What Rakus (TSE:3923)'s Potential Alliance with Plus Alpha Consulting Means For Shareholders

Reviewed by Sasha Jovanovic

- On November 14, 2025, Rakus Co., Ltd. announced that its board had considered entering into a capital and business alliance agreement with Plus Alpha Consulting Co., Ltd.

- This development highlights how partnerships within Japan’s business services sector may unlock new avenues for operational collaboration and innovation.

- We’ll examine how the prospect of enhanced collaboration with Plus Alpha Consulting influences Rakus’s broader investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Rakus' Investment Narrative?

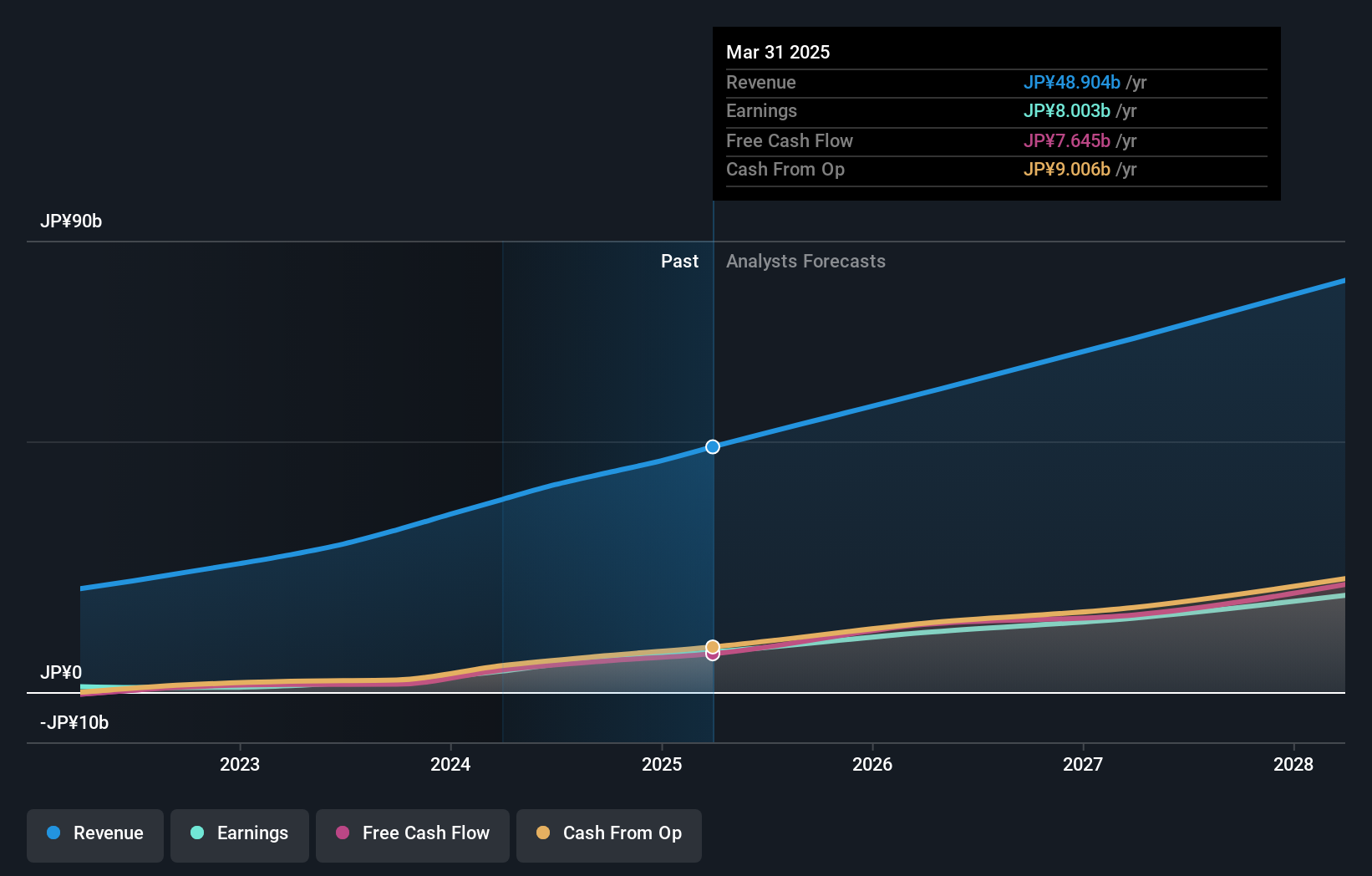

To be a shareholder in Rakus, you’d likely need confidence in management’s ability to keep up its impressive revenue and profit growth, while adapting to a quickly evolving software market in Japan. The company’s alliance with Plus Alpha Consulting, now advancing to a potential capital partnership, adds a new layer of potential for future revenue streams or technical collaboration, possibly influencing Rakus’s short-term growth catalysts if synergy delivery is swift. The news doesn’t appear to have prompted significant price moves yet; if the agreement proves mostly incremental, then core risks, like Rakus’s premium valuation versus peers and short management tenure, remain front and center. However, should the partnership lead to meaningful top-line gains or expanded customer access, near-term catalysts could look different. For now, the primary investor narrative focuses on whether Rakus can justify its high earnings multiple with continued outperformance.

On the flipside, an elevated price-to-earnings ratio is something every investor should keep in mind. Despite retreating, Rakus' shares might still be trading 19% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Rakus - why the stock might be worth as much as 34% more than the current price!

Build Your Own Rakus Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rakus research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Rakus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rakus' overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3923

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives