Discovering Hidden Opportunities In Three Promising Small Caps

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced additional pressure, with indices like the S&P 600 experiencing notable declines. In this environment, identifying promising small-cap opportunities requires a keen eye for companies with strong fundamentals and growth potential that can weather broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 15.53% | 54.51% | 76.29% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| DorightLtd | 0.56% | 14.02% | 7.14% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.21% | 50.35% | 68.60% | ★★★★★☆ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 6.86% | 64.15% | 63.49% | ★★★★★☆ |

| Kappa Create | 74.42% | -0.45% | 3.62% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Texmaco Rail & Engineering (NSEI:TEXRAIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Texmaco Rail & Engineering Limited manufactures, sells, and provides services for rail and rail-related products in India and internationally with a market capitalization of ₹85.18 billion.

Operations: The company's primary revenue streams include the Freight Car Division, generating ₹36.78 billion, followed by Infra - Rail & Green Energy at ₹5.06 billion, and Infra - Electrical contributing ₹2.92 billion.

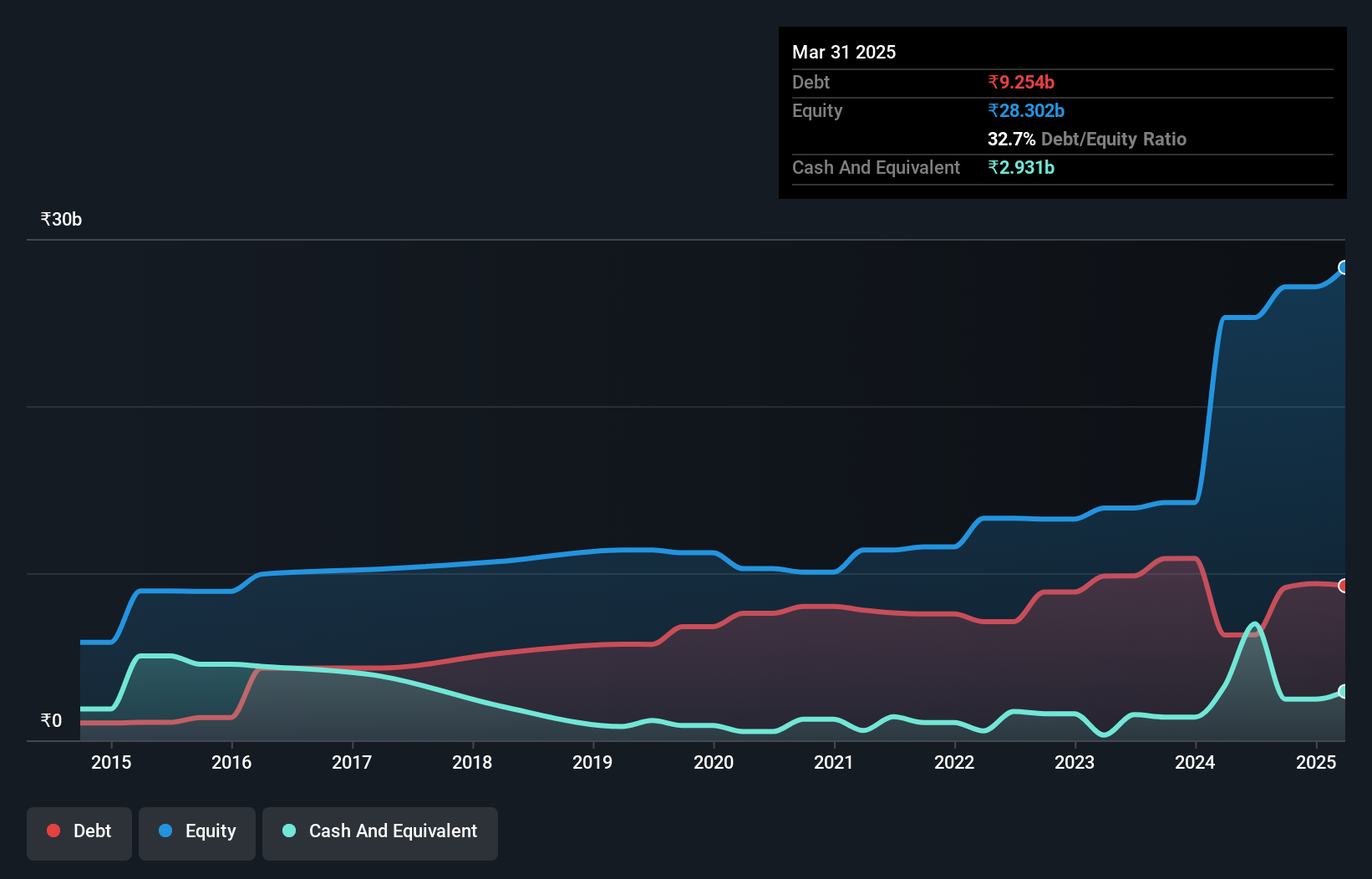

Texmaco Rail & Engineering, a promising player in the rail sector, has shown impressive financial growth with earnings surging 204% over the past year, outpacing its industry peers. The company's net income for the recent quarter reached INR 728.59 million from INR 246.49 million a year ago, and it reported sales of INR 13.46 billion compared to INR 8.05 billion previously. Despite shareholder dilution last year, Texmaco's debt-to-equity ratio improved significantly from 60.6% to 33.7% over five years, indicating prudent financial management while trading at about two-thirds below estimated fair value suggests potential upside for investors seeking value opportunities in this sector.

Comture (TSE:3844)

Simply Wall St Value Rating: ★★★★★☆

Overview: Comture Corporation offers a range of solutions including cloud, digital, business, platform and operation, and digital learning services in Japan with a market capitalization of ¥72.69 billion.

Operations: Comture's revenue primarily comes from its Solution Services segment, which generated ¥34.84 billion. The company has a market capitalization of ¥72.69 billion.

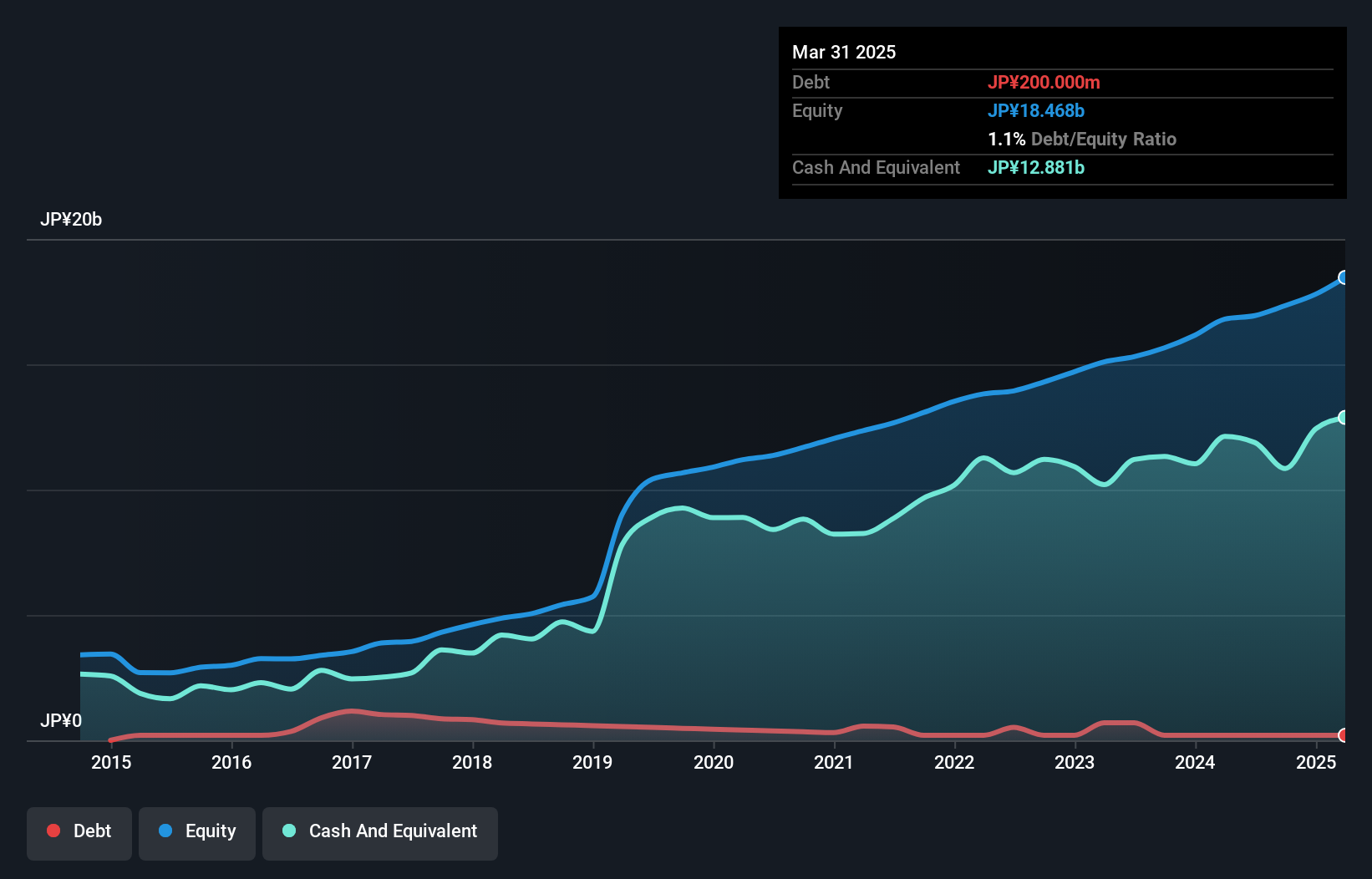

Comture, a smaller player in the IT sector, has seen its earnings grow by 11% over the past year, outpacing the industry average of 10.3%. The company is trading at 22.4% below its estimated fair value, suggesting potential undervaluation. Over five years, Comture's debt-to-equity ratio improved significantly from 4.9 to 1.2, indicating better financial health and management of liabilities. Recent news highlights a dividend increase to ¥12 per share for Q1 FY2025 from ¥11.50 previously, reflecting confidence in cash flow sustainability amidst high-quality earnings and positive free cash flow generation.

- Click to explore a detailed breakdown of our findings in Comture's health report.

Assess Comture's past performance with our detailed historical performance reports.

Taiwan Glass Ind (TWSE:1802)

Simply Wall St Value Rating: ★★★★★☆

Overview: Taiwan Glass Ind. Corp. is involved in the manufacturing, processing, and selling of diverse glass products across Taiwan, China, and international markets with a market capitalization of NT$56.56 billion.

Operations: The company generates revenue primarily from three segments: Flat-Panel Glass (NT$32.57 billion), Glass Fibers (NT$8.88 billion), and Glassware (NT$3.87 billion).

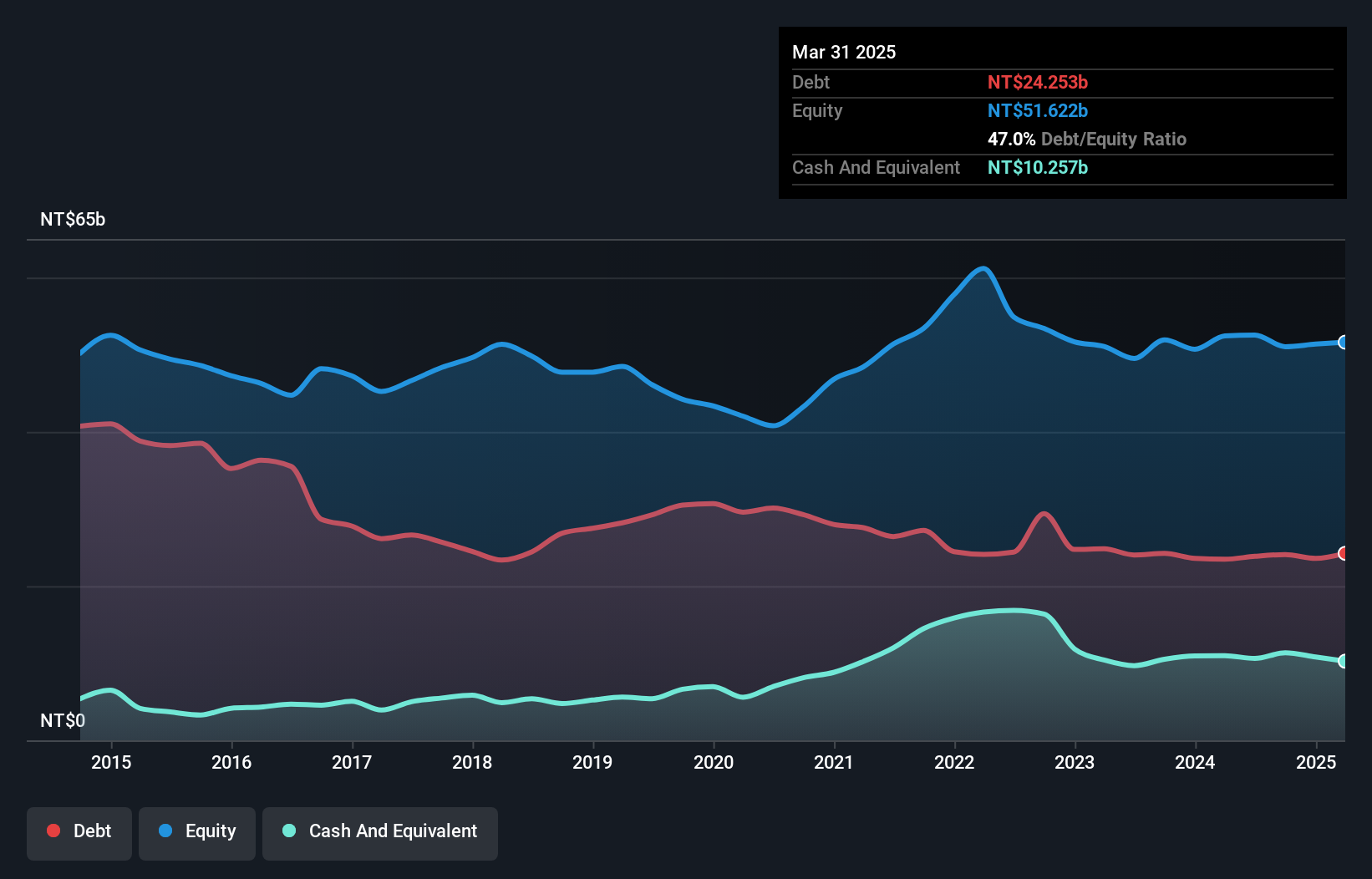

Taiwan Glass Ind. has shown resilience despite facing challenges, with its net loss for the second quarter of 2024 at TWD 169.52 million, an increase from TWD 13.05 million a year ago. However, the company seems to be on a path of improvement as its six-month net loss decreased to TWD 429.53 million from TWD 863.74 million last year, reflecting a potential turnaround in operations. Sales figures for the same period were slightly down at TWD 20,841.44 million compared to last year's TWD 21,175.15 million, indicating stable demand amidst market fluctuations and strategic adjustments likely contributing positively over time.

- Take a closer look at Taiwan Glass Ind's potential here in our health report.

Gain insights into Taiwan Glass Ind's past trends and performance with our Past report.

Summing It All Up

- Delve into our full catalog of 4742 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texmaco Rail & Engineering might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:TEXRAIL

Texmaco Rail & Engineering

Manufactures, sells, and provides services for rail and rail related products in India and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives