Slammed 25% Core Concept Technologies Inc. (TSE:4371) Screens Well Here But There Might Be A Catch

Core Concept Technologies Inc. (TSE:4371) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

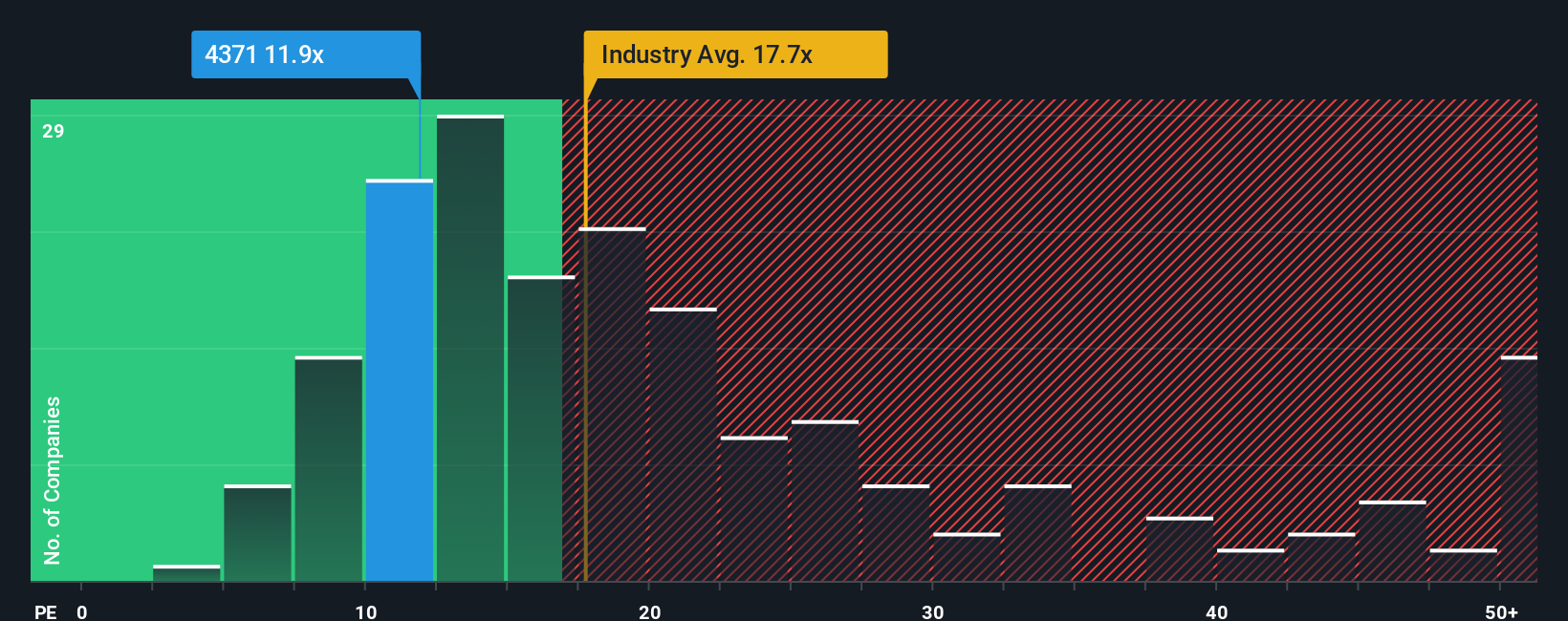

Although its price has dipped substantially, given about half the companies in Japan have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Core Concept Technologies as an attractive investment with its 11.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's inferior to most other companies of late, Core Concept Technologies has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Core Concept Technologies

How Is Core Concept Technologies' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Core Concept Technologies' to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow EPS by an impressive 65% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 9.6% per annum growth forecast for the broader market.

In light of this, it's peculiar that Core Concept Technologies' P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Core Concept Technologies' P/E has taken a tumble along with its share price. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Core Concept Technologies currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with Core Concept Technologies.

Of course, you might also be able to find a better stock than Core Concept Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4371

Core Concept Technologies

Engages in the provision of digital transformation support in Japan.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success