Market Cool On Pole To Win Holdings, Inc.'s (TSE:3657) Revenues Pushing Shares 29% Lower

Pole To Win Holdings, Inc. (TSE:3657) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

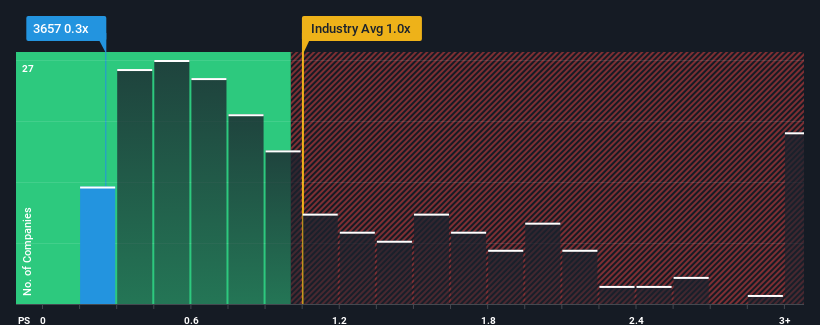

Since its price has dipped substantially, considering around half the companies operating in Japan's IT industry have price-to-sales ratios (or "P/S") above 1x, you may consider Pole To Win Holdings as an solid investment opportunity with its 0.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Pole To Win Holdings

How Pole To Win Holdings Has Been Performing

Pole To Win Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Pole To Win Holdings will help you uncover what's on the horizon.How Is Pole To Win Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Pole To Win Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. The latest three year period has also seen an excellent 69% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.9% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 5.1%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Pole To Win Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Pole To Win Holdings' P/S Mean For Investors?

Pole To Win Holdings' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems Pole To Win Holdings currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Pole To Win Holdings (1 is significant!) that you should be aware of.

If you're unsure about the strength of Pole To Win Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3657

Pole To Win Holdings

Engages in the testing/verification and evaluation, and Internet supporting businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives