SHIFT (TSE:3697): Valuation in Focus as Bahrain Expansion and Nikkei 225 Entry Raise Investor Interest

Reviewed by Kshitija Bhandaru

SHIFT (TSE:3697) has just taken two important steps that could boost its market profile: establishing a subsidiary in Bahrain to expand in the Middle East and joining the Nikkei 225 Index.

See our latest analysis for SHIFT.

With the Nikkei 225 inclusion and a push into the Middle East, momentum around SHIFT is picking up. Even amid recent share price volatility, while the stock has given back some ground in the last month, its total shareholder return sits at an impressive 20.7% over the past year, suggesting that long-term holders are still seeing strong rewards.

If SHIFT’s global ambitions have you thinking bigger, this could be an ideal moment to explore opportunities in fast growing stocks with high insider ownership.

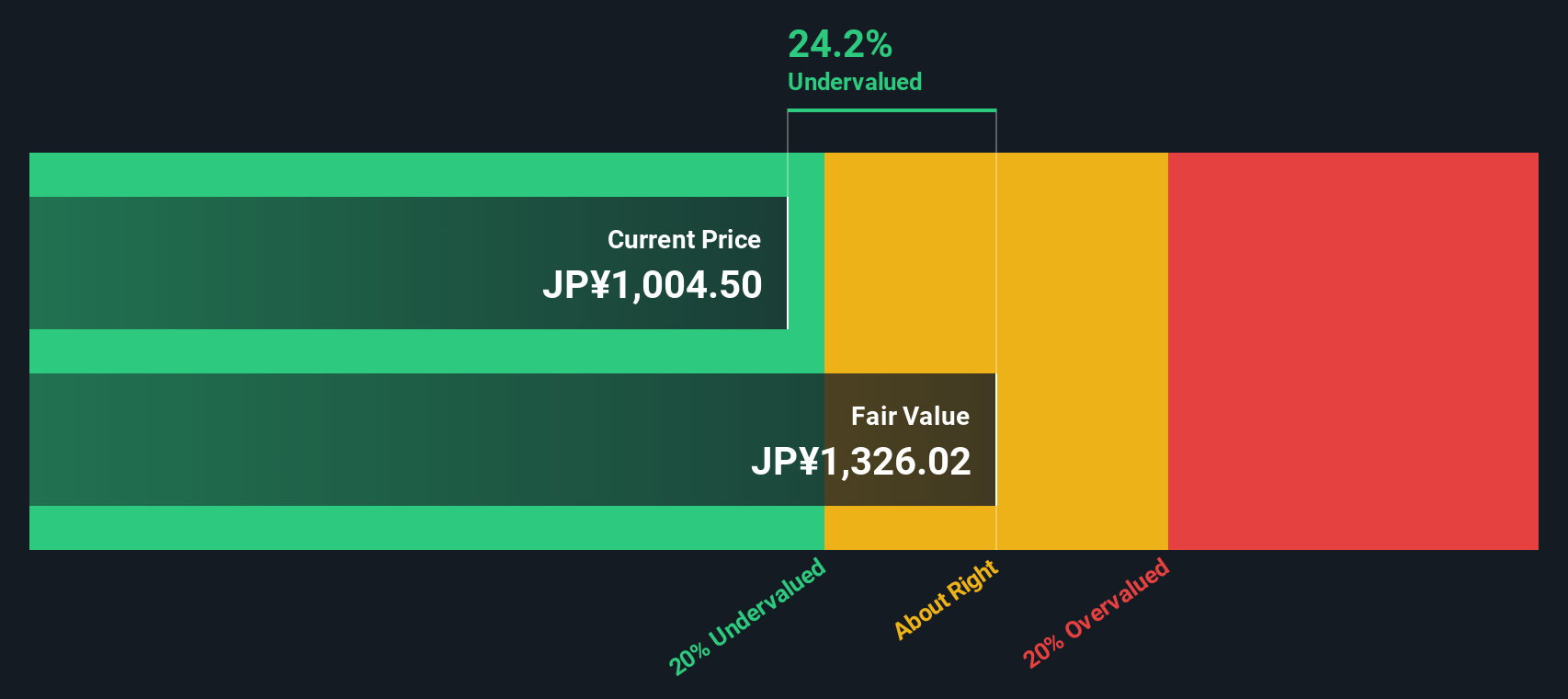

Given these developments and SHIFT’s recent price swings, the key question now is whether the stock’s potential is already reflected in its valuation or if there is still room for investors to capitalize on future growth.

Price-to-Earnings of 41x: Is it justified?

SHIFT is currently trading at a price-to-earnings (P/E) ratio of 41x, making it significantly pricier than both its listed peers and the broader JP IT industry average.

The price-to-earnings ratio tells investors how much they're paying for every yen of SHIFT’s reported earnings. In software and technology sectors, high P/E ratios can reflect confidence in future profit growth, but they also raise questions about whether current earnings can justify the elevated price.

Compared to its direct peers (average P/E of 24.1x) and the JP IT industry (17.8x), SHIFT’s premium is hard to ignore. The estimated fair P/E ratio for SHIFT sits at 34.5x. This means the market is pricing in expectations that are a step above what the underlying fundamentals suggest is reasonable. If sentiment shifts, the stock could move closer to that level.

Explore the SWS fair ratio for SHIFT

Result: Price-to-Earnings of 41x (OVERVALUED)

However, if SHIFT’s earnings growth slows or if market sentiment turns, its elevated valuation could quickly come under pressure, posing risks for investors.

Find out about the key risks to this SHIFT narrative.

Another View: What Does the DCF Model Suggest?

Looking at SHIFT through our SWS DCF model provides a different perspective. Despite a high price-to-earnings ratio, the DCF model suggests SHIFT is actually trading about 12% below its estimated fair value. This raises the question of whether the market is skeptical of future growth or if there might be an overlooked opportunity.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SHIFT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SHIFT Narrative

If you see SHIFT's story differently or want to dig into the numbers yourself, it's easy to build your own perspective in just a few minutes. Then share your view — Do it your way.

A great starting point for your SHIFT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop searching for the next winner. Expand your horizon today and spot fresh opportunities that others might overlook by using these proven strategies:

- Unlock potential gains by targeting strong companies trading at attractive prices through these 893 undervalued stocks based on cash flows.

- Stay ahead of the curve by accessing top performers driving dramatic change in artificial intelligence through these 25 AI penny stocks.

- Grow your passive income by seizing openings in reliable businesses boasting higher yields with these 18 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion