Core (TSE:2359) Margin Dip Challenges Bullish View on Earnings Quality

Reviewed by Simply Wall St

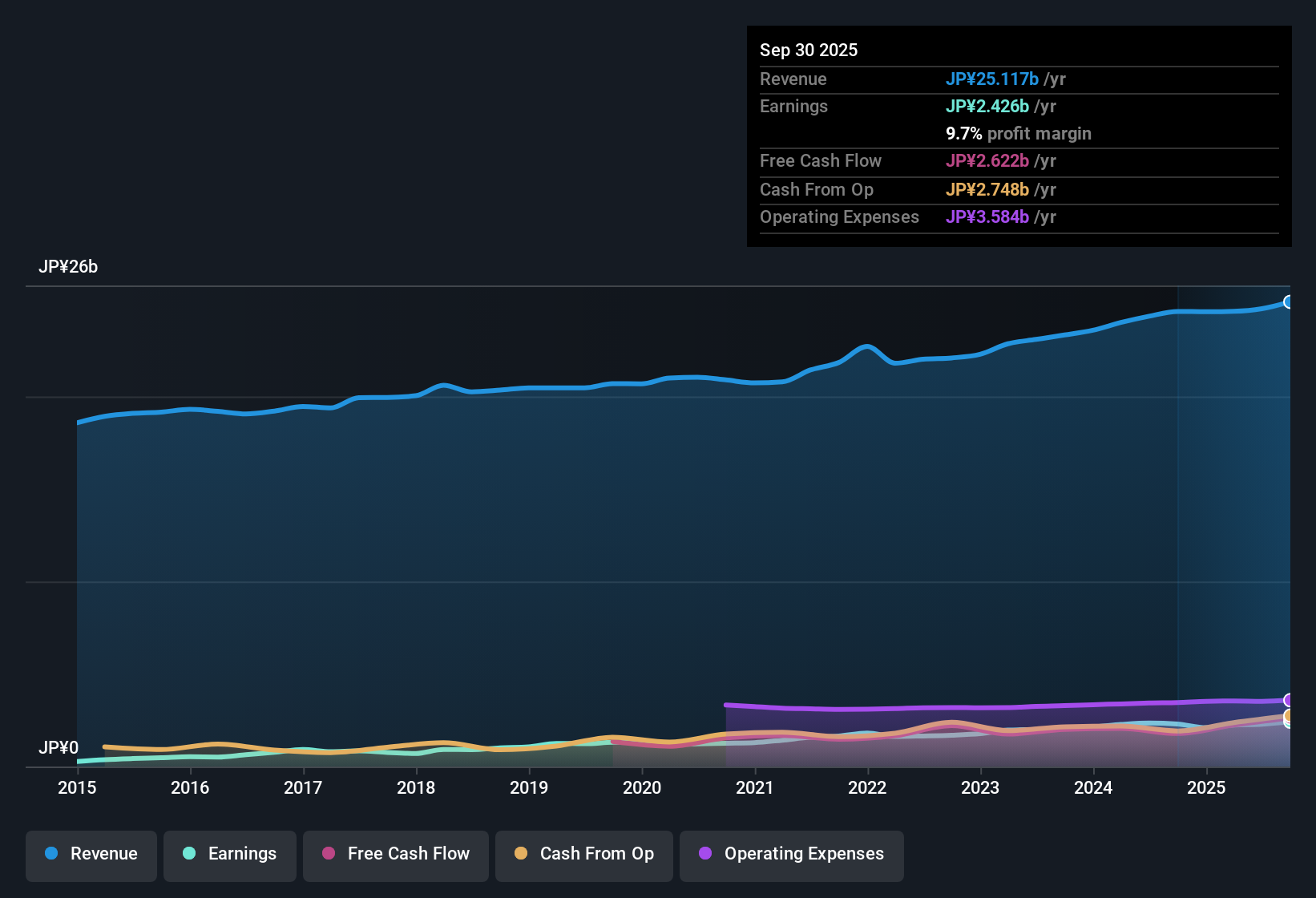

Core (TSE:2359) delivered average earnings growth of 11.9% per year over the last five years, accompanied by current net profit margins of 9.2%, slightly under last year's 9.7%. The company’s shares trade at ¥2,039, a notable discount to the estimated fair value of ¥2,545.65. The Price-To-Earnings Ratio of 12.8x sits well below both the JP IT industry and peer group averages. With steady five-year profit expansion, high-quality earnings, and a value-oriented market position, the latest results suggest investor optimism may be warranted. However, recent margin softness invites some caution on profitability trends.

See our full analysis for Core.The next section stacks these headline results against some of the most widely followed narratives for Core, highlighting just where the numbers confirm or challenge the market’s prevailing views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Softness Outpaces Industry Peers

- Net profit margin slipped from 9.7% to 9.2% over the last year, while the company's five-year average earnings growth remains robust at 11.9% per year.

- What is surprising is that, even with this minor margin dip, the prevailing market view credits Core for sustaining higher-quality earnings and value, thanks to strong multi-year profit expansion and a much lower Price-To-Earnings Ratio than sector averages.

- The combination of steady earnings growth and only slight margin compression strongly supports optimism that Core’s profitability remains resilient compared to many peers.

- The lack of any new risks flagged in recent filings further supports a stable, defensible margin profile despite industry pressures.

P/E Discount Signals More Than Caution

- Core's P/E ratio stands at 12.8x, noticeably below the JP IT industry average of 17.2x and peer average of 13.9x, even with consistent five-year growth.

- Prevailing perspectives highlight that, unlike some rivals trading near sector multiples, Core’s valuation discount is not due to falling profitability but rather to cautious investor positioning relative to its high-quality historical growth.

- Even at a 12.8x multiple, the market appears to be pricing in some doubt around margin trajectory. Continued high earnings quality challenges the view that Core deserves such a discount.

- This price-to-earnings gap, when set against ongoing earnings strength, reinforces the idea that investors may be overlooking Core’s structural advantages.

Share Price Lags DCF Fair Value

- Shares are trading at ¥2,039, a significant discount to the DCF fair value of ¥2,545.65, despite ongoing profitability and lack of new risk disclosures.

- The prevailing market view notes that while the market hesitates to close this gap in the face of recent margin softness, current pricing appears attractive for value-focused buyers who see reliable earnings as a foundation for future potential.

- The absence of flagged risks means little stands in the way of a rerating if margins stabilize, especially with a multi-year growth track record to support confidence.

- Investors awaiting a catalyst could view the persistent discount to fair value as an opportunity rather than a warning sign.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Core's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Core continues to outpace peers in sustained profit growth, recent softness in net profit margins highlights ongoing pressure on profitability and the potential for further margin erosion.

If steady and resilient earnings matter to you, check out stable growth stocks screener (2121 results) for companies that maintain stronger, consistent growth even in challenging conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2359

Core

Provides information and communication technology services in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives