Investors Still Aren't Entirely Convinced By SHANON Inc.'s (TSE:3976) Revenues Despite 25% Price Jump

SHANON Inc. (TSE:3976) shares have had a really impressive month, gaining 25% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.0% in the last twelve months.

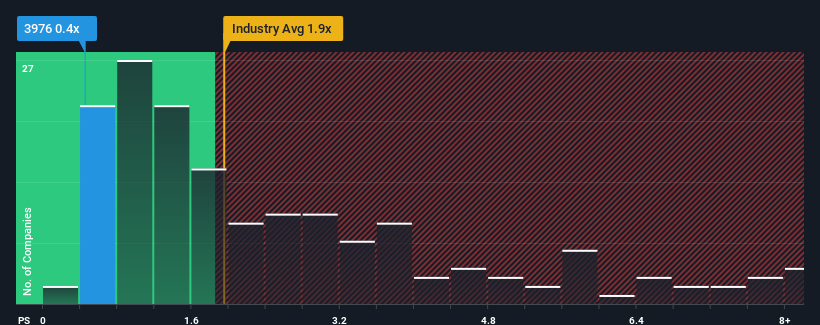

Although its price has surged higher, SHANON may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Software industry in Japan have P/S ratios greater than 1.9x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for SHANON

How Has SHANON Performed Recently?

SHANON has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on SHANON will help you shine a light on its historical performance.How Is SHANON's Revenue Growth Trending?

In order to justify its P/S ratio, SHANON would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The latest three year period has also seen an excellent 56% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is only predicted to deliver 12% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this information, we find it odd that SHANON is trading at a P/S lower than the industry. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On SHANON's P/S

SHANON's stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see SHANON currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 3 warning signs for SHANON that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3976

SHANON

Provides cloud solutions. It develops and sells SHANONMARKETING PLATFORM, an integrated marketing support cloud product; SHANONAdCloud, a demand-side platform for advertising distribution services; SHANONvbitCMCloud, a content management system; and ZIKU, a metaverse event platform, as well as creates related homepages and databases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives