- France

- /

- Capital Markets

- /

- ENXTPA:VIL

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets react to recent political developments and economic shifts, major indices like the S&P 500 have reached new highs, buoyed by optimism surrounding potential trade deals and AI investments. However, small-cap stocks have lagged behind their larger counterparts, presenting unique opportunities for investors seeking to diversify their portfolios with lesser-known companies. In this environment, identifying a good stock often involves looking beyond the headlines to find solid fundamentals and growth potential that may not yet be reflected in market valuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Nacity Property Service GroupLtd | NA | 8.88% | 3.51% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

VIEL & Cie société anonyme (ENXTPA:VIL)

Simply Wall St Value Rating: ★★★★★☆

Overview: VIEL & Cie, société anonyme is an investment company offering interdealer broking, online trading, and private banking services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region with a market capitalization of approximately €749.42 million.

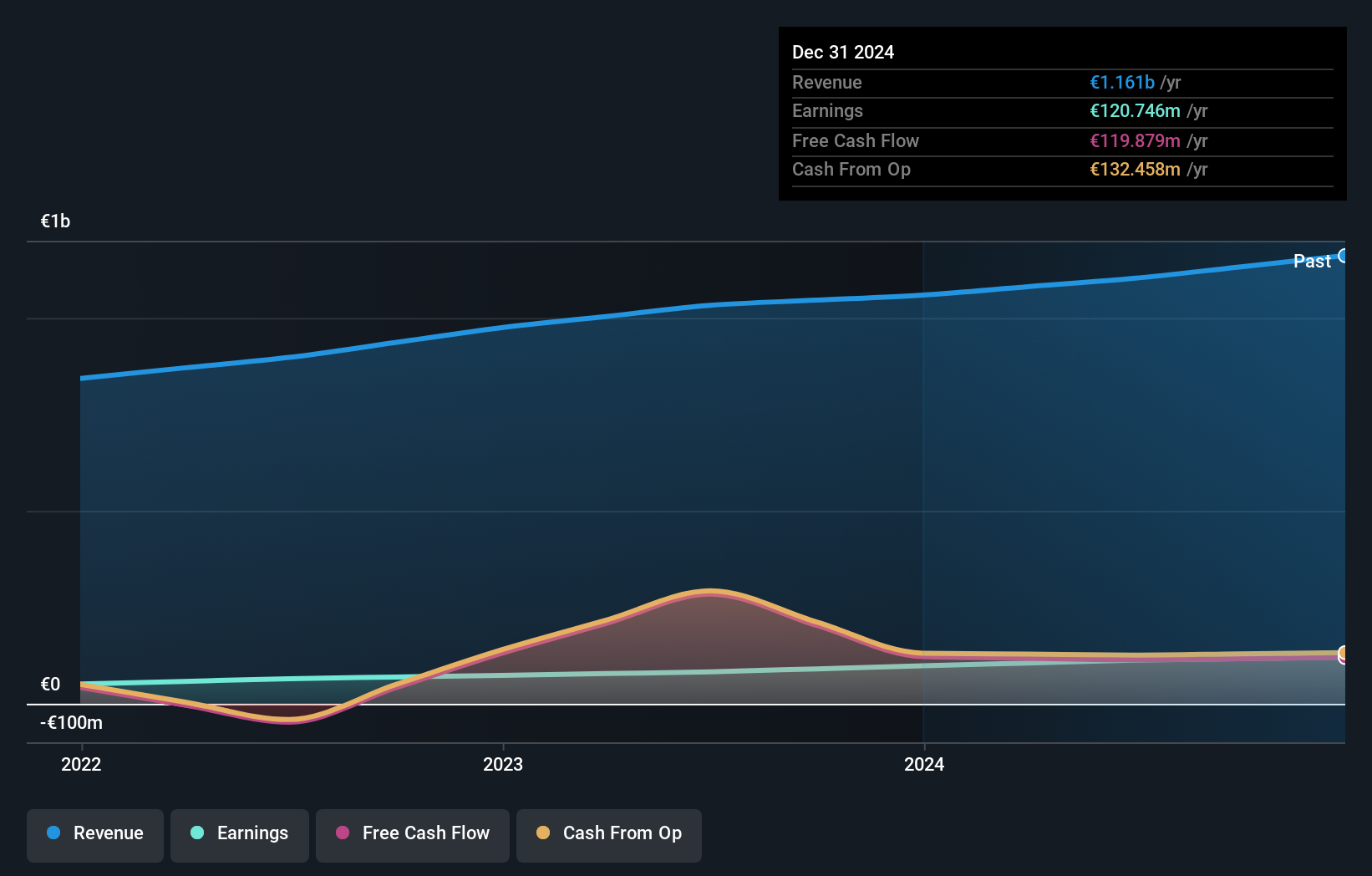

Operations: VIEL & Cie generates revenue primarily from professional intermediation (€1.05 billion) and stock exchange online activities (€71.02 million), with a minor contribution from holdings (€3.63 million). The company's financial performance is influenced by these diverse revenue streams, which are critical in evaluating its overall business strategy and market position.

VIEL & Cie société anonyme, a smaller player in the capital markets, shows intriguing financial dynamics. Over the past five years, its debt to equity ratio has improved significantly from 90.2% to 54%, indicating better financial health. The company is trading at 34.8% below its estimated fair value, suggesting potential undervaluation in the market. With earnings growing at an annual rate of 19.9%, it demonstrates robust performance despite not outpacing industry growth last year at 36%. Additionally, VIL's high-quality earnings and positive free cash flow highlight solid operational efficiency amidst competitive pressures.

- Dive into the specifics of VIEL & Cie société anonyme here with our thorough health report.

Understand VIEL & Cie société anonyme's track record by examining our Past report.

m-up holdings (TSE:3661)

Simply Wall St Value Rating: ★★★★★★

Overview: m-up holdings, Inc. is involved in the development and distribution of mobile and PC content as well as e-commerce businesses in Japan, with a market capitalization of approximately ¥57.88 billion.

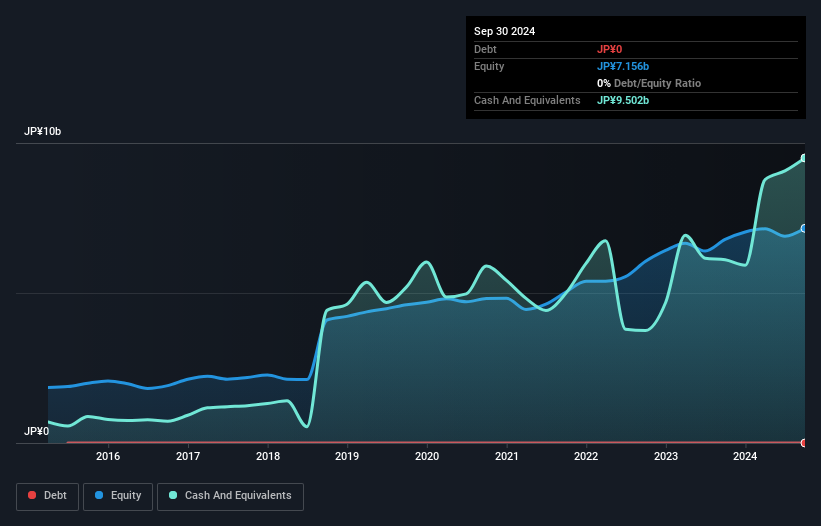

Operations: The company's primary revenue streams are from its Content Business and e-Ticketing, generating ¥18.37 billion and ¥3.67 billion, respectively. The net profit margin trend is noteworthy for analysis, providing insight into the company's profitability dynamics over time.

M-up Holdings, a nimble player in the market, showcases impressive earnings growth of 21.7% over the past year, outpacing the Software industry's 12.1%. This debt-free company trades at a significant discount of 49.1% below its estimated fair value and boasts high-quality earnings with positive free cash flow. Despite recent share price volatility, M-up's profitability ensures that cash runway isn't a concern. Looking ahead, they project net sales of ¥24 billion (US$), operating profit of ¥3.9 billion (US$), and basic earnings per share at ¥55.86 (US$) for fiscal year ending March 2025, reflecting robust financial health and potential upside for investors.

- Delve into the full analysis health report here for a deeper understanding of m-up holdings.

Gain insights into m-up holdings' past trends and performance with our Past report.

Ryoyu Systems (TSE:4685)

Simply Wall St Value Rating: ★★★★★★

Overview: Ryoyu Systems Co., Ltd. offers IT solutions across multiple industries in Japan and has a market capitalization of ¥39.39 billion.

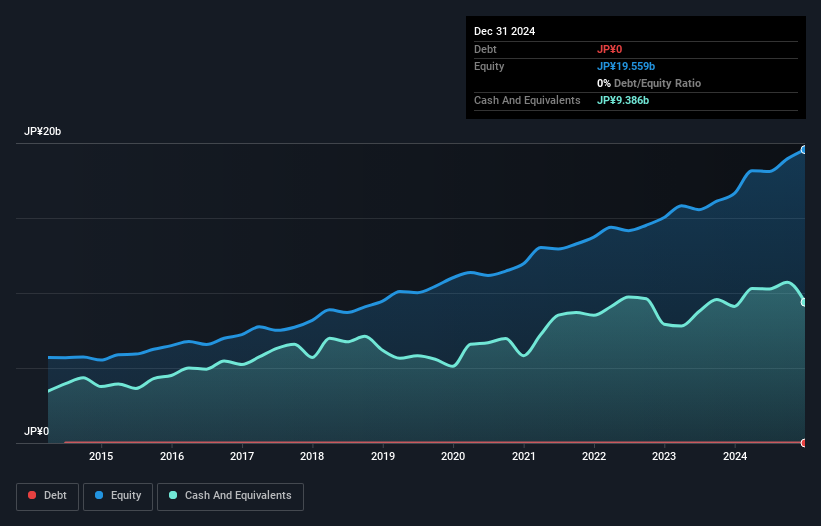

Operations: Ryoyu Systems generates revenue primarily from its Information Service segment, amounting to ¥38.43 billion. The company's market capitalization is ¥39.39 billion.

Ryoyu Systems, a small player in the IT sector, is debt-free and has not carried any debt for the past five years. This financial freedom likely contributes to its impressive earnings growth of 38.9% over the last year, outpacing the industry average of 11.4%. The company is trading at a notable discount of 38.1% below its estimated fair value, suggesting potential undervaluation in the market. With high-quality earnings and positive free cash flow reported recently at A$3,421 million as of March 2024, Ryoyu appears well-positioned within its niche for future opportunities despite market challenges.

- Get an in-depth perspective on Ryoyu Systems' performance by reading our health report here.

Examine Ryoyu Systems' past performance report to understand how it has performed in the past.

Summing It All Up

- Click this link to deep-dive into the 4670 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VIL

VIEL & Cie société anonyme

An investment company, provides interdealer broking, online trading, and private banking services in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives