As global markets continue to navigate the evolving landscape shaped by recent policy changes and economic indicators, major indices like the S&P 500 have reached record highs, driven by optimism surrounding trade policies and advancements in artificial intelligence. While large-cap stocks have generally outperformed their smaller counterparts, small-cap stocks remain a fertile ground for uncovering potential opportunities. In this context, identifying undiscovered gems involves focusing on companies with robust fundamentals that can capitalize on current market trends and economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, with a market cap of CHF1.01 billion, operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland.

Operations: Jungfraubahn Holding AG generates revenue primarily from its Jungfraujoch - TOP of Europe segment, contributing CHF190.99 million, and the Experience Mountains segment with CHF51.27 million. The Winter Sports segment adds CHF40.47 million to the revenue stream.

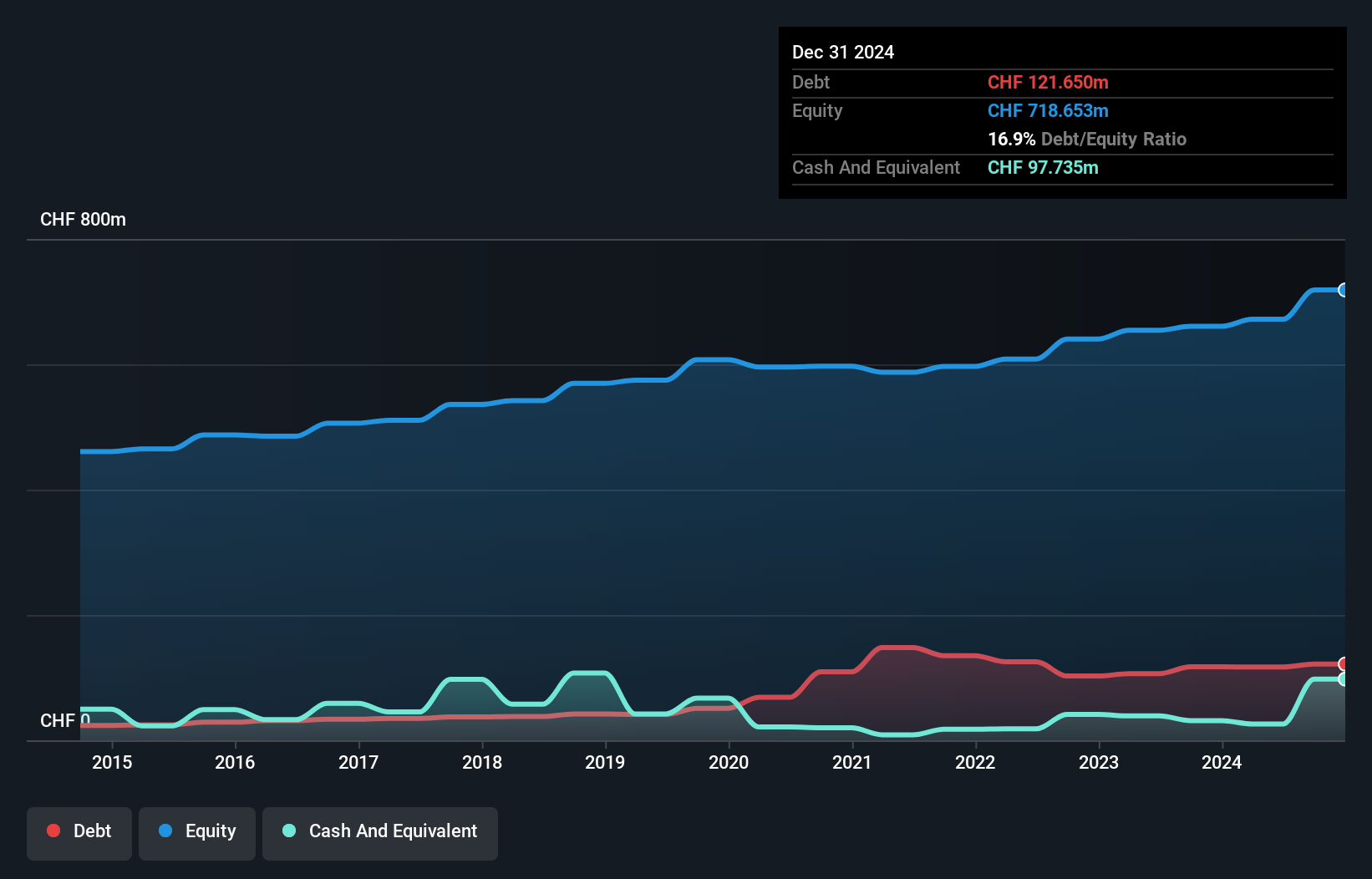

Jungfraubahn Holding, a relatively small player in the transportation sector, stands out with its high-quality earnings and robust financial health. Over the past year, earnings surged by 24%, significantly outperforming the wider industry, which saw a 15.8% contraction. The company's debt to equity ratio rose from 7.2% to 17.4% over five years but remains satisfactory with a net debt to equity of 13.6%. Trading at approximately 40% below its estimated fair value suggests potential undervaluation and room for growth as earnings are projected to increase by about 3.15% annually moving forward.

OPTiM (TSE:3694)

Simply Wall St Value Rating: ★★★★★☆

Overview: OPTiM Corporation offers IoT platform and remote management services in Japan, with a market cap of ¥39.95 billion.

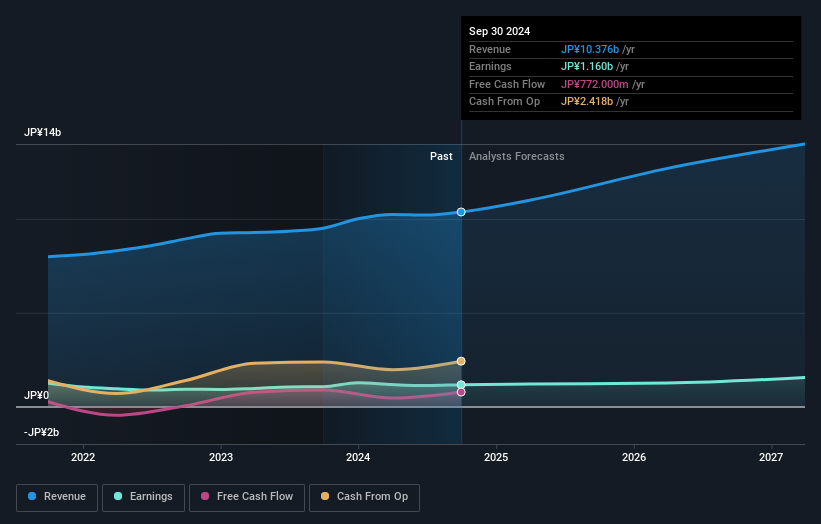

Operations: The company's primary revenue stream is from its License Sales and Maintenance Support Service (Optimal) Business, generating ¥10.38 billion.

OPTiM, a nimble player in the tech space, showcases robust prospects with earnings projected to grow at 11.47% annually. Over the past five years, earnings have increased by 15.3% per year, indicating consistent upward momentum. Despite a highly volatile share price recently, the company maintains high-quality earnings and positive free cash flow of JPY 772 million as of September 2024. With more cash than total debt and interest payments well covered by EBIT at an impressive 1,971 times coverage, OPTiM's financial health seems solid. For fiscal year ending March 2025, it anticipates net sales of JPY 11.3 billion and operating profit of JPY 1.95 billion.

- Take a closer look at OPTiM's potential here in our health report.

Evaluate OPTiM's historical performance by accessing our past performance report.

AOKI Holdings (TSE:8214)

Simply Wall St Value Rating: ★★★★★☆

Overview: AOKI Holdings Inc. operates in Japan across diverse sectors including fashion, anniversary and bridal services, entertainment, and real estate rental, with a market capitalization of ¥110.34 billion.

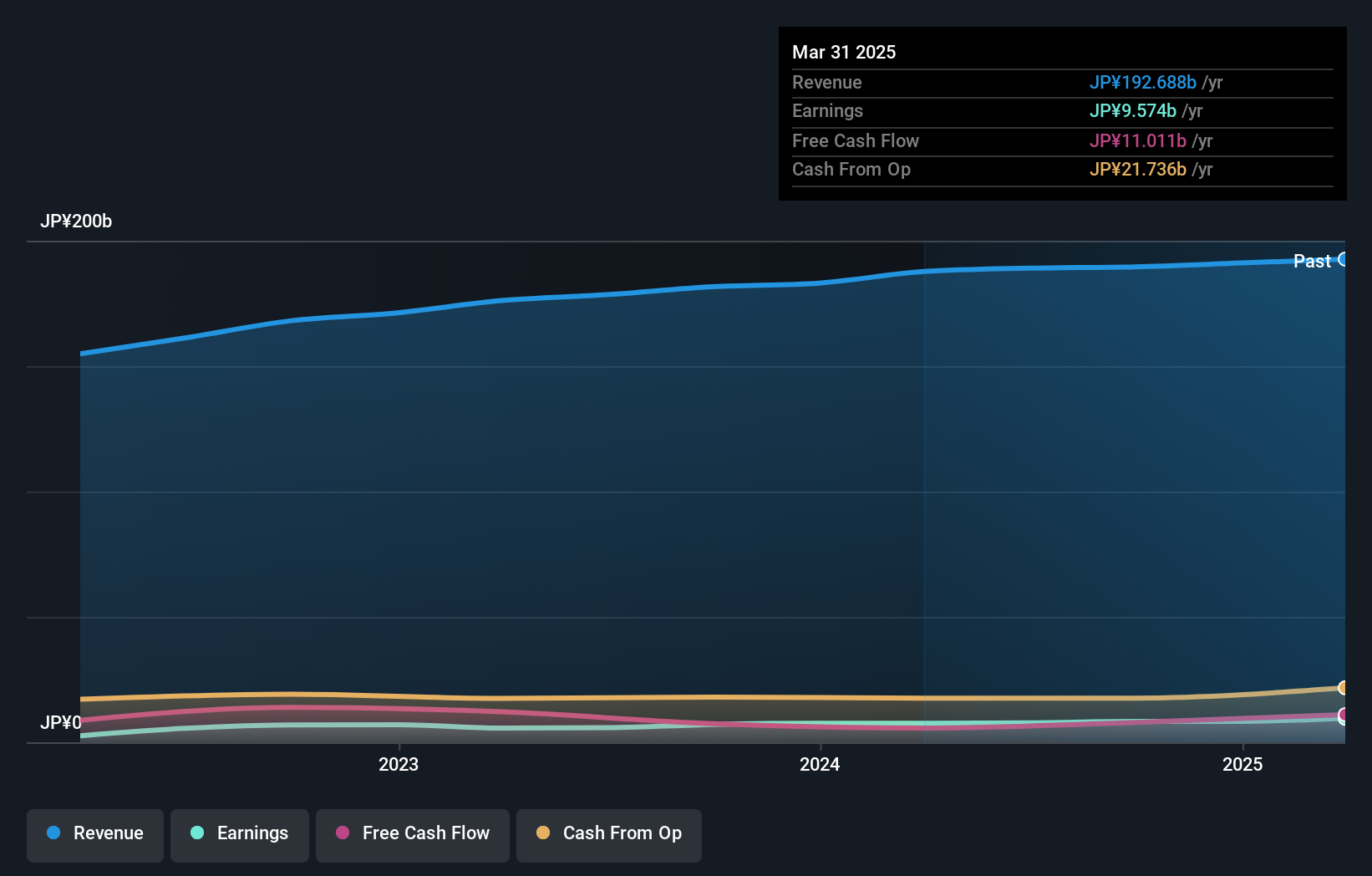

Operations: AOKI Holdings generates revenue primarily from its fashion business, which accounts for ¥100.66 billion, followed by the entertainment segment at ¥75.97 billion. The company also derives income from its anniversary and bridal services and real estate leasing segments, contributing ¥10.82 billion and ¥6.71 billion respectively.

AOKI Holdings, a small cap player in the retail space, has shown promising growth with earnings increasing by 16.8% over the past year, outpacing industry growth of 5.7%. Its interest payments are well covered by EBIT at 93 times coverage, indicating strong financial health. The net debt to equity ratio stands satisfactorily at 6.6%, making it a stable investment prospect. Recently, AOKI revised its earnings guidance for fiscal year ending March 2025 with expected net sales of ¥191.8 billion and operating profit of ¥15 billion. Additionally, dividends were increased to ¥15 per share from last year's ¥13 per share.

- Delve into the full analysis health report here for a deeper understanding of AOKI Holdings.

Gain insights into AOKI Holdings' past trends and performance with our Past report.

Taking Advantage

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4667 more companies for you to explore.Click here to unveil our expertly curated list of 4670 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3694

OPTiM

Provides IoT platform, remote management, support, and other services in Japan.

Excellent balance sheet with acceptable track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion