The Market Lifts Hottolink, Inc. (TSE:3680) Shares 26% But It Can Do More

Hottolink, Inc. (TSE:3680) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 7.9% isn't as attractive.

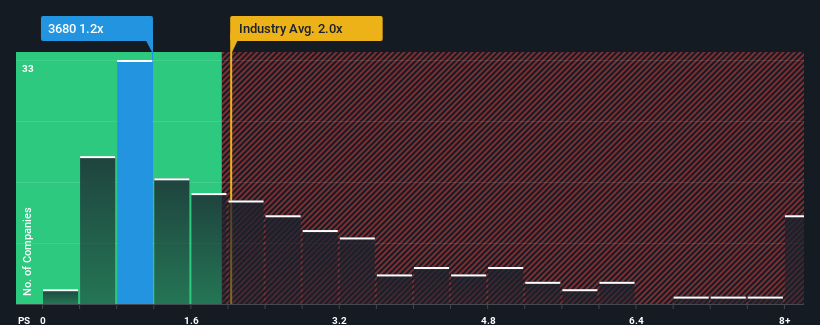

Although its price has surged higher, given about half the companies operating in Japan's Software industry have price-to-sales ratios (or "P/S") above 2x, you may still consider Hottolink as an attractive investment with its 1.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Hottolink

What Does Hottolink's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Hottolink's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Hottolink will help you uncover what's on the horizon.How Is Hottolink's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hottolink's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. The last three years don't look nice either as the company has shrunk revenue by 42% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 893% over the next year. That's shaping up to be materially higher than the 12% growth forecast for the broader industry.

In light of this, it's peculiar that Hottolink's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Hottolink's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Hottolink's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Hottolink that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hottolink might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3680

Hottolink

Provides social media marketing support that collects, analyzes, and utilizes social big data in Japan.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.