Appirits' (TSE:4174) Shareholders Will Receive A Bigger Dividend Than Last Year

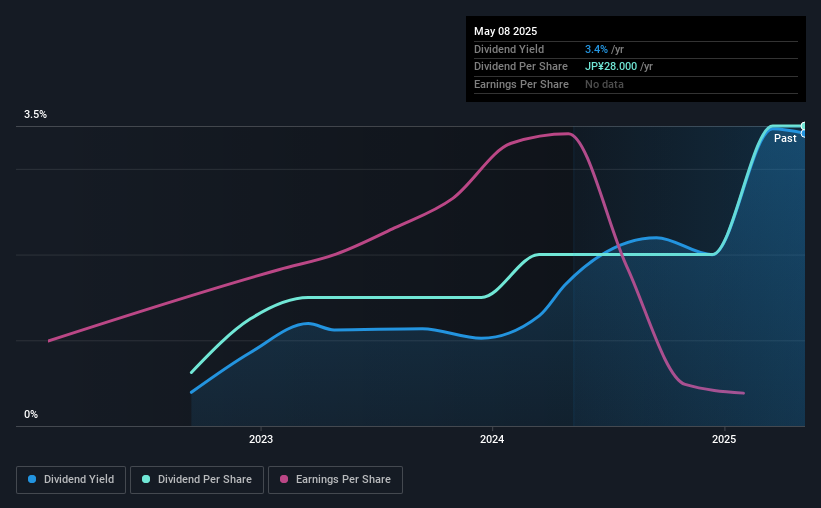

Appirits Inc.'s (TSE:4174) dividend will be increasing from last year's payment of the same period to ¥14.00 on 14th of October. This will take the dividend yield to an attractive 3.4%, providing a nice boost to shareholder returns.

Our free stock report includes 4 warning signs investors should be aware of before investing in Appirits. Read for free now.Appirits' Future Dividends May Potentially Be At Risk

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before this announcement, Appirits was paying out 101% of what it was earning, and not generating any free cash flows either. This high of a dividend payment could start to put pressure on the balance sheet in the future.

EPS is set to fall by 16.9% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could reach 236%, which could put the dividend in jeopardy if the company's earnings don't improve.

Check out our latest analysis for Appirits

Appirits Is Still Building Its Track Record

The company has maintained a consistent dividend for a few years now, but we would like to see a longer track record before relying on it. Since 2022, the dividend has gone from ¥5.00 total annually to ¥28.00. This means that it has been growing its distributions at 78% per annum over that time. We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

The Dividend Has Limited Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. Appirits' earnings per share has shrunk at 17% a year over the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

We're Not Big Fans Of Appirits' Dividend

In conclusion, we have some concerns about this dividend, even though it being raised is good. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. The dividend doesn't inspire confidence that it will provide solid income in the future.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 4 warning signs for Appirits (1 makes us a bit uncomfortable!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4174

Appirits

Develops and sells web services and related consulting services.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026