- Norway

- /

- Healthtech

- /

- OB:NORDH

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

In February 2025, global markets are navigating a complex landscape marked by U.S. tariff uncertainties and mixed economic signals, with key indices like the S&P 500 experiencing slight declines amid strong earnings reports from major companies. As investors assess these dynamics, identifying high growth tech stocks that can thrive in such volatile conditions requires attention to their innovation potential and resilience to external shocks.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Bioneer (KOSDAQ:A064550)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bioneer Corporation is a biotechnology company with global operations, including South Korea, the Americas, Europe, Asia, and Africa, and has a market cap of ₩445.74 billion.

Operations: Bioneer Corporation generates revenue primarily through its biotechnology operations across multiple regions, including South Korea and internationally. The company's business model focuses on developing and commercializing biotech products and services.

Despite current unprofitability, Bioneer is poised for significant growth with revenue expected to increase by 26.1% annually, outpacing the KR market's 8.7%. This tech firm is also on a trajectory to profitability within three years, a robust indicator of potential given the forecasted annual earnings growth of 104.84%. Recent strategic calls aim to enhance corporate value and understanding of their innovative business model, crucial as they navigate from recent losses towards anticipated gains. With R&D investments sharpening competitive edges in biotech, Bioneer's future prospects appear promising amidst challenging transitions.

- Dive into the specifics of Bioneer here with our thorough health report.

Evaluate Bioneer's historical performance by accessing our past performance report.

Nordhealth (OB:NORDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordhealth AS offers healthcare software solutions across Norway, Finland, Sweden, Denmark, Germany, and internationally with a market capitalization of NOK3.02 billion.

Operations: Nordhealth AS generates revenue primarily through its healthcare software solutions, serving markets in several European countries and beyond. The company has a market capitalization of approximately NOK3.02 billion.

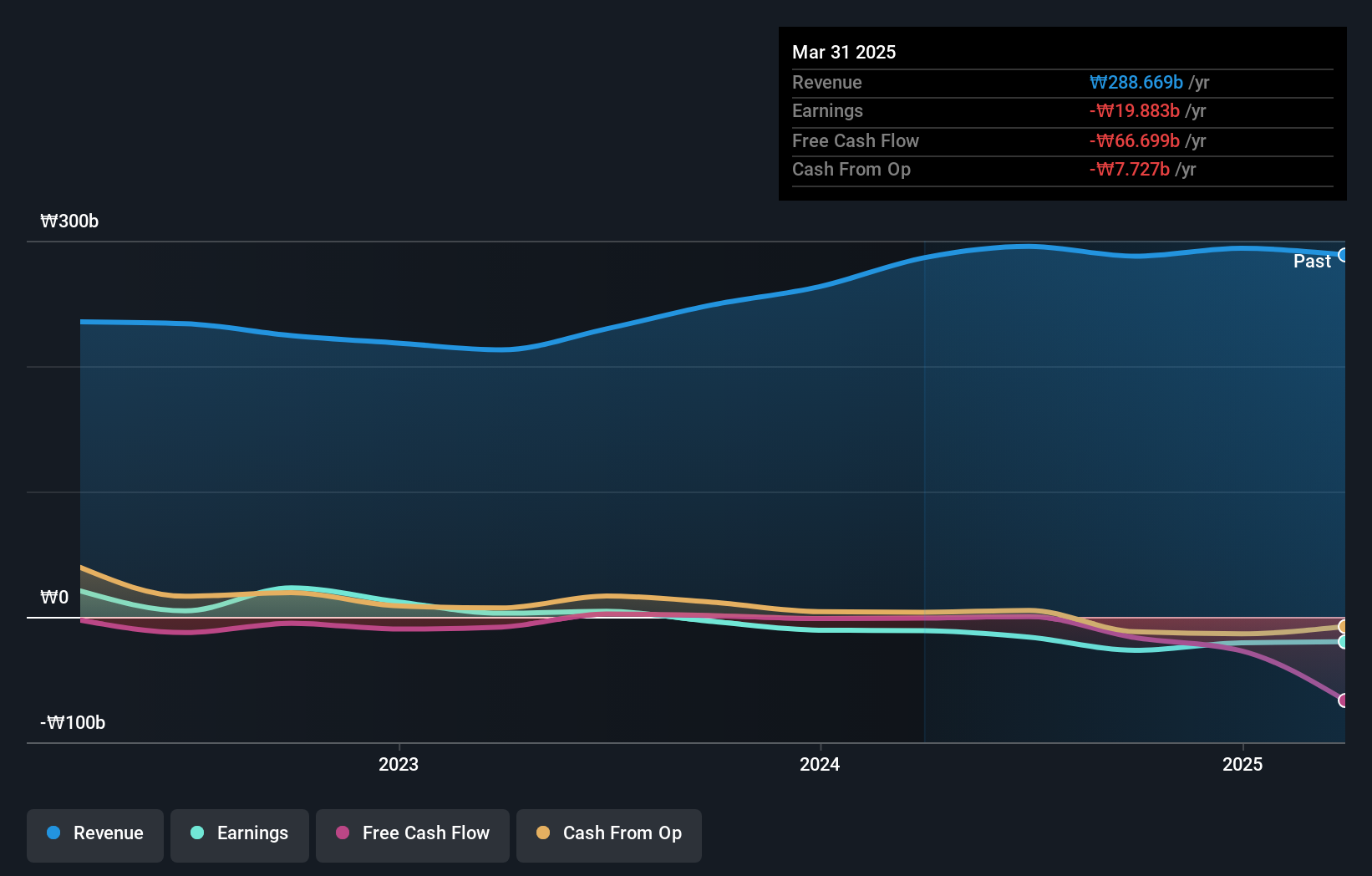

Nordhealth, despite its current unprofitability, is navigating a promising trajectory with expected annual revenue growth of 16.7%, outstripping Norway's average of 2.8%. The recent appointment of Alexander Cram as CFO hints at strategic financial restructuring, potentially accelerating the path to profitability forecasted within three years. Moreover, Provet Cloud's expansion into a major U.S. veterinary group underscores Nordhealth’s aggressive market penetration strategy and could significantly bolster future earnings, which are projected to surge by 85.68% annually.

- Click here to discover the nuances of Nordhealth with our detailed analytical health report.

Gain insights into Nordhealth's past trends and performance with our Past report.

I'LL (TSE:3854)

Simply Wall St Growth Rating: ★★★★☆☆

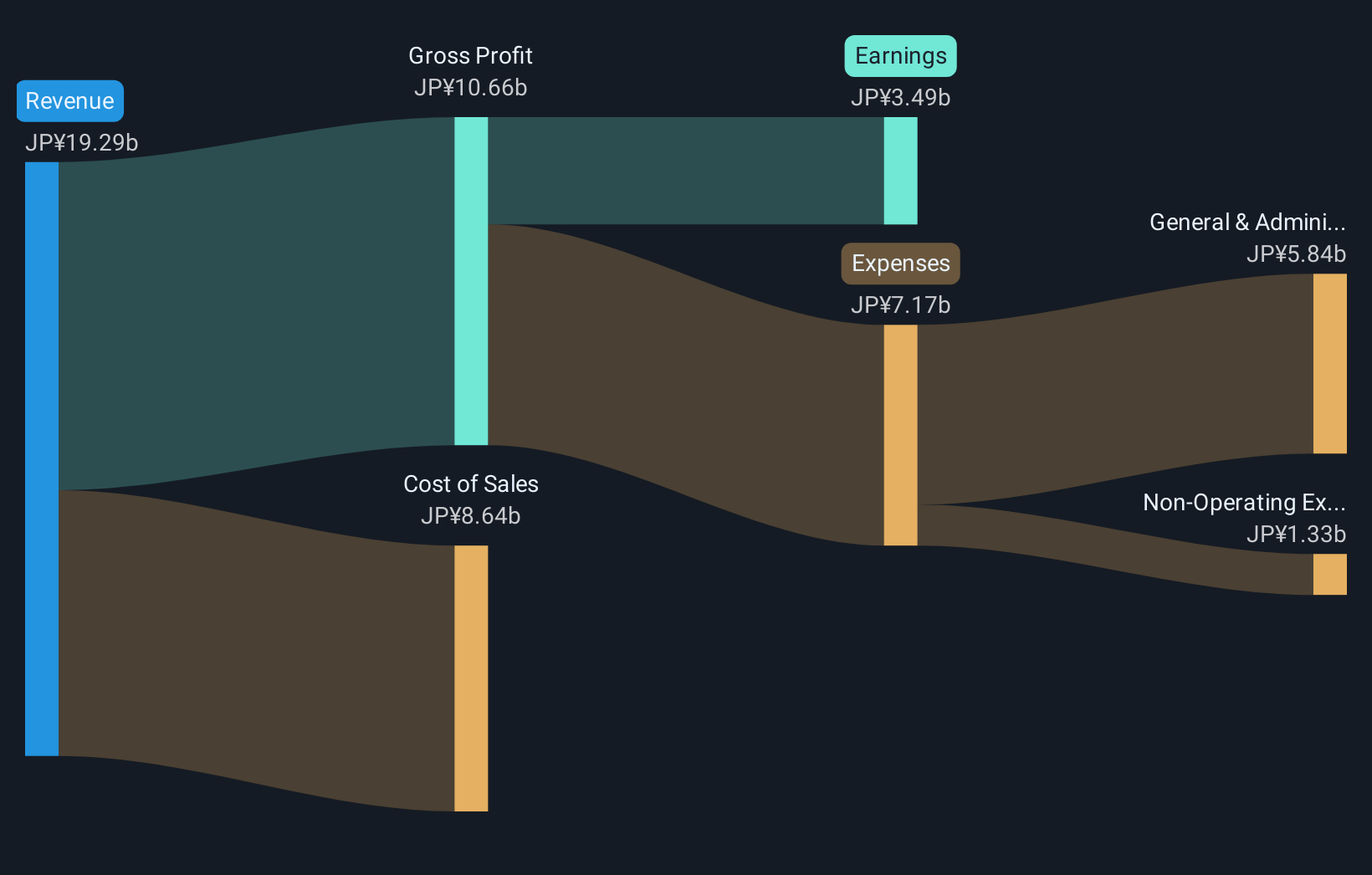

Overview: I'LL Inc. is engaged in the system solution business in Japan, with a market capitalization of ¥61.99 billion.

Operations: The company focuses on providing system solutions in Japan. It generates revenue primarily from its system solution services, contributing significantly to its overall financial performance.

I'LL has demonstrated robust financial health, with a notable annual revenue growth of 9.4%, outpacing the JP market's average of 4.3%. This growth is complemented by an impressive earnings increase of 14.6% per year, signaling strong operational efficiency and market demand. Investing heavily in innovation, I'LL allocated significant resources to R&D, spending $1.2 billion last year alone, which represents a strategic move to sustain its competitive edge in a rapidly evolving tech landscape. These investments not only enhance product offerings but also secure long-term growth prospects in sectors critical to technological advancements and consumer needs.

- Delve into the full analysis health report here for a deeper understanding of I'LL.

Review our historical performance report to gain insights into I'LL's's past performance.

Next Steps

- Click through to start exploring the rest of the 1209 High Growth Tech and AI Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordhealth might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORDH

Nordhealth

Provides healthcare software solutions in Norway, Finland, Sweden, Denmark, Germany, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives