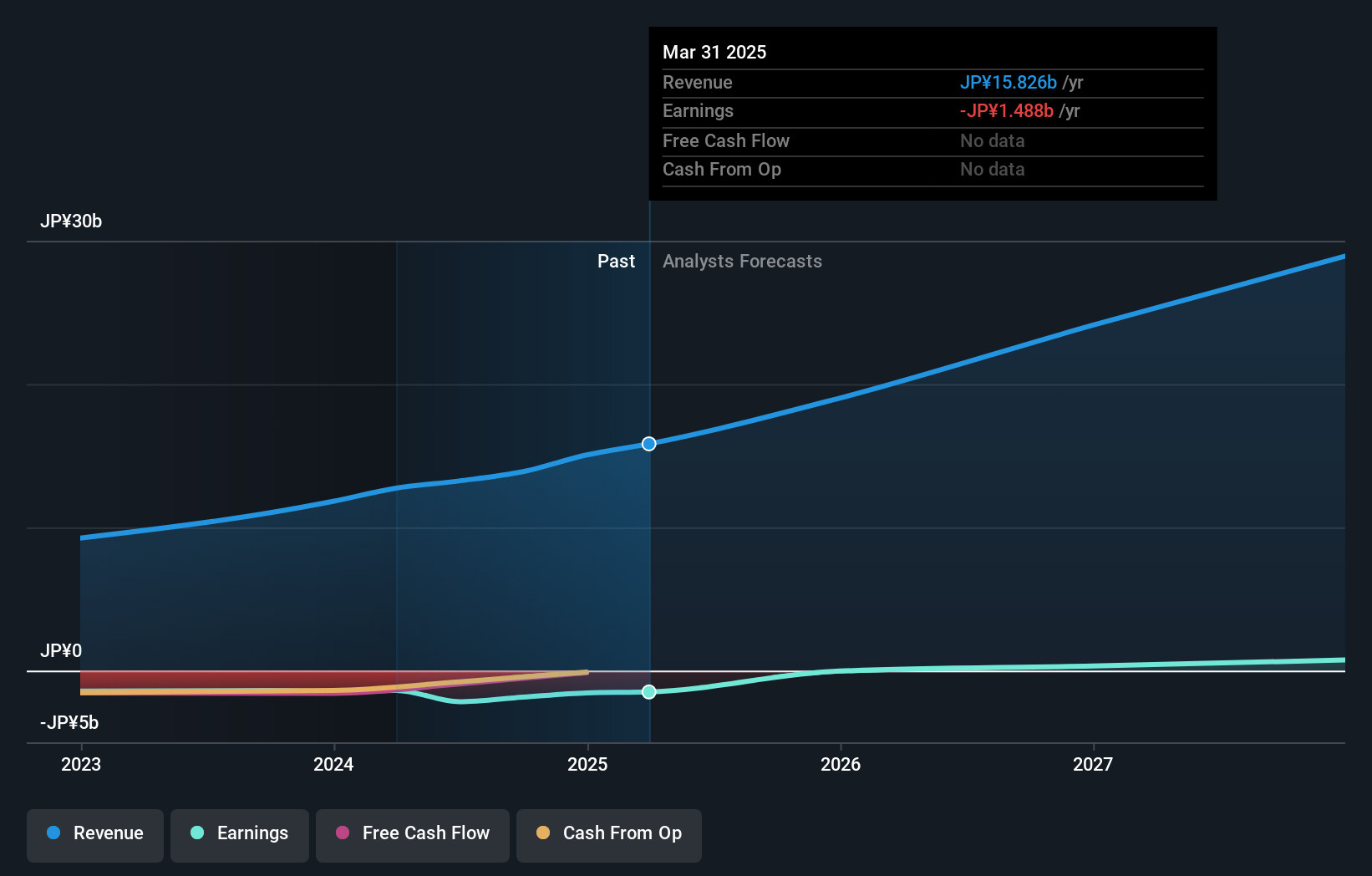

Overview: Safie Inc. is a Japanese company that develops and operates a cloud-based video recording platform under the Safie brand, with a market cap of ¥39.35 billion.

Operations: The primary revenue stream for Safie Inc. is its Video Platform Business, generating ¥13.88 billion. The company focuses on providing cloud-based video recording solutions in Japan.

Safie, despite its current unprofitability, is positioned for significant growth with revenue projected to increase by 19.7% annually, outpacing the Japanese market's average of 4.3%. This growth is underpinned by a robust R&D investment strategy that aligns with its revenue trajectory, ensuring continuous innovation in a competitive sector. Moreover, Safie's anticipated shift to profitability within three years highlights its potential resilience and adaptability in the tech landscape. The company's ability to maintain a volatile share price amidst these advancements reflects both challenges and opportunities ahead as it navigates through technological evolutions and market demands.

Where To Now?

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1228 more companies for you to explore.Click here to unveil our expertly curated list of 1231 High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:GTK

Gentrack Group

Engages in the development, integration, and support of enterprise billing and customer management software solutions for the energy and water utility, and airport industries.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives